In our “Commentary on Gold” dated November 11, 2008, we made some outlandish claims about the lack of performance by three undisputed experts on gold. One claim that we made was that “…when the price of stocks fall so too does the price of gold, and to a greater degree, gold & silver stocks.” This was said after the precious metals and the XAU and HUI indexes had already hit their final lows on October 24, 2008 and October 27, 2008 respectively. We demonstrated our claim through research performed by David Marantette which showed that from 1975 to 2001, declines of 10% or more in the Dow Jones Industrial Average resulted in larger declines in the gold stock indexes and the price of gold. We completed the research by providing the data from 2001 to 2007.

The point of our December 9, 2008 article was best summed up in our closing paragraph:

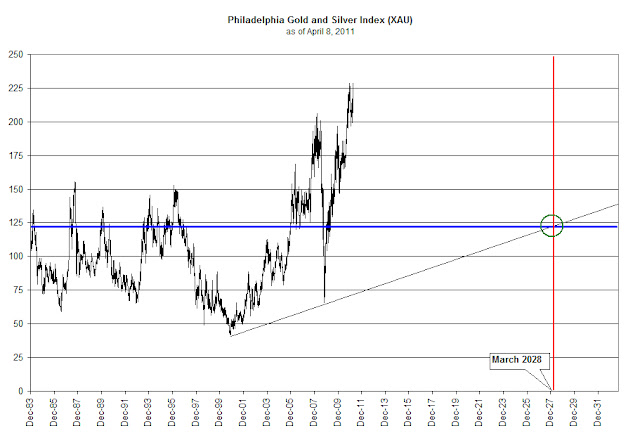

“The long term trend in gold and silver stocks as demonstrated by the Philadelphia Gold Stock Index (XAU), which was initiated in November 2000, will eventually head permanently higher. The continuation of that trend will be among the key indicators that the bear market in stocks is at or near an end.”

Our overall assertion was, and is, if precious metals and their stocks continue heading higher so will the general stock market. If the stock market starts to collapse then so too will the price of gold and silver and to a greater degree gold and silver stocks.

When we wrote our earlier pieces on precious metals, gold enthusiasts argued that the physical metal and the gold stock indexes are completely unrelated and therefore it doesn’t make sense to compare the two, not realizing that we weren’t comparing them at all. Other gold enthusiasts countered that with the price of gold falling only -29% from the March 2008 high investment in that area was justified considering that the Dow and S&P 500 had fallen over -35% in 2008, not realizing that losing less money isn’t the reason why people invest. Not liking the outcome of the data, because it only covered the period from 1975 to 2007, some said that it didn’t go back far enough.To respond to the critics about our data, we gathered prices of gold and silver stocks from 1924 to 1933. That data demonstrated that gold and silver stocks got hammered during that period. Below we have included a previously unpublished Gold Stock Average of the 13 precious metal stocks (out of 21) with complete price history from 1924 to 1933.

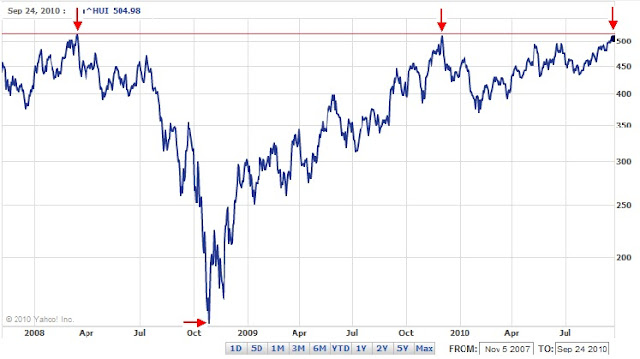

As you can plainly see, when you exclude the performance of Homestake Mining, the value of the gold stocks fell 76.47% from their peak in 1925 to the bottom in 1932. This performance is in line with the decline of the Amex Gold Bug Index (HUI) from March 14, 2008 to October 27, 2008; which has 16 precious metal stocks in it. In the chart below, you can see that the HUI index and the Philadelphia Gold and Silver Index (XAU) fell 70.56% and 68.15% respectively, within the 8-month period.

Few people will readily agree that all the deflating of the financial system has been expunged from the markets. However, when compared to the deflation that took place from 1924 to 1932, first reflected in the gold stocks and later the entire stock market, it becomes very clear that the general stock market decline of over 50% and the eight month decline of the gold stock index on such a large scale signaled the end of the deflationary period. For investors, one area we think that holds the most promise is in silver.

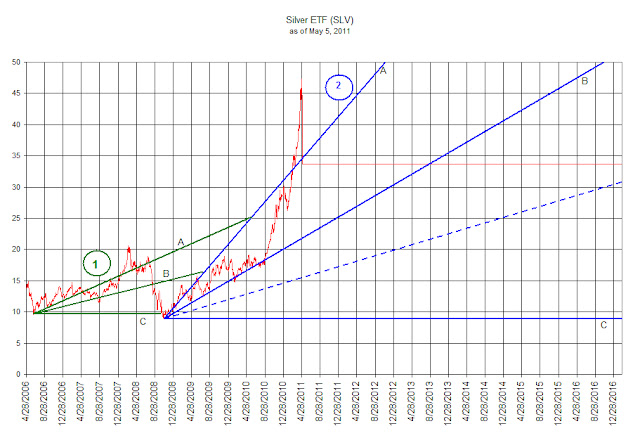

On September 9, 2009 we wrote an article titled “Silver Should be the Focus.” We indicated that if there were a need to participate in the run in precious metals, silver would be the best investment/speculative choice. At the time, silver closed at $16.36 an ounce. On Friday September 24, 2010, silver closed at $21.46 with an increase of 31.17%. During the same period of time, the price of gold increased 30.61%. So far, the precious metals appear to be in lock step with each other since our last article on the topic. However, since the bottom in the market on October 24, 2008, the price of gold is up 82% with the price of silver is up 142%. Although these are considerably large increases in value in a very short period of time, compared to past price increases the current moves are in their infancy.

The most pressing matter for the precious metals market right now is confirmation. So far, the price of gold and silver has exceeded their respective 2008 highs. However, the corresponding stock indexes, the XAU and the HUI, have not yet confirmed the trend. If the trend is confirmed then we will have received the indication of the beginning of a secular bull market in gold and silver. In our Richard Russell Review posted on July 4, 2010, we outlined Russell’s significant detail on the importance of confirmations. Although our analysis shows how Russell got the interpretation incorrect, it is well worth re-examining this article since it outlines exactly how to utilize both indicators (price of gold and gold stock index) for confirmation of the trend.

Below is the HUI index with what appears to be the third attempt at the 514.89 level.

Although not likely, failure to breach the 2008 peaks for the XAU and the HUI index could mean very hard economic times ahead. Alternatively, going above the previous peak, which seems much more likelier, may mean that we’re entering the early stages of higher interest rates and inflation. It is necessary to keep in mind that higher inflation and higher interest rates won’t initially wreck havoc on the economy.

Most investors have the tendency to remember only the periods at the extremes, the real estate bust, the real estate bubble, the dot com bust, the dot com bubble, the gold bubble and the gold bust, skyrocketing interest rate, the current zero interest rate environment. In every instance, the recollection of such periods is rooted in the final stage. However, what is more important is the slow transition that takes place from trough to the next peak.

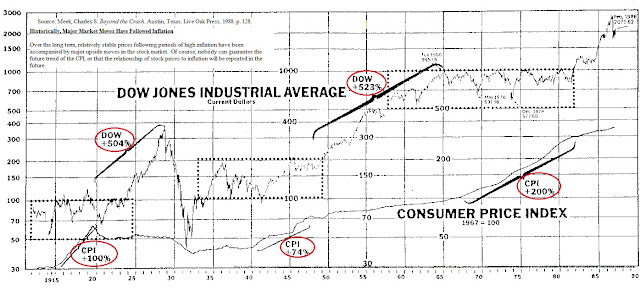

In the case of inflation, the slow transition was the innocuous period, saved for a world war, from 1932 to 1966. Unfortunately, most investor over concentrate on the period from 1973 to 1980 due to the exaggerated moves upward. The transitional period brought many cyclical and one secular bull market in the Dow Jones Industrial Average. It is possible that as our inflation rate climbs the Dow Jones Industrial Average could experience a bull market similar to the period form 1949 to 1966.

According to the chart below, periods of inflation coincided or preceded extremely large moves in the stock market. The period from 1940 to 1947 had a 74% increase in the CPI while at the same time the stock market doubled in value. Naturally the argument is that the stock market only managed to beat inflation by a small amount over that period. The reality is that the response by the Dow Industrials was to go from the 100 level in 1941 to the 1000 level in 1966.

Looking at the chart above, it is hard to believe that the CPI increase of 200% in the 1970's would follow the pattern of previous high inflation periods with stocks increasing 10 times in each instance.

While we watch and wait for the confirmation of the new high in the price of gold and silver with the XAU and HUI indexes by breaking above their 2008 highs, our overall assertion still is that if precious metals and their stocks continue heading higher so will the general stock market.