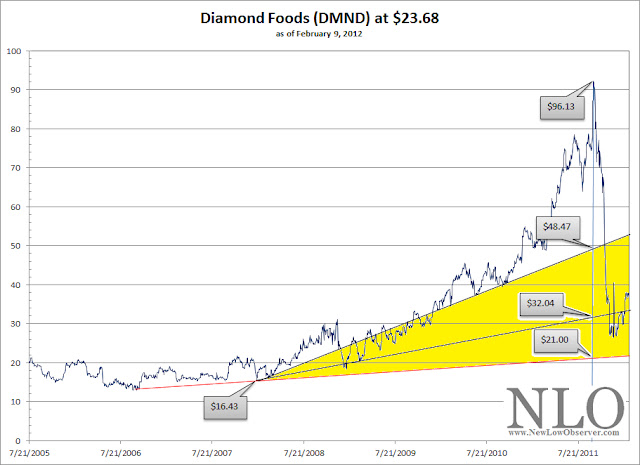

In retrospect, everything appears “oh so clear.” We love history and attempt to interpret events from the past as a means to project into the future, assuming everything remains the same. Which is why the chart below seems so stunning to us.

The above chart of Diamond Foods (DMND), which has recently been blown out the water due to some accounting “irregularities” and the dismissal of the CEO and CFO, demonstrates the seeming power of Edson Gould’s speed resistance lines (SRL). First, notice that the high of DMND was at$96.13, the starting point for all analysis of SRLs. Based on the high of $96.13, the conservative downside target would have been the $48.47 level. At the same time, the extreme downside target would have been the $21.00 level with an intermediate downside target of $32.04.

Amazingly, every downside target has been met with DMND reaching as low as $21.44 , on an intraday low. By the way, little mention has been made of the accounting firm that signed off on Diamond Foods spurious books.

Already, in our prior work, we've seen a Netflix (NFLX) SRL, done in December 2010, give us an extreme downside target of $66. Almost a year later, NFLX declined through the $66 level to fall to as low as $62.37 on November 30, 2011. Another SRL that we ran before it came to fruition was Green Mountain Coffee Roasters(GMCR) on October25, 2011. At the time, GMCR was trading at $64.75. We estimated, using the SRL, that GMCR had an extreme downside target of $37.21. The stock recently fell as low as $39.42 as reviewed in our February2, 2012 posting.

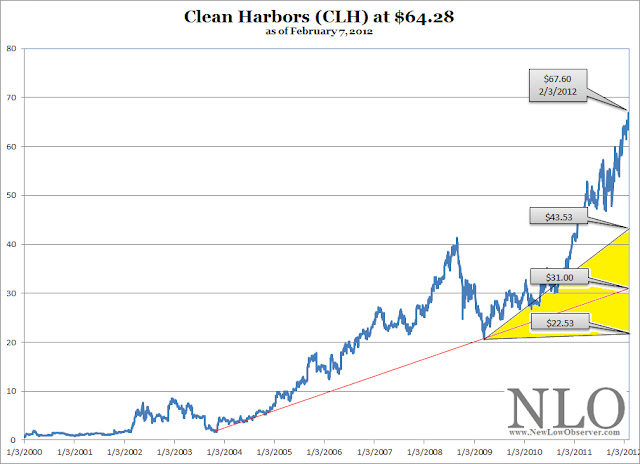

Below is the latest speed resistance lines for a stock that we've been curious about for some time, Clean Harbors (CLH).

Some could reasonably argue that we’re allowing correlation to equal causation, which we’d gladly confess to. However, this explains why we a reactively seeking companies which we can run Edson Gould’s SRLs beforehand to ensure some semblance of integrity in the concept. We want to run this examination through as many companies as we can before the actual decline.

A word of warning, the fact that a stock reaches the extreme downside target does not necessarily mean that the stock or index is considered to be a “buy.” Nor does it suggest that the stock or index cannot fall further. Instead, it only reflects what potentially could happen on the downside. Additionally, SRLs do not suggest a time frame that a decline is expected to occur.

For the NLO team, speed resistance lines appeal to our sense of considering the worst case scenario, which has saved us a lot of money simply by avoiding situations that would create significant loss. Using history to assist us in projecting the downside risk is the primary reason we started examining speed resistance lines.