We’ve long maintained the view that in order for long-term investors to beat inflation, the conventional wisdom of investing in gold and silver stocks is not the most advantageous way to benefit from what almost everyone believes is coming as a consequence of QE4ever. While we favor the physical metals (especially silver) and their paper derivatives like (GLD) and (SLV), we’ve also claimed that a specific strategy is needed in order to get the most mileage out of gold and silver stock investing. However, in order to really beat inflation, forget gold and silver stocks and instead consider companies involved in food processing, producing and distribution industries.

Before we can tackle our food processors, producers and distributors, we need to examine the well documented wealth destruction that has occurred in the gold stock sector in the last year despite the relatively slight decline in the price of gold. Below is a table reflecting the percentage range that many gold and silver stocks have experienced between their one year high and low.

| Symbol |

Name |

1-yr % range |

| NG |

NovaGold Resources Inc. |

-69.33% |

| MUX |

McEwen Mining Inc. |

-68.23% |

| SSRI |

Silver Standard Resources Inc. |

-57.35% |

| PAAS |

Pan American Silver Corp. |

-56.19% |

| KGC |

Kinross Gold Corporation |

-55.98% |

| BAA |

Banro Corporation |

-53.55% |

| AUQ |

AuRico Gold Inc. |

-53.13% |

| AEM |

Agnico-Eagle Mines Ltd. |

-51.78% |

| HMY |

Harmony Gold Mining Co. Ltd. |

-44.81% |

| ABX |

Barrick Gold Corporation |

-41.79% |

| GG |

Goldcorp Inc. |

-41.74% |

| NEM |

Newmont Mining Corp. |

-40.69% |

| AU |

AngloGold Ashanti Ltd. |

-37.81% |

| GFI |

Gold Fields Ltd. |

-36.32% |

| BVN |

Compania de Minas Buenaventura SA |

-34.03% |

| SLV |

iShares Silver Trust |

-30.46% |

| GLD |

SPDR Gold Shares |

-15.50% |

In all instances, those who had invested in these stocks did not expect that they’d face the prospect of –30% declines in value before they’d realize a gain. In fact, many of these stocks are not at a break-even point if purchased a year ago. Naturally, this should lead inflationistas and gold bugs to feeling a high level of frustration with the belief that gold stocks are a true inflation hedge.

Some perpetual gold bull analysts/marketers argue that gold junior and exploration companies provide better investment opportunities as compared to the many large cap gold stocks like Barrick Gold (ABX), Agnico-Eagle (AEM), and Newmont Mining (NEM). However, the last year has been unforgiving to the larger junior and exploration companies as represented by the Market Vectors Junior Gold Miners (GDXJ) in the chart below:

As early as 2008, in an article titled “Why Gold Will Decline More than the Markets,” we’ve cautioned gold stock investors to be prepared for gold stocks to decline by a greater percentage whenever the general stock market, as represented by the Dow Jones Industrial Average (DIA) or S&P 500 Index (SPY), declines -10% or more.

Within the last year, the closest the Dow Industrials and S&P 500 came to a -10% decline was from April 2nd to June 1st when the indexes fell –8.63% and –9.93%, respectively. Unfortunately, the Philadelphia Gold and Silver Stock Index (XAU) was already in a declining trend after having lost -22.85% from the April 8, 2011 high until April 2, 2012. Despite this fact, the XAU Index managed to lose an additional –20.87% from April 2, 2012 to the May 15, 2012 low.

As an alternative to the “mines” of precious metal stock investing, we’ve recommended investing in food processors, producers and distributors that have a history prudent of dividend increasing policies to take advantage of the expectations of high inflation down the road. Among the many companies that we’re currently following closely in this sector are Hershey (HSY), ConAgra (CAG), and Sysco Foods (SYY).

With all the unexplained pain in the precious metal sector in the last year, companies like ConAgra (CAG), Hershey (HSY) and Sysco Foods (SYY) have continued to increase shareholder value, dividend payments and see steady gains in their stock price. Although the last two years hasn’t been as favorable for Sysco Foods, HSY and CAG have managed to keep pace with the overall market.

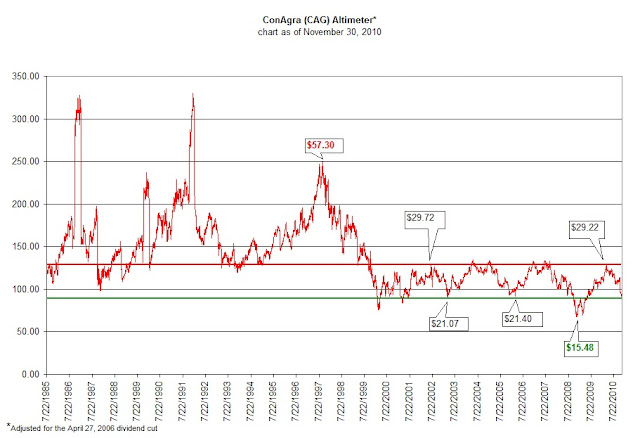

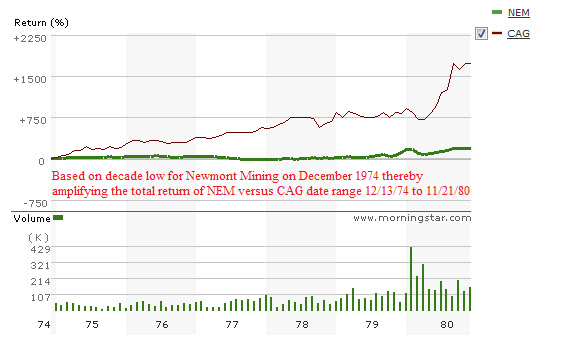

Our belief in the processors, producers and distributors is rooted in the performance of these stocks during the last precious metal bull market from 1970 to 1980 and beyond. In a piece titled “ConAgra: A History of Beating Precious Metals During a Commodity Bull Market,” we compared the performance of ConAgra to Newmont Mining (NEM) and Hecla Mining (HL) at the peak in the market in 1972, before the –42% decline in the Dow Industrials, and the subsequent peak in the commodity bull market in 1980.

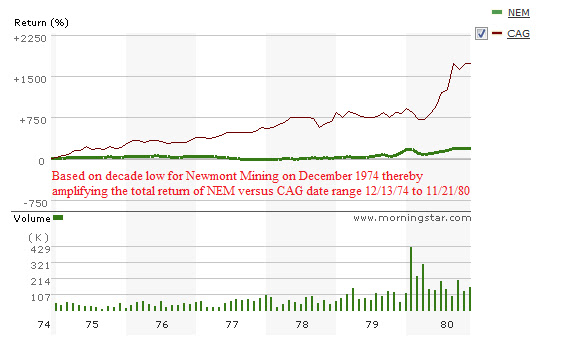

What we found was that CAG matched the performance of NEM and HL by the end of the gold bull market in 1980 and went on to out-distance both stocks after the commodity bull market ended, by nearly seven time in 1983. As a follow-up to our initial ConAgra observation in November 21, 2010, we can see the performance of the same three stock in the chart below:

The performance of ConAgra over the last 2 years has been exceptional in comparison to Newmont Mining and Hecla Mining. Today, ConAgra reported that first quarter net doubled and raised their full year expected earnings. CAG’s stock was up +6.20% on the news. The news out of ConAgra suggests that processors, producers and distributors have much to gain from the coming inflation.

Precious metal enthusiasts will likely argue that the less than redeeming attributes of the companies selected (Newmont Mining and Hecla Mining) such as bad management, unprofitable properties, etc. contributed to the poor performance. Another common refrain is, “look how my gold stocks have done in the last 3 or 4 months.” We believe such arguments are the equivalent of whistling past the graveyard.

Consider the following data points, since June 30, 1972 CAG, HL and NEM have generated the following returns, according to Morningstar.com:

-

CAG: +9,021.62%

-

HL: -42.76%

-

NEM: +392.29%

When viewed from the perspective of trying to beat inflation, during the only proven gold bull market in recent history, gold and silver stocks don’t have the durability to truly beat inflation. For those that are ardent long-term value investors, you don’t really need to wade into the dark pools of precious metal stock investing where a mine can flood, a strike will break out, management can be slightly off with their estimates or the cost of production increases causing a stock to collapse in the middle of widely recognized gold bull market. Instead, focus your research and due diligence in the food processors, producers and distributors that are trading near their respective new lows. You will be rewarded far beyond the high inflation period to come.