In a note on Barry Ritholtz’s

The Big Picture there is an article dated October 3, 2010 that asks the age old question, “

Do Dividends Matter?” The author of the article compares the performance of dividend paying stocks against non-dividend paying stocks that are constituents of the S&P 500. After selecting a period of time from December 31, 2009 to September 29, 2010, the author breaks down the analysis by separating the performance of the stocks into three distinct periods; 12/31/2009 to 9/29/10, 4/23/2010 to 9/29/2010 and 12/31/2009 to 4/23/2010.

The conclusion of the article is that whether a company pays a dividend isn’t as important as people think. However, the conclusion comes as no surprise since the period in question is less than a year and the goal was to determine the impact dividends play in the performance of a stock’s price. All measures within a year cannot reveal the same amount of impact of dividends over several decades. In a strange twist, the article proves exactly what the New Low Observer has been saying all along.

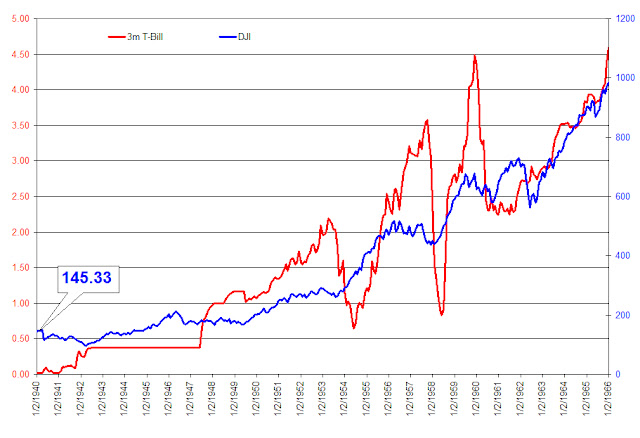

First, market performance is often measured in a year or less. As market observers, we don’t control this characteristic, we only make certain that our investment strategy reflects and caters to this fact. This “research” on Ritholtz’s site doesn’t hold up since it doesn’t even span a decade of continuous examination. An individual would do better to accept the mountains of buy-and-hold evidence; which indicates that dividends contribute more than half the total return when measured over a span of 40 years or more. Just be sure that you’ve got a 40-year investment time horizon before you act on such factual data.

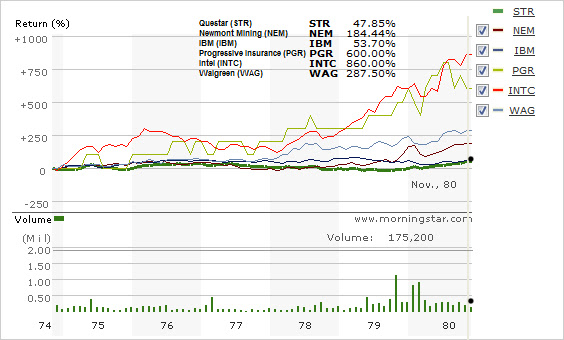

Second, the performance of the dividend paying stocks in Tier 1, Tier 2 and Tier 3 over the December 31, 2009 to April 23, 2010 period, beat the non-dividend paying stocks resoundingly. Tier 3, the lowest performing of the dividend paying stocks, outperformed the non-dividend paying stocks by 2% over the given timeframe. As regular readers of our site know, we seek mediocre returns of 9%-12% from each investment. This means that we would have sold somewhere short of 20% and then moved on to the next stock. The worst performing group, Tier 5 of the dividend paying stocks, was only able to achieve 7.57% in the 4-month period. However, if Tier 5 stocks were bought and sold in the time selected, the annualized return would have been 24.41%.

Finally, low dividend yielding stocks easily outperform high yielding stocks. In the survey, Tier 1 had the lowest yielding stocks while Tier 5 had the highest yielding stocks. Tier 1, Tier 2 and Tier 3 of the dividend paying stocks in the “study” easily outperformed the market and the non-dividend paying stocks. Our article titled “

Low Yielding Stocks Offer Exceptional Gains” outlined the importance of quality of dividends rather than dividend yield. We were specific in pointing out that what is lacking in yield is typically made up for in appreciation of the stock price. This is very important because most people who have been burned in their investments typically seek out alternatives that might seem to help make up for substantial losses. Unfortunately, this is the time when the markets are about to turn around and the high yielding stocks underperform on the upswing.

Again, we don’t attempt to explain why information on the markets comes in two incongruent varieties, focused in the short-term data with an inappropriate strategy or focused on long-term data that is incompatible with real world investment time frames. We only observe that, within any one-year time span a stock reaches a new low. If narrowed down to the number of companies that have a proven track record of dividend increases or are part of an index that most mutual funds are required to buy, then the odds are in your favor to obtain reasonable gains that exceed the historical market returns. This (il)logical thinking only works if you’re willing to sell in the same time frame that your analysis takes place. These factors are frequently left out of the “research” of whether dividend matter or not.