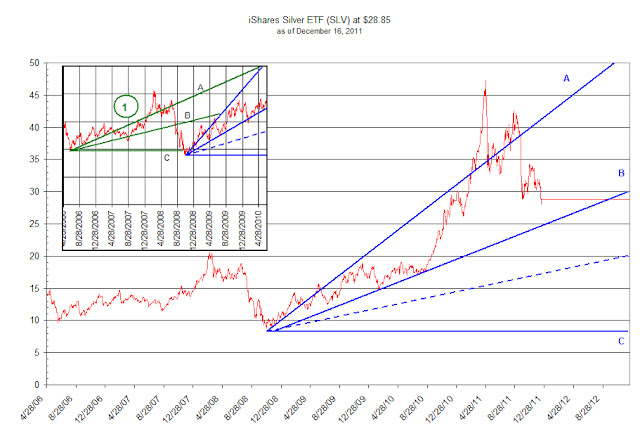

In our previous reviews of the iShares Silver Trust (SLV) (found here), we attempted to apply Dow Theory to the price movement of SLV. However, we have made an error in our analysis that has resulted in arriving at the wrong conclusion of the price potentially declining to the previous low that was established at the beginning of the bull market run on November 21, 2008 at $9.02.

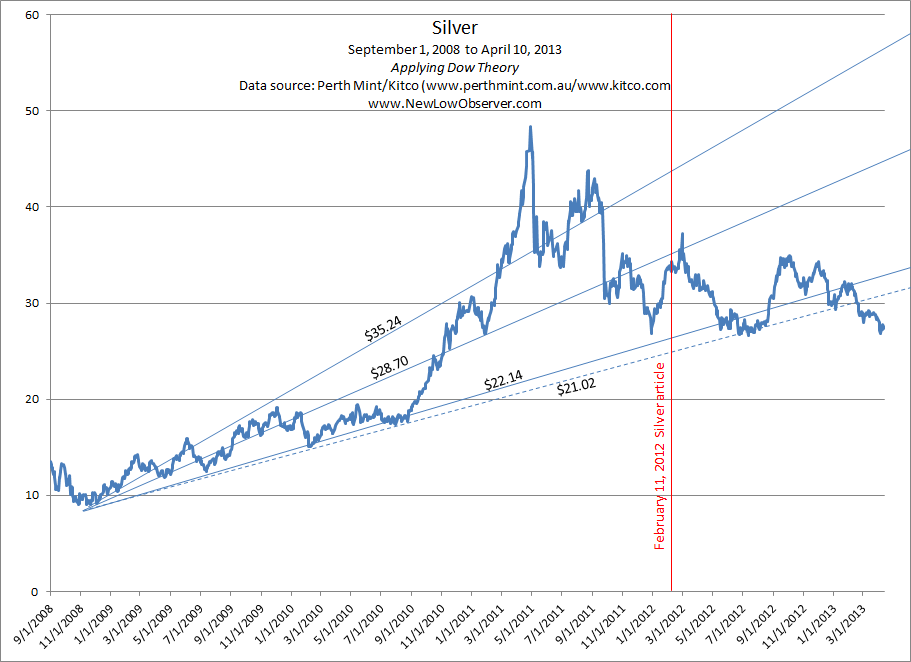

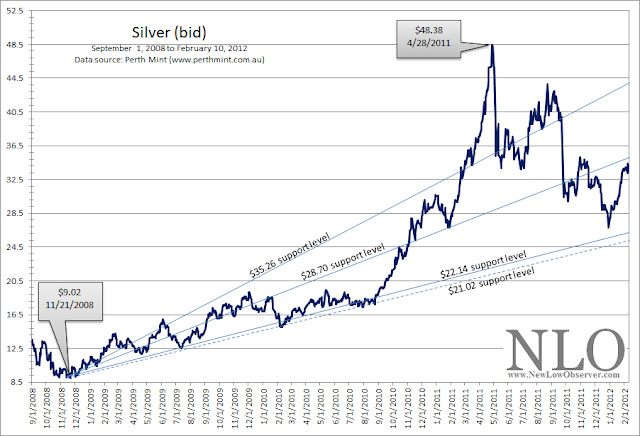

Instead, we are revising our analysis to reflect that the price of silver may decline as low as $21.02 if it were to replicate the rise and decline from October 2001 to November 2008.This revision should provide a more qualitative view on the future prospects for both SLV and the price of silver.

As background to the error that was made, we first must explain that the iShares Silver Trust (SLV) is supposed to track the price of silver. However, SLV has only been in existence since April 2006.Our Dow Theory analysis of SLV was incorrect because we didn’t have an appropriate starting point, the previous low, to arrive at a correct downside target. The previous low occurred in 2001 which was long before SLV began trading.

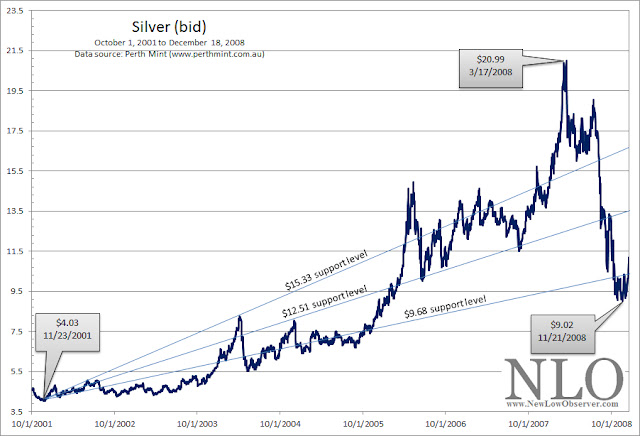

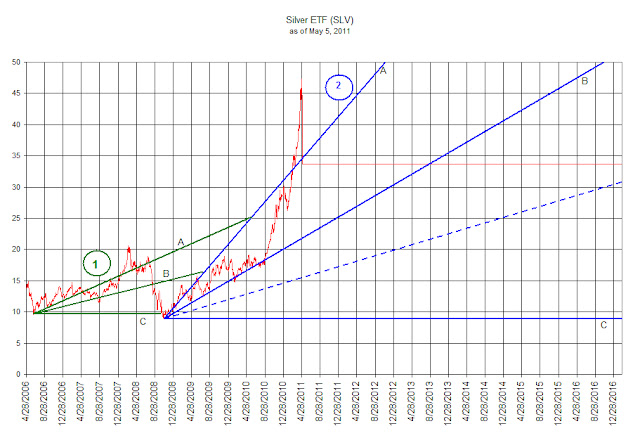

This resulted in the mistaken belief that SLV should be expected to go back to the low of 2008 at $9.02. To remedy our error, we have obtained the price of silver from the last major low in the price, and re-ran our Dow Theory analysis. The chart below provides the three downside targets from the March 17, 2008 high of $20.99.

The downside targets from the peak were as follows:

In the final outcome, the price of silver fell below the third downside target of $9.68, ultimately resting at the $9.02 level before making the ascent to the recent high of $48.35.This sets the stage for our analysis of the current price action.

Our current Dow Theory analysis involves the period from the November 21, 2008 low at $9.02 to the peak of April 28, 2011 at the $48.38 level. The downside targets are as follows:

It should be noticed in the chart below that as time passes, the support levels increase which exerts greater pressure on the price to either rise substantially or breakdown.

Despite the revision to our numbers, our previous analysis about the expected outcome has remained accurate.Our May 5, 2011 article was on target with the claim that SLV would trade in a range before falling much further. SLV traded in a range until mid-July and ultimately fell as low as $26.16, a drop of -30.87% since that article was written.

The current indications suggest that SLV will fall as the $22.14 support level. Because silver easily fell to the third support level in the period from 2001 to 2008 (within the context of a precious metal bull market), we expect that the $21.02 is a realistic worst case scenario to watch for. We will consider buying silver and related derivatives at $22.25 and below.

We view the most recent rise from the December 2011 low as running out of steam.Therefore, the rising resistance level established at $28.70 appears to be firmly in place…for now.