Members

-

Topics

Archives

-

-

Recent Posts

-

-

-

Investor Education

Market Return After Exceptional Years

Dollar Cost Averaging Tool

Dow Theory: The Formation of a Line

Dividend Capture Strategy Analysis

Golden Cross – How Golden Is It?

Debunked – Death Cross

Work Smart, Not Hard

Charles H. Dow, Father of Value Investing

It's All About the Dividends

Dow Theory: Buying in Scales

How to Avoid Losses

When Dividends are Canceled

Cyclical and Secular Markets

Inflation Proof Myth

What is Fair Value?

Issues with P-E Ratios

Beware of Gold Dividends

Gold Standard Myth

Lagging Gold Stocks?

No Sophisticated Investors

Dollar down, Gold up?

Problems with Market Share

Aim for Annualized Returns

Anatomy of Bear Market Trade

Don’t Use Stop Orders

How to Value Earnings

Low Yields, Big Gains

Set Limits, Gain More

Ex-Dividend Dates -

-

Historical Data

1290-1950: Price Index

1670-2012: Inflation Rate

1790-1947: Wholesale Price Cycle

1795-1973: Real Estate Cycle

1800-1965: U.S. Yields

1834-1928: U.S. Stock Index

1835-2019: Booms and Busts

1846-1895: Gold/Silver Value

1853-2019: Recession/Depression Index

1860-1907: Most Active Stock Average

1870-2033: Real Estate Cycles

1871-2020: Market Dividend Yield

1875-1940: St. Louis Rents

1876-1934: Credit-New Dwellings

1896-1925: Inflation-Stocks

1897-2019: Sentiment Index

1900-1903: Dow Theory

1900-1923: Cigars and Cigarettes

1900-2019: Silver/Dow Ratio

1901-2019: YoY DJIA

1903-1907: Dow Theory

1906-1932: Barron's Averages

1907-1910: Dow Theory

1910-1913: Dow Theory

1910-1936: U.S. Real Estate

1910-2016: Union Pacific Corp.

1914-2012: Fed/GDP Ratio

1919-1934: Barron's Industrial Production

1920-1940: Homestake Mining

1921-1939: US Realty

1922-1930: Discount Rate

1924-2001: Gold/Silver Stocks

1927-1937: Borden Co.

1927-1937: National Dairy Products

1927-1937: Union Carbide

1928-1943: Discount Rate

1929-1937: Monsanto Co.

1937-1969: Intelligent Investor

1939-1965: Utility Stocks v. Interest Rates

1941-1967: Texas Pacific Land

1947-1970: Inventory-Sales Ratio

1948-2019: Profits v. DJIA

1949-1970: Dow 600? SRL

1958-1976: Gold Expert

1963-1977: Farmland Values

1971-2018: Nasdaq v. Gold

1971-1974: REIT Crash

1972-1979: REIT Index Crash

1986-2018: Hang Seng Index Cycles

1986-2019: Crude Oil Cycles

1999-2017: Cell Phone Market Share

2008: Transaction History

2010-2021: Bitcoin Cycles -

Interesting Read

Inside a Moneymaking Machine Like No Other

The Fuzzy, Insane Math That's Creating So Many Billion-Dollar Tech Companies

Berkshire Hathaway Shareholder Letters

Forex Investors May Face $1 Billion Loss as Trade Site Vanishes

Why the oil price is falling

How a $600 Million Hedge Fund Disappeared

Hedge Fund Manager Who Remembers 1998 Rout Says Prepare for Pain

Swiss National Bank Starts Negative

Tice: Crash is Coming...Although

More on Edson Gould (PDF)

Schiller's CAPE ratio is wrong

Double-Digit Inflation in the 1970s (PDF)

401k Crisis

Quick Link Archive

Author Archives: NLObserver Team

A Review of Projection Strategies

In the News: August 7, 2011

“Our Investment Observation of Wesco Financial (WSC) on August 24, 2010 was quickly verified as being undervalued by Warren Buffett's offer to buy the remaining portion that he didn't already own on Thursday August 26th. We were able to provide a new Investment Observation of Transatlantic Holdings (TRH). With Transatlantic Holdings selling below book value, median price-to-earnings and dividend increases every year since going public, we believe TRH is a great alternative to Wesco Financial.”

NLO Dividend Watch List: August 6, 2011

| symbol | name | price | p/e | earnings | yield | p/b | % from low |

| GBCI | Glacier Bancorp, Inc. | 12.41 | 21.66 | 0.59 | 3.9 | 1.05 | 0.08% |

| SYBT | S.Y. Bancorp, Inc. | 21.47 | 12.41 | 1.71 | 3 | 1.72 | 0.28% |

| BOH | Bank of Hawaii | 43.04 | 12.77 | 3.37 | 4 | 2.03 | 0.49% |

| O | Realty Income | 30.01 | 28.5 | 1.04 | 5 | 2.21 | 0.81% |

| SFNC | Simmons First National | 23.47 | 11.29 | 2.15 | 3 | 1.03 | 0.95% |

| FNFG | First Niagara Financial | 11.06 | 16.58 | 0.76 | 5 | 0.79 | 1.10% |

| CHFC | Chemical Financial | 18.05 | 13.52 | 1.34 | 4.2 | 0.88 | 1.12% |

| MLM | Martin Marietta | 67.63 | 36.76 | 2.24 | 2 | 2.16 | 1.17% |

| SUSQ | Susquehanna Bancshares | 6.8 | 39.53 | 0.17 | 1 | 0.45 | 1.19% |

| CFR | Cullen/Frost Bankers | 51.28 | 14.53 | 3.5 | 3.4 | 1.46 | 1.24% |

| PRK | Park National | 60 | 13.52 | 4.51 | 5.8 | 1.42 | 1.52% |

| TCB | TCF Financial | 11.83 | 13.77 | 0.99 | 1.5 | 1.07 | 1.55% |

| SON | Sonoco Products | 29.9 | 15.03 | 2.04 | 3.5 | 1.91 | 1.63% |

| CMA | Comerica | 29.13 | 14.98 | 1.68 | 1.2 | 0.88 | 1.75% |

| IBKC | IBERIABANK | 49.18 | 28.84 | 1.84 | 2.3 | 1 | 1.80% |

| ALL | Allstate | 26.29 | 25.06 | 2.45 | 3 | 0.72 | 1.94% |

| EMR | Emerson Electric | 45.39 | 13.99 | 3.11 | 2.5 | 3.15 | 1.95% |

| BRK-A | Berkshire Hathaway | 107k | 16.3 | 6.6k | - | 1.1 | 1.98% |

| MCY | Mercury General | 36.54 | 13.43 | 2.72 | 6.2 | 1.11 | 2.07% |

| MDP | Meredith | 26.56 | 9.56 | 2.85 | 3.4 | 1.58 | 2.08% |

| NTRS | Northern Trust | 41.3 | 16.39 | 2.71 | 2.4 | 1.41 | 2.13% |

| FII | Federated Investors | 19.53 | 12.14 | 1.67 | 4.3 | 3.75 | 2.20% |

| GS | Goldman Sachs | 125.18 | 12.28 | 9.13 | 1 | 0.94 | 2.31% |

| HGIC | Harleysville | 29.5 | 10.56 | 2.79 | 4.7 | 1.03 | 2.36% |

| SEIC | SEI Investments | 17.76 | 14.56 | 1.22 | 1.2 | 3.11 | 2.36% |

| AFL | AFLAC | 41.72 | 10.97 | 4.44 | 2.7 | 1.65 | 2.38% |

| PG | Procter & Gamble | 60.59 | 15.97 | 3.8 | 3.3 | 2.53 | 2.40% |

| BKH | Black Hills | 28.8 | 17.61 | 1.64 | 4.8 | 1 | 2.42% |

| LEG | Leggett & Platt | 19.3 | 16.31 | 1.16 | 4.6 | 1.88 | 2.50% |

| CINF | Cincinnati Financial | 25.97 | 14.36 | 2.27 | 5.8 | 0.84 | 2.53% |

| WMT | Wal-Mart Stores | 50.85 | 11.11 | 4.58 | 2.7 | 2.68 | 2.54% |

| AVY | Avery Dennison | 29.12 | 10.47 | 2.88 | 3.2 | 1.72 | 2.57% |

| UBSI | United Bankshares, Inc. | 22.66 | 13.73 | 1.66 | 4.8 | 1.24 | 2.58% |

| ANAT | American Nat'l Insurance | 76.02 | 12.85 | 5.91 | 4.1 | 0.55 | 2.59% |

| WEYS | Weyco Group, Inc. | 22.83 | 19.85 | 1.15 | 2.5 | 1.48 | 2.61% |

| NWN | Northwest Natural Gas | 42.8 | 16.31 | 2.62 | 3.7 | 1.58 | 2.64% |

| AVP | Avon Products | 23.21 | 13.56 | 1.62 | 3.3 | 4.87 | 2.72% |

| TDS | TDS | 25.47 | 19.59 | 1.3 | 1.6 | 0.7 | 2.83% |

| RBCAA | Republic Bancorp | 17.29 | 3.95 | 4.36 | 2.9 | 0.83 | 2.86% |

| CYN | City National | 48.58 | 16.09 | 3.02 | 1.5 | 1.27 | 2.95% |

| BXS | BancorpSouth | 11.92 | 25.36 | 0.16 | 0.3 | 0.83 | 3.03% |

| LLTC | Linear Technology | 27.08 | 10.83 | 2.36 | 3.1 | 12.52 | 3.08% |

| MRK | Merck & Company | 31.71 | 59.94 | 0.53 | 4.2 | 1.79 | 3.12% |

| EV | Eaton Vance | 23.29 | 15.12 | 1.54 | 2.5 | 5.71 | 3.14% |

| TRH | Transatlantic Holdings | 45.24 | 17.2 | 3.06 | 1.7 | 0.69 | 3.17% |

| TEG | Integrys Energy Group | 47.58 | 12.67 | 3.75 | 5.2 | 1.23 | 3.19% |

| NUE | Nucor | 34.95 | 23.6 | 0.82 | 3.6 | 1.48 | 3.22% |

| SCG | SCANA Corp | 37.32 | 12.56 | 2.97 | 4.7 | 1.24 | 3.38% |

| VLY | Valley National Bancorp | 12.15 | 14.45 | 0.77 | 5 | 1.6 | 3.47% |

| VNO | Vornado Realty Trust | 80.78 | 18.75 | 4.31 | 2.8 | 2.61 | 3.48% |

| ADM | Archer-Daniels-Midland | 28.64 | 9.15 | 3.25 | 2.1 | 0.97 | 3.58% |

| FCBC | First Community Banc | 12.04 | 9.48 | 1.25 | 2.7 | 0.76 | 3.70% |

| ECL | Ecolab Inc. | 47.78 | 21.51 | 2.23 | 1.4 | 4.77 | 3.71% |

| UVV | Universal | 36.33 | 6.7 | 5.42 | 5.1 | 0.84 | 3.74% |

| VAL | Valspar | 30.17 | 13.94 | 2.16 | 2.1 | 1.82 | 3.78% |

| BMI | Badger Meter | 35.27 | 20.04 | 1.76 | 1.5 | 3.01 | 3.80% |

| GCI | Gannett Co. | 10.8 | 5.07 | 2.13 | 2.3 | 1.19 | 3.85% |

| LOW | Lowe's | 20.15 | 14.18 | 1.42 | 2.4 | 1.53 | 4.13% |

| PEP | Pepsico | 64.67 | 16.45 | 3.74 | 3.1 | 4.17 | 4.22% |

| SJW | SJW | 22.86 | 17.2 | 1.28 | 2.8 | 1.67 | 4.48% |

| MUR | Murphy Oil | 55.2 | 11.64 | 4.74 | 1.6 | 1.29 | 4.55% |

| FFIN | First Financial | 30.44 | 14.79 | 1.99 | 2.8 | 2 | 4.85% |

| KMB | Kimberly-Clark | 64.07 | 15.12 | 4.4 | 4.1 | 4.22 | 4.93% |

| Symbol | Company | 2010 | 2011 | % change |

| PBI | Pitney Bowes Inc | 20.71 | 20.02 | -3.33% |

| WST | West Pharmaceutical Services | 35.26 | 41.91 | 18.86% |

| PAYX | Paychex, Inc. | 25.56 | 27.09 | 5.99% |

| HGIC | Harleysville Group | 30.9 | 29.5 | -4.53% |

| CWT | California Water Service Group | 17.49 | 18.09 | 3.43% |

| Average | 4.08% | |||

| ^DJI | Dow Industrials | 10653.56 | 11444.61 | 7.43% |

| ^GSPC | S&P 500 | 1121.64 | 1199.39 | 6.93% |

Dow Theory: Q&A

“The market is always responsive to the great law of action and reaction. The longer the swing one way the longer it will be the other. One of the best general rules in speculation is the theory that reaction in an advance or a decline will be at least one-half of the primary movement [50% principle].“The fact that the law is working through short ranges and long ones at the same time makes it impossible to tell with certainty what any particular swing may do; but for practical purposes, it is not infrequently wise to believe that when a stock has risen 10 points, and as a result of one or two short swings [double tops] does not go above the high point, but rather recedes from it, that it will gradually work off 4 or 5 points.[1]”

“It often happens that the secondary movement in a market amounts to 3/8 to ½ of the primary movement.[2]”

“Whoever will study our averages, as given in the Journal for years past, will see how uniformly periods of advance have been followed by periods of decline, amounting in a large proportion of cases to from one-third to one-half of the rise. [3]”

“The law of action and reaction applies to both the general market and to individual stocks. This law states that the reaction to an advance or decline will approximate half the original movement.[4]”

“The second type of market low is based on the premise that the Dow fulfills the Wave principle and falls below the upward trending line (red) to the old support level 8100 and then 6440. A true Wave move down to the old low would bring the market below 6440. However, the last time this was fulfilled, in the period from 1970 to 1974, the market only fell 8.5% below the previous low of 631.16 on the Dow Industrials in 1970. Additionally, the Industrials ran up from 631.16 in 1970 to 1051.70 in 1973, an increase of 118% of the previous peak. As more time passes I expect the index to fall to 5474 if we do manage to complete a Wave formation on the downside.”

"Even in a bear market, this method of trading will usually be found safe, although the profits taken should be less because of the liability of weak spots breaking out and checking the general rise.[5]"

[1] Sether, Laura. Dow Theory Unplugged. W&A Publishing. 2009. page 112.

[2] Dow, Charles H. Wall Street Journal. January 22, 1901.

[2] Bishop, George. Charles H. Dow and the Dow Theory. Appleton-Century-Crofts. New York. 1960. page 120.

[2] Sether, Laura. Dow Theory Unplugged. W&A Publishing. 2009. page 117.

[3] Dow, Charles H. Wall Street Journal. January 30, 1901

[3] Bishop, George. Charles H. Dow and the Dow Theory. Appleton-Century-Crofts. New York. 1960. page 120.

[3] Sether, Laura. Dow Theory Unplugged. W&A Publishing. 2009. page 199.

[4] Bishop, George. Charles H. Dow and the Dow Theory. Appleton-Century-Crofts. New York. 1960. page 231.

[5] Schultz, Harry D. A Treasury of Wall Street Wisdom. Investors' Press. (New Jersey, 1966). p. 12. Additional commentary here.

Posted in 50% principle, Dow Theory, law of action and reaction

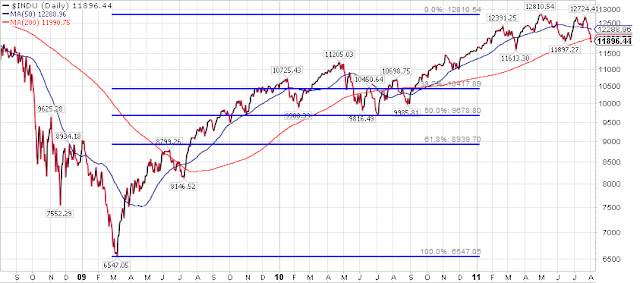

Dow Theory: August 2, 2011

Today, the Dow indexes continued to slump and ended the day down more than 2%. While we would look for a breach of the June 2011 low to be a key indicator of the bearish trend, we’re primarily focused on the March 2011 low to be the most revealing level. The charts below graphically make clear what may become the trend for the market over the next several months.

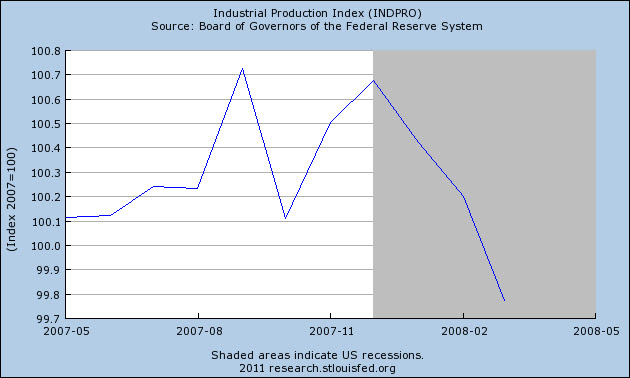

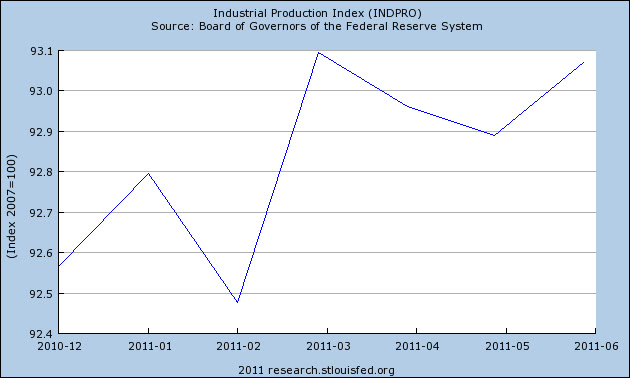

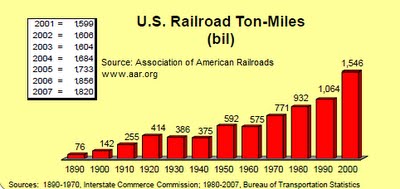

The connection between the Industrial Production Index and Dow Theory is well established as put forth by the Dow Theorist Robert Rhea. Our last article (found here ) on the Industrial Production Index made clear the importance of considering the movements of this indicator.

We’d be jumping to conclusions if we went so far as to conclude that the July Industrial Production Index numbers would not exceed the March 2011 high of 93.0943. However, we would be surprised if the INDPRO, despite already being so close to the high, manages to go above the numbers that were set in June and March 2011.

The caveat to our analysis on the Dow Industrials and Dow Transports is the possibility that the Industrials actually don’t go below the low set in March 2011 (considered a divergence or non-confirmation of the trend). If the Dow Industrials do not confirm the same lows as the Transports then we’d essentially be in a Dow Theory no-man’s land. Under such conditions, the bias should be towards being bearish but on a wait and see basis.

Posted in bear market, Dow Theory

Nasdaq 100 Watch List: July 29, 2011

| Symbol | Name | Price | P/E | EPS | Yield | P/B | % from Low |

| RIMM | Research In Motion | 25 | 3.97 | 6.3 | 0.00% | 1.38 | 0.77% |

| YHOO | Yahoo! Inc. | 13.1 | 14.79 | 0.89 | 0.00% | 1.38 | 1.24% |

| QGEN | Qiagen N.V. | 16.94 | 29.21 | 0.58 | 0.00% | 1.57 | 2.17% |

| AKAM | Akamai Technologies | 24.22 | 25.63 | 0.95 | 0.00% | 2.02 | 2.45% |

| LLTC | Linear Technology | 29.3 | 12.42 | 2.36 | 3.20% | 17.06 | 2.99% |

| TEVA | Teva Pharmaceutical | 46.64 | 12.54 | 3.72 | 1.70% | 1.8 | 3.97% |

| FSLR | First Solar, Inc. | 118.23 | 16.87 | 7.01 | 0.00% | 2.84 | 6.13% |

| LIFE | Life Technologies | 45.03 | 22.45 | 2.01 | 0.00% | 1.87 | 6.20% |

| PCAR | PACCAR Inc. | 42.81 | 21.73 | 1.97 | 1.70% | 2.67 | 7.64% |

| CSCO | Cisco Systems, Inc. | 15.97 | 12.47 | 1.28 | 1.50% | 1.87 | 8.05% |

| AMGN | Amgen Inc. | 54.7 | 11.37 | 4.81 | 0.00% | 2 | 8.83% |

| ADBE | Adobe Systems | 27.71 | 14.84 | 1.87 | 0.00% | 2.57 | 8.88% |

| SPLS | Staples, Inc. | 16.06 | 13.05 | 1.23 | 2.50% | 1.57 | 8.88% |

| INFY | Infosys Limited | 62.22 | 22.88 | 2.72 | 1.40% | 5.69 | 9.68% |

| WCRX | Warner Chilcott plc | 21.02 | 32.9 | 0.64 | 0.00% | N/A | 10.57% |

| VRSN | VeriSign, Inc. | 31.21 | 6.66 | 4.69 | 0.00% | 9.89 | 12.27% |

| MRVL | Marvell Technology Group, Ltd. | 14.82 | 11.73 | 1.26 | 0.00% | 1.87 | 12.53% |

| CHRW | C.H. Robinson Worldwide, Inc. | 72.31 | 28.92 | 2.5 | 1.60% | 9.29 | 13.34% |

| ATVI | Activision Blizzard, Inc | 11.84 | 27.41 | 0.43 | 1.40% | 1.34 | 13.85% |

| FLIR | FLIR Systems, Inc. | 27.46 | 20.95 | 1.31 | 0.90% | 2.72 | 14.42% |

| PAYX | Paychex, Inc. | 28.23 | 19.88 | 1.42 | 4.40% | 6.86 | 14.52% |

| LRCX | Lam Research Corporation | 40.88 | 6.96 | 5.88 | 0.00% | 2.28 | 15.51% |

| MU | Micron Technology, Inc. | 7.37 | 11.66 | 0.63 | 0.00% | 0.87 | 15.88% |

| SHLD | Sears Holdings | 69.67 | N/A | -0.49 | 0.00% | 0.91 | 15.88% |

| URBN | Urban Outfitters, Inc. | 32.54 | 21.32 | 1.53 | 0.00% | 3.96 | 16.38% |

| FFIV | F5 Networks, Inc. | 93.48 | 34.38 | 2.72 | 0.00% | 6.53 | 16.85% |

| MSFT | Microsoft Corporation | 27.4 | 10.19 | 2.69 | 2.30% | 4.07 | 17.50% |

| NIHD | NII Holdings, Inc. | 42.35 | 18.76 | 2.26 | 0.00% | 2.04 | 19.13% |

| AMAT | Applied Materials, Inc. | 12.32 | 10.36 | 1.19 | 2.60% | 2.01 | 19.96% |

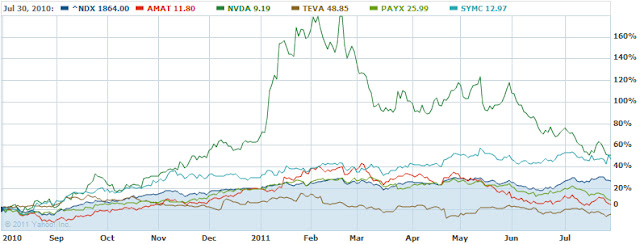

Watch List Performance Review

| Symbol | Name | 2010 | 2011 |

% change

|

|||

| SYMC | Symantec Corp. | 12.97 | 19.06 |

46.95%

|

|||

| AMAT | Applied Materials | 11.80 | 12.32 |

4.41%

|

|||

| NVDA | NVIDIA Corp. | 9.19 | 13.83 |

50.49%

|

|||

| TEVA | Teva Pharma. | 48.85 | 46.64 |

-4.52%

|

|||

| PAYX | Paychex, Inc. | 25.99 | 28.23 |

8.62%

|

|||

| Average gain |

21.19%

|

||||||

| ^NDX | Nasdaq 100 | 1864.00 | 2362.81 |

26.76%

|

|||

Posted in Uncategorized

In the News

Technological Innovation vs. Financial Innovation (video) at GregFielding.com

Groupon Therapy at VanityFair.com

Betting the Farm at VanityFair.com

The Prince Who Blew Through Billions at VanityFair.com

Fake Apple store cuts to core of China risk to brands at Asahi Shimbun

Allstate Falls Most Since February as Lacher Steps Down Amid Lower Returns at Bloomberg

Cree a Strong Rebound Candidate at SeekingAlpha.com

Icahn's Activism Lifts Some Stocks, but Others Plunge at Yahoo!Finance.com

Shareholder Activism à la Carl Icahn: A Clinical Study (PDF) by Venkiteshwaran, Iyer and Rao

Why Cisco is a better bet than Apple at MarketWatch.com

China Mobile shares rise after 3G subscriber data at MarketWatch.com

Transatlantic to Pursue Better Validus Offer to Beat Allied at Bloomberg

Carl Icahn Urges Motorola Mobility to Explore Options for Wireless Patents at Bloomberg

Microsoft Handily Beats Estimates at TheStreet.com

Competition draining Japan's hold on battery materials market at Asahi Shimbun

Mizuho bank to invest in Vietnam's largest bank at Asahi Shimbun

Stanford emerging as hub for fast-growing investment trend at San Jose Mercury

Dow Theory Misunderstood

“The averages, indeed, must be read with a single heart. They become deceptive if and when the wish is father to the thought”[1].

“Diligent study of the averages will sufficiently show where a ‘line,’ having proved to be one of accumulation, has given definite information, not merely useful to the trader but valuable to those who look upon the stock market as a means of forecasting the trend of the country's general business”[2].

“Perhaps it might be permissible to say that the secondary [reaction] movement suspends for a time the great primary swing, although a natural law is still in force even when we counteract it”[3].

“… in examining the action of the Averages over a period of sixty-five years, the Dow Theorist has learned, among other things, that the movement of a single Average should never be considered alone. Further, the Dow Theorist has learned that the last trend should be considered to remain in effect until the contrary has been proved”[4].

“…the stock market and the commodity market move substantially together” [5].

“One of the shortest ways of going wrong is to accept an indication by one average which has not been clearly confirmed by the other. [6]”

NLO Dividend Watch List: July 22, 2011

| Symbol | Name | Price | % Yr Low | P/E | EPS (ttm) | Dividend | Yield | Payout Ratio |

| MDP | Meredith Corp. | 29.36 | -0.05% | 10.30 | 2.85 | 1.02 | 3.47% | 36% |

| ANAT | American National Insurance | 76.58 | 0.37% | 12.96 | 5.91 | 3.08 | 4.02% | 52% |

| WABC | Westamerica BanCorp. | 48.57 | 0.39% | 15.52 | 3.13 | 1.44 | 2.96% | 46% |

| MCY | Mercury General Corp. | 38.7 | 1.45% | 14.23 | 2.72 | 2.40 | 6.20% | 88% |

| GBCI | Glacier BanCorp., Inc. | 13.12 | 2.22% | 22.24 | 0.59 | 0.52 | 3.96% | 88% |

| TCB | TCF Financial Corp. | 13.05 | 2.55% | 13.18 | 0.99 | 0.20 | 1.53% | 20% |

| HGIC | Harleysville Group Inc. | 30.72 | 2.71% | 11.01 | 2.79 | 1.44 | 4.69% | 52% |

| SFNC | Simmons First National Corp. | 25.15 | 2.72% | 11.70 | 2.15 | 0.76 | 3.02% | 35% |

| TDS | Telephone and Data Systems | 30.18 | 2.84% | 23.22 | 1.30 | 0.47 | 1.56% | 36% |

| AFL | AFLAC Inc. | 46.21 | 3.08% | 10.41 | 4.44 | 1.20 | 2.60% | 27% |

| UVV | Universal Corp. | 37.14 | 3.16% | 6.85 | 5.42 | 1.92 | 5.17% | 35% |

| BRK-A | Berkshire Hathaway Inc. CL 'A' | 115,750 | 3.37% | 17.59 | 6580.82 | N/A | N/A | N/A |

| SYBT | S.Y. BanCorp., Inc. | 23.35 | 3.62% | 13.65 | 1.71 | 0.72 | 3.08% | 42% |

| STBA | S&T BanCorp., Inc. | 17.61 | 5.04% | 15.18 | 1.16 | 0.60 | 3.41% | 52% |

| CMA | Comerica, Inc. | 33.78 | 5.31% | 18.56 | 1.82 | 0.40 | 1.18% | 22% |

| PEP | PepsiCo Inc. | 65.76 | 5.50% | 17.58 | 3.74 | 2.06 | 3.13% | 55% |

| AVY | Avery Dennison Corp. | 33.69 | 5.66% | 11.70 | 2.88 | 1.00 | 2.97% | 35% |

| ALL | Allstate Corp. | 28.69 | 5.73% | 11.71 | 2.45 | 0.84 | 2.93% | 34% |

| NTRS | Northern Trust Corp. | 45.92 | 5.81% | 16.94 | 2.71 | 1.12 | 2.44% | 41% |

| NWN | Northwest Natural Gas Co. | 46.62 | 5.96% | 17.79 | 2.62 | 1.74 | 3.73% | 66% |

| CHFC | Chemical Financial Corp. | 19.1 | 6.30% | 17.36 | 1.10 | 0.80 | 4.19% | 73% |

| SUSQ | Susquehanna Bancshares, Inc. | 7.9 | 6.95% | 46.47 | 0.17 | 0.08 | 1.01% | 47% |

| SCG | SCANA Corporation | 40.54 | 7.06% | 13.65 | 2.97 | 1.94 | 4.79% | 65% |

| CINF | Cincinnati Financial Corp. | 28.4 | 7.14% | 12.51 | 2.27 | 1.60 | 5.63% | 70% |

| BOH | Bank of Hawaii Corp. | 46.35 | 7.33% | 12.91 | 3.59 | 1.80 | 3.88% | 50% |

| BXS | BanCorp.South Inc. | 12.49 | 7.62% | 78.06 | 0.16 | 0.04 | 0.32% | 25% |

| GS | Goldman Sachs Group, Inc. | 135.49 | 7.66% | 14.84 | 9.13 | 1.40 | 1.03% | 15% |

| PRK | Park National Corp. | 63.95 | 7.76% | 14.18 | 4.51 | 3.76 | 5.88% | 83% |

| SON | Sonoco Products Co. | 32.94 | 8.36% | 16.15 | 2.04 | 1.16 | 3.52% | 57% |

| PG | Procter & Gamble Co. | 64.25 | 8.62% | 16.91 | 3.80 | 2.10 | 3.27% | 55% |

| WMT | Wal-Mart Stores, Inc. | 54.52 | 8.74% | 11.90 | 4.58 | 1.46 | 2.68% | 32% |

| BKH | Black Hills Corp. | 30.84 | 8.90% | 18.80 | 1.64 | 1.46 | 4.73% | 89% |

| AVP | Avon Products, Inc. | 28.69 | 9.16% | 17.71 | 1.62 | 0.92 | 3.21% | 57% |

| LLTC | Linear Technology Corp. | 31.27 | 9.25% | 13.25 | 2.36 | 0.96 | 3.07% | 41% |

| CTL | CenturyTel, Inc. | 38.66 | 9.57% | 12.97 | 2.98 | 2.90 | 7.50% | 97% |

| CFR | Cullen/Frost Bankers, Inc. | 55.77 | 9.72% | 15.93 | 3.50 | 1.84 | 3.30% | 53% |

| MLM | Martin Marietta Materials, Inc. | 79.16 | 9.77% | 35.18 | 2.25 | 1.60 | 2.02% | 71% |

| FII | Federated Investors Inc | 22.18 | 9.89% | 13.28 | 1.67 | 0.96 | 4.33% | 57% |

| C | Citigroup Inc | 40.26 | 10.42% | 13.16 | 3.06 | 0.04 | 0.10% | 1% |

| 39 Companies | ||||||||

Watch List Summary

There is a noticeably large number of insurance and financial companies on our list. This may be because of the foreign debt situation in Greece or the possibility of a debt ceiling impass. Further analysis would have to be done but it appears that this sector is out of favor and worth investigating.

On the top of our list is Meredith (MDP), a major player in the media sector. While the Murdoch scandal seems to casts a pall over the sector, Meredith has emerged to be in good shape financially. The company earned $2.85 in the last 12 months and is paying $1.02 in dividends. Next year earnings are expected to come in at $2.68 which would not jeopardize the dividend payment in our view. Historically, MDP is considered undervalued with a dividend yield of 1.3% thus the current yield of 3.47% suggests that the stock could double in due time. The company will report its quarterly earning on July 28th.

American National Insurance (ANAT) is no stranger to the NLO team. This life insurer trades at a 55% discount to its book value and offers a hefty 4% dividend yield. With the payout ratio at 50%, earnings will need to drop substantially for the company to consider cutting, halting or borrowing to pay the dividend. Anyone interested in this stock should be aware that it is a highly illiquid stock. The average volume based on the last three months is merely 21,000. Friday's volume for ANAT was 12,150. American National Insurance has been trading in a line formation or consolidation for a year and any move, up or down, could set the trend for the stock.

Another stock hitting our radar is Pepsico (PEP). Pepsi reported higher profits but scaled back on their guidance which took down the stock. Pepsi's yield is slightly above 3% making the stock worth looking into. Historically, Pepsi trades between 2.2% and 1.2% so a 3% yield would imply that this company is undervalued by as much as 40%.

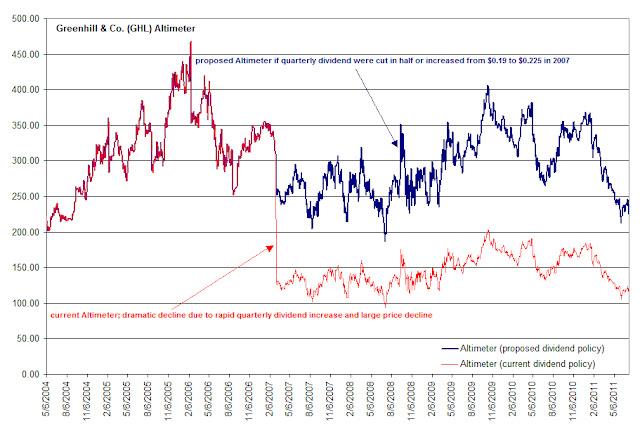

Stock Highlight: Greenhill & Co. (GHL)

Top Five Performance Review

| Symbol | Name | 2010 Price | 2011 Price | % change |

| BEC | Beckman Coulter, Inc. | 47.26 | 83.5 | 76.68% |

| JNJ | Johnson & Johnson | 57.63 | 66.72 | 15.77% |

| FRS | Frisch's Restaurants, Inc | 19.99 | 22.4 | 12.06% |

| XRAY | DENTSPLY International | 29.26 | 39.54 | 35.13% |

| WST | West Pharmaceutical | 35.41 | 46.45 | 31.18% |

| Average | 34.16% | |||

| DJI | Dow Jones Industrial | 10,424.62 | 12,681.16 | 21.65% |

| SPX | S&P 500 | 1,102.66 | 1,345.02 | 21.98% |

Disclaimer:

Posted in NLO Dividend Watch List

In the News: July 18, 2011

Icahn Says He Expects Interest in Clorox From Other Bidders at Bloomberg.com

Wealthtrack with Steven Romick (video) at Blip.tv

MGIC Swings to Loss as Claims Costs Increase at Bloomberg.com

BofA Needs to Build $50 Billion Cushion for Housing Losses at Bloomberg.com

Greenhill Sees Departures as Advisers Are Paid in Sliding Stock at Bloomberg.com

Dodd-Frank Prompts Change To ERISA Definition Of 'Fiduciary' at Institutional Investor

'Scary Things' On Horizon As Food Prices Rise at Institutional Investor

Investors In ETFs Need To Know What They're Investing In at Institutional Investor

What Constitutes An Actively Managed ETF? at Institutional Investor

What If Analysts' Estimates Were Based On ETF Benchmarks? at Institutional Investor

Tokio Marine Nichido to offer car insurance by the day at Asahi Shimbun

Foreign investors snapping up choice Silicon Valley property at San Jose Mercury News

Zeltiq files for $115 million IPO at San Jose Mercury News

S&P threatens downgrade of U.S. financial companies at Yahoo!Finance

Beginning of the end of the entire crisis? at MarketWatch.com

The Stock Market Barometer by William Peter Hamilton

Nasdaq 100 Watch List: July 15, 2011

| Symbol | Name | Trade | P/E | EPS | Yield | P/B | % from low |

| CSCO | Cisco Systems, Inc. | 15.59 | 12.17 | 1.28 | 1.50% | 1.8 | 3.23% |

| AKAM | Akamai Technologies | 29.85 | 31.59 | 0.95 | 0 | 2.51 | 5.48% |

| SPLS | Staples, Inc. | 15.2 | 12.35 | 1.23 | 2.60% | 1.49 | 6.11% |

| TEVA | Teva Pharmaceutical | 47.97 | 12.9 | 3.72 | 1.70% | 1.87 | 6.93% |

| MRVL | Marvell Technology | 14.87 | 11.77 | 1.26 | 0 | 1.83 | 7.21% |

| URBN | Urban Outfitters, Inc. | 31.41 | 20.58 | 1.53 | 0 | 3.81 | 8.20% |

| QGEN | Qiagen N.V. | 18.28 | 31.52 | 0.58 | 0 | 1.68 | 8.42% |

| AMGN | Amgen Inc. | 55.05 | 11.44 | 4.81 | 0 | 2.08 | 9.53% |

| INFY | Infosys Limited | 61.39 | 22.57 | 2.72 | 1.40% | 5.63 | 9.74% |

| BRCM | Broadcom Corp | 33.27 | 16.79 | 1.98 | 1.10% | 3.06 | 11.27% |

| YHOO | Yahoo! Inc. | 14.69 | 17.26 | 0.85 | 0 | 1.49 | 13.52% |

| CERN | Cerner Corporation | 61.9 | 42.11 | 1.47 | 0 | 5.14 | 14.09% |

| ADBE | Adobe Systems | 29.29 | 15.69 | 1.87 | 0 | 2.69 | 15.09% |

| ATVI | Activision Blizzard | 11.91 | 27.57 | 0.43 | 1.40% | 1.33 | 15.41% |

| LLTC | Linear Technology | 30.48 | 12.92 | 2.36 | 3.10% | 17.46 | 16.11% |

| MU | Micron Technology | 7.41 | 11.72 | 0.63 | 0 | 0.85 | 16.51% |

| MSFT | Microsoft Corp | 26.78 | 10.64 | 2.52 | 2.40% | 4.18 | 17.82% |

| LRCX | Lam Research | 42.06 | 7.16 | 5.88 | 0 | 2.23 | 18.85% |

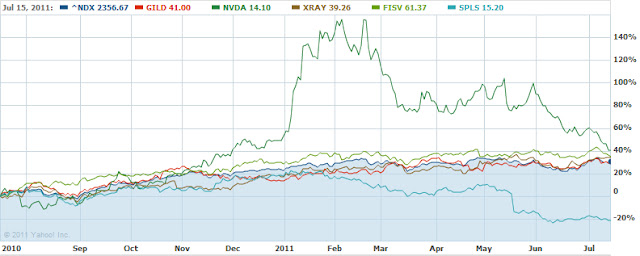

| Symbol | Company | 2010 | 2011 | % change | |||

| GILD | Gilead Sciences | $31.94 | $41.00 | 28.37% | |||

| NVDA | NVIDIA | $10.05 | $14.10 | 40.30% | |||

| XRAY | DENTSPLY | $29.25 | $39.26 | 34.22% | |||

| FISV | Fiserv, Inc. | $45.60 | $61.37 | 34.58% | |||

| SPLS | Staples, Inc. | $19.31 | $15.20 | -21.28% | |||

| - | - | - | - | - | |||

| - | - | - | Average | 23.24% | |||

| - | - | - | - | - | |||

| NDX | Nasdaq 100 | 1803.48 | 2356.67 | 30.67% | |||

In the News: July 10, 2011

- Saudi Arabia Imposes Quotas to Boost Local Hiring at BusinessWeek

-

Illegal Workers in Alabama: The Exodus at BusinessWeek

-

Two ‘geezers’ who are bullish at MarketWatch

-

Insurance cheaters call their luxury cars farm vehicles at L.A. Times

-

Homeowner associations foreclose on residents at USA Today

-

JPMorgan pays $228M to settle bid-rigging charges at USA Today

-

Amazon's former Calif. affiliates brace for lost revenue at San Jose Mercury

-

Bay Area housing market reflects different rebounds at San Jose Mercury

Comments Off on In the News: July 10, 2011

Posted in In the news

NLO Dividend Watch List: July 8, 2011

July 8, 2011 Watch List

| Symbol | Name | Price | % Yr Low | P/E | EPS (ttm) | Dividend | Yield | Payout Ratio |

| CMA | Comerica, Inc. | 33.79 | 2.15% | 18.57 | 1.82 | 0.40 | 1.18% | 22% |

| NTRS | Northern Trust Corp. | 45.87 | 2.89% | 16.93 | 2.71 | 1.12 | 2.44% | 41% |

| BXS | BanCorp.South Inc. | 12.01 | 3.80% | 75.06 | 0.16 | 0.04 | 0.33% | 25% |

| GS | Goldman Sachs Group, Inc. | 134.08 | 4.51% | 14.69 | 9.13 | 1.40 | 1.04% | 15% |

| BRK-A | Berkshire Hathaway Inc. CL 'A' | 115,050 | 4.66% | 17.48 | 6580.82 | N/A | N/A | N/A |

| GBCI | Glacier BanCorp., Inc. | 13.44 | 4.67% | 22.78 | 0.59 | 0.52 | 3.87% | 88% |

| AFL | AFLAC Inc. | 46.51 | 5.35% | 10.48 | 4.44 | 1.20 | 2.58% | 27% |

| NWN | Northwest Natural Gas Co. | 45.93 | 5.42% | 17.53 | 2.62 | 1.74 | 3.79% | 66% |

| WABC | Westamerica BanCorp. | 49.7 | 5.95% | 15.63 | 3.18 | 1.44 | 2.90% | 45% |

| ANAT | American National Insurance | 78.74 | 6.20% | 13.32 | 5.91 | 3.08 | 3.91% | 52% |

| MCY | Mercury General Corp. | 39.61 | 6.22% | 14.56 | 2.72 | 2.40 | 6.06% | 88% |

| SYBT | S.Y. BanCorp., Inc. | 23.59 | 6.41% | 13.80 | 1.71 | 0.72 | 3.05% | 42% |

| SCG | SCANA Corporation | 39.55 | 6.63% | 13.32 | 2.97 | 1.94 | 4.91% | 65% |

| CHFC | Chemical Financial Corp. | 19.07 | 6.83% | 17.34 | 1.10 | 0.80 | 4.20% | 73% |

| TCB | TCF Financial Corp. | 13.85 | 7.36% | 13.99 | 0.99 | 0.20 | 1.44% | 20% |

| BKH | Black Hills Corp. | 30.25 | 7.57% | 18.45 | 1.64 | 1.46 | 4.83% | 89% |

| BOH | Bank of Hawaii Corp. | 46.24 | 7.69% | 12.88 | 3.59 | 1.80 | 3.89% | 50% |

| UVV | Universal Corp. | 38.11 | 7.78% | 7.03 | 5.42 | 1.92 | 5.04% | 35% |

| SFNC | Simmons First National Corp. | 26.13 | 8.24% | 12.15 | 2.15 | 0.76 | 2.91% | 35% |

| HGIC | Harleysville Group Inc. | 32.01 | 8.51% | 11.47 | 2.79 | 1.44 | 4.50% | 52% |

| MDP | Meredith Corp. | 31.41 | 8.61% | 11.02 | 2.85 | 1.02 | 3.25% | 36% |

| KMB | Kimberly-Clark Corp. | 66.62 | 9.11% | 15.14 | 4.40 | 2.80 | 4.20% | 64% |

| AVP | Avon Products, Inc. | 28.53 | 9.23% | 17.61 | 1.62 | 0.92 | 3.22% | 57% |

| SUSQ | Susquehanna Bancshares, Inc. | 8.08 | 9.49% | 47.53 | 0.17 | 0.08 | 0.99% | 47% |

| PG | Procter & Gamble Co. | 64.93 | 9.73% | 17.09 | 3.80 | 2.10 | 3.23% | 55% |

| PRK | Park National Corp. | 64.98 | 9.95% | 14.41 | 4.51 | 3.76 | 5.79% | 83% |

| TDS | Telephone and Data Systems | 31.85 | 10.44% | 24.50 | 1.30 | 0.47 | 1.48% | 36% |

| HHS | Harte-Hanks, Inc. | 8.39 | 10.54% | 10.62 | 0.79 | 0.32 | 3.81% | 41% |

| WMT | Wal-Mart Stores, Inc. | 54.08 | 10.84% | 11.81 | 4.58 | 1.46 | 2.70% | 32% |

| CINF | Cincinnati Financial Corp. | 29.02 | 10.89% | 12.78 | 2.27 | 1.60 | 5.51% | 70% |

| 30 Companies | ||||||||

Watch List Summary

Northern Trust (NTRS) is now trading below $47 but the fundamentals have gotten stronger. Net tangible assets rose from $6,369M in September 2010 quarter to $6,522M in March 2011 quarter. Credit Suisse shares our view with a recent report of five banks with strong capital level.

Top Five Performance Review

| Symbol | Name | 2010 Price | 2011 Price | % change |

| FRS | Frisch's Restaurants, Inc | 19.95 | 22.47 | 12.63% |

| DNB | Dun & Bradstreet Corp. | 67.46 | 76.04 | 12.72% |

| WMT | Wal-Mart Stores, Inc. | 49.43 | 54.08 | 9.41% |

| FII | Federated Investors Inc | 21.24 | 24 | 12.99% |

| XOM | Exxon Mobil Corp. | 58.78 | 82.42 | 40.22% |

| Average | 17.59% | |||

| DJI | Dow Jones Industrial | 10,198.03 | 12,657.20 | 24.11% |

| SPX | S&P 500 | 1,077.96 | 1,343.80 | 24.66% |

In our view, it is important to learn from the past and thus we shall revisit what the news of Exxon (XOM) was a year ago. The most compelling case we found was from an article featured in Barron's titled Buy Into the ExxonMobil Slide. Collins Stewart's analyst, Katherine Lucas Minyard, called for a 40% upside and amazingly hit that mark (and more) in less than a year. Her research was very prescient and well timed. In her report, Minyard stated that based on historical P/E multiples, Exxon should be trading at $82 per share. Moreover, just as we subscribe to the dividend yield theory, Minyard noted that "ExxonMobil's dividend yield is currently 3.1%, with a return to the 10-year average 2.2% implying a share price of $82". The stock closed at $82.42 on Friday July 8, virtually one year after Minyard's report was published.

Disclaimer:

iShares Silver Trust (SLV): Tipping its hand or major bluff

“…in general, we should see SLV tread water for a brief period of time before falling back to the prior low which began with the current run back in November 2008. Dow Theory suggests that a reasonable buying opportunity would exist at below line B (blue line B). However, we wouldn’t jump in at the slightest move below line B. Instead, we’d like to see the price decline to the dashed blue line at $15.41 or below.”

Our claim that SLV would tread water or trade in a range was based on the prior move from the peak in March 2008 to July 2008. We felt that, until proven otherwise, the 2006 to 2008 run was the best precedent to go by. In the charts below, we have found some striking similarities that are worth observing.

In the News: July 3, 2011

- Huge rare earth deposits found in Pacific at Reuters

- Deep-sea mud in the Pacific Ocean as a potential resource for rare-earth elements at Nature Geoscience

- Why The Dow Will Plunge To 7,000 at MarketWatch.com

- How to buy stocks high and sell them low at MarketWatch.com

- ETFs on the Brink at Smart Money

- ETFs' European Bank Stocks May Carry Greek Risk at Smart Money

- Don't Lose Your Grip at Wall Street Journal

- In Case of ETF Emergency at Wall Street Journal

- BYD Can Recover From Missteps: Munger at Bloomberg

- Bats Options Program, Criticized by Rivals, Gets SEC Approval at Bloomberg

- Digitimes Insight: LED capacity growth to exceed 20% in 3Q11 at DigiTimes

- Analyst says Cree's stock beaten down too far by AP at Yahoo!Finance

- Legg Mason’s Miller Sells Kodak Stake After Decade of Decline at Bloomberg

- Biggest Tax Avoiders Win Most Gaming $1 Trillion U.S. Tax Break at Bloomberg

- MRVL Could Offer Dividend at Barron's

- Why China’s Heading for a Hard Landing, Part 1: A. Gary Shilling at Bloomberg

- Are You An Informed Investor? at North American Securities Adminstrators Association

- Please consider donating to the New Low Observer. Thank you.

Posted in In the news