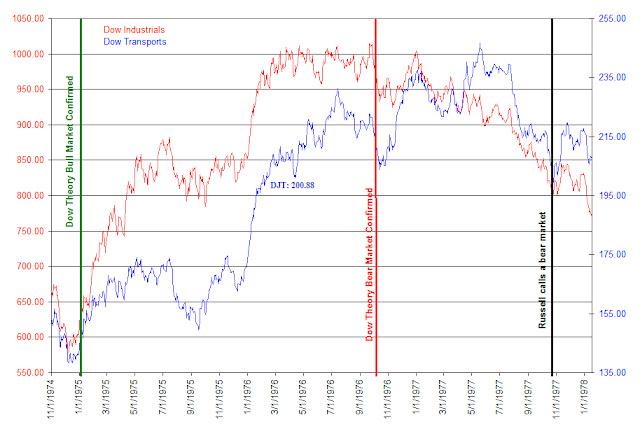

This review of Richard Russell’s Dow Theory Letters is dated November 9, 1977 when the Dow Jones Industrial Average was at 818.43 and the Dow Jones Transportation average was at 206.56.

Dow Theory

The first topic addressed by Richard Russell is Dow Theory. On this topic, Russell says the following:

“THE PICTURE: As far as I’m concerned, as far as my studies of the Dow Theory are concerned, a valid primary bear market signal was given when, on October 24 [1977], the Transportation Average confirmed the prior bearish indications of the Industrials. There are always those who cry, ‘The signal was late, it was too late!’ But no competent Dow Theorist in history ever waited for an actual bull or bear signal before taking action! For instance, we bought stocks in December, 1974 before the 1975 bull market signal, and we sold our stocks in March and April of this year well ahead of the October, 1977 bear market signal. We bought and sold on many clear indications, and the final Dow Theory signal merely confirmed what we had suspected and had acted upon.”

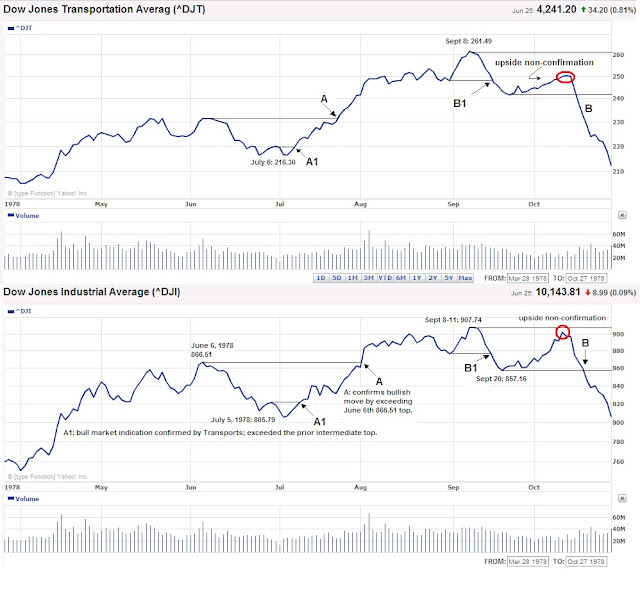

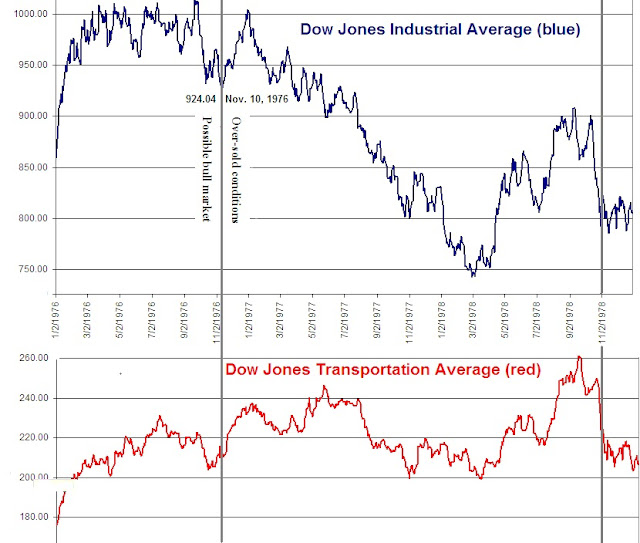

First, we’d like to address when a bear market signal is most likely to have occurred after the bull market signal that was confirmed in January 1975. From our perspective, the bear market was signaled on October 5, 1976 for the Transports and October 8, 1976 for the Industials when both indexes fell below the late August 1976 lows.

For whatever reason, Russell acknowledges that the call was late but doesn’t confirm how late he was. Looking back at the October 16, 1976 issue of Dow Theory Letters (Letter 678), in the first issue after we believe the bear market began, Russell makes no reference to the dual violation to the downside by both indexes. Russell does allude to the Transportation Average level of 200.88 which he believed the market to be “weak” if the index fell below such a point. On October 16, 1976, Russell said the following:

“On the other hand, if the 200.88 level is broken, I would take this as a sign of unusual weakness, and I would take an even more cautious stance towards the market (which means selling more stocks and upping the bond portion of your portfolio even further.”

Naturally, there is a high level of inconsistency in suggesting that he would lighten up on his stock holdings if the Transportation Average fell below 200.88. In the November 9, 1977 issue, Russell claimed that at the time the Transports fell below the indicated level he “sold our stocks in March and April of this year well ahead of the October, 1977 bear market signal.”

Although done in hindsight, our interpretation, almost a full year ahead of Russell’s call of a bear market, would have sheltered the investor from 3 times the loss.

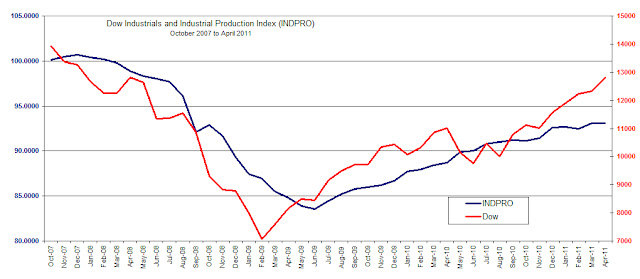

This is consistent with our Dow Theory bull market indication in July 2009 and our more recent bear market call on August 2, 2011 (

all NLO Dow Theory Bull Market articles) contrasted with Russell’s many bull and bear misinterpretations from March 9, 2011 (as partially outlined

here).

The difference in Dow Theory Bear Market interpretations to the March 6, 1978 low:

|

|

Date

|

|

Transports decline

|

|

Industrials decline

|

|

Russell:

|

|

10/24/1977

|

|

-1.20%

|

|

-7.43%

|

|

NLO:

|

|

10/8/1976

|

|

-4.89%

|

|

-22%

|

Ironically, Russell says the following of those skeptical of the Dow Theory bear signal on October 24, 1977:

“…others said that if it was indeed a bear signal, then probably the greatest portion of the market slide was over anyway. Two days after the bear signal, the market rallied sharply, as if in disbelief.”

Since Russell’s call of a bear market was in fact long after the majority of losses were incurred, he only furthered the skepticism and misinformation of a useful tool for investors and businesses alike. From the March 6, 1978 low to the April 27, 1981 high, the Dow Industrials increased by 37.87% while the Transportation Average increased 119.71%. Alternatively, the Dow Industrials increased 23.17% and the Transports increased 117.55% after Russell’s indication that a bear market began on October 24, 1977.

Steps to a Dow Theory Bear Market signal:

- July 14, 1976 Transports hit new high 231.27 but unconfirmed by Industrials

- Sept. 21, 1976 Industrials hit new high at 1014.79 but unconfirmed by Transports

- Oct. 8, 1976 both indexes fall below the late August lows-Bear Market begins

On page 3 of the DTL, Russell starts a Q&A with a question that has a very interesting answer:

“Question: Suppose we get a rally that turns out to be a huge advance? Then what, Russell?

“Answer: We have a number of ‘fail-safes’ that work on either the bull side or the bear side of the market. The one I’m thinking about in particular is my study of the three moving averages of the Dow. At this juncture, the 13-week MA is a whopping 71 points below the 50-week MA, and we would need a crossing to get a major bull signal. Furthermore, the 4-week MA (short-term MA) is at 814, 29 points below the 13-week MA (intermediate-term) which is at 843. We need a crossing of the 4-week MA above the 13-week MA merely to get a ‘buy-alert.’ That would take time. So in the absence of a full over-sold bottom, I would say, ‘Skip any rally that may be forthcoming, or wait for the Dow’s moving averages to cross.’”

There is a concern that we have regarding this section of Russell’s letter. First, a “fail-safe” provision should address what actions to take if investments don’t work out. Being out of stocks altogether isn’t investing nor is it working towards compounding, an overarching, albeit conflicting, theme in Russell’s work. Therefore, Russell’s “fail-safe” observations based on a moving average requires reacting to a lagging indicator which compounds the delay in taking advantage of investment opportunities. In fact, using such an approach causes investment activity, or lack thereof, to be made at the worst possible time.

In general, the use of moving averages for buy indications seems to be in contradiction to Dow Theory. As pointed out earlier, moving averages are lagging indicators whereas the use of Dow Theory is supposed to act as a leading indicator. Although Dow Theory provides bull or bear market indications not buy and sell recommendations, it can be effectively used to navigate market gyrations. Based on the performance of the markets after Russell’s call of a bear market, it is clear that the mixing of moving averages and Dow Theory led to conflicting ideas of market direction that allowed Russell’s “Great” Depression bias to become the default reaction.

Treasuries

On page 4, Russell gives a quick blurb that had been overlooked for a long time in the mainstream media until recently. Russell says the following:

“I might also mention that if the public became wary of the banking system, there could be a major move out of bank deposits and into Treasury bills.”

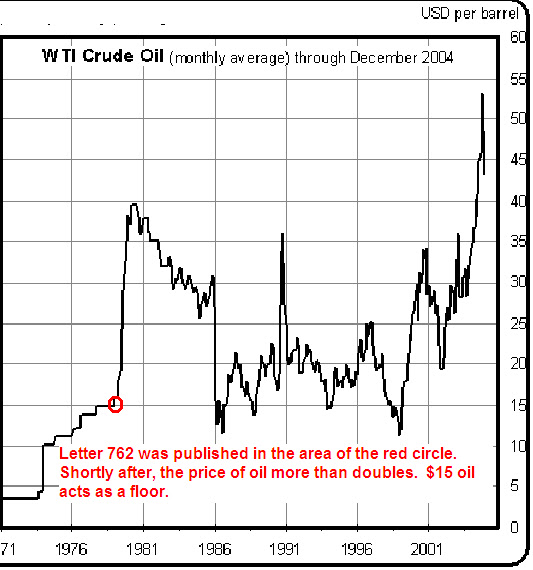

This has been the story of our experience in the market since 2008. Furthermore, as the European Union struggles with their less than integrated banking system, demand for Treasuries grows. This is in stark contrast to the belief that gold is king when there is a banking crisis. We believe such a view is a holdover from when countries propped the price of gold with a gold standard. The decline of gold and gold stocks in 2008 shows that there is another horse in the race for financial “safety.”

Gold & Swiss Franc

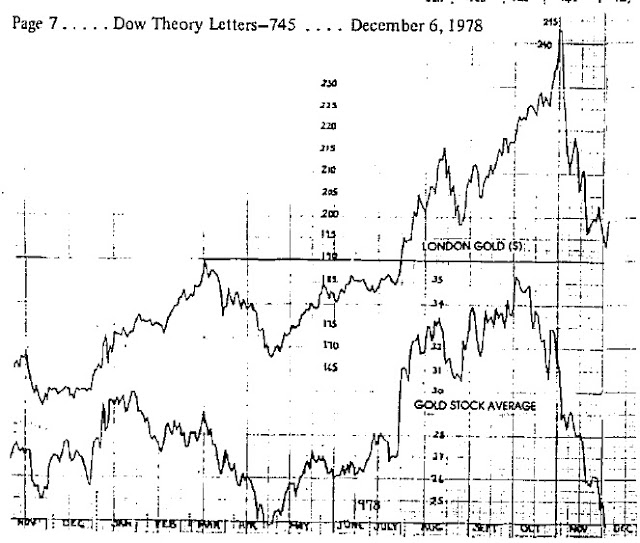

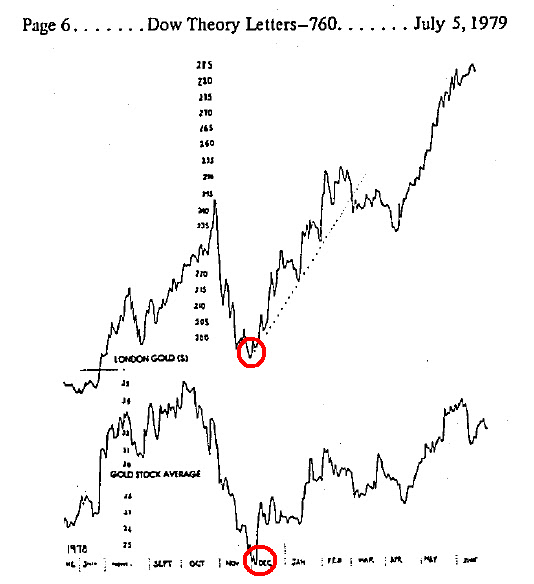

Russell points out something which seems extremely relevant to any investor in gold and that is the relationship between gold, gold stocks and the Swiss franc. Russell says the following:

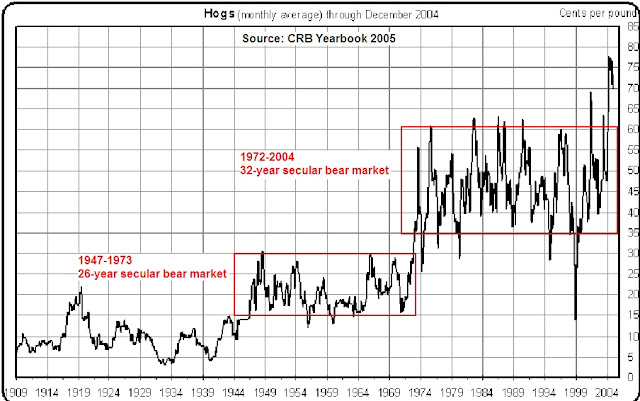

“Now here’s what nobody (or let’s say very few people) know. If I asked you “How’d you like to own Swiss francs at the early-1974 price?” you’d probably jump at the chance. Why would you jump? Because the Swiss franc has been a hot item, a glamour currency. Look at my next chart (bottom of p.5). Note that the Swiss franc was about 31 cents in early-1974. Gold at that time was $166 per ounce. All right, the franc is now 45 cents or about 45% above its early-1974 price, in terms of dollars. But gold is roughly the same price as it was in early-1974! Now what the hell makes the Swiss franc better than gold? The irony is that the Swiss franc is highly valued because it has such a high level of gold backing.”

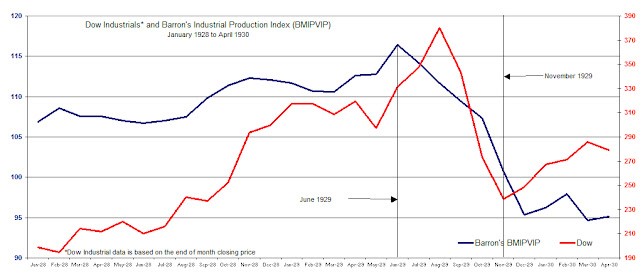

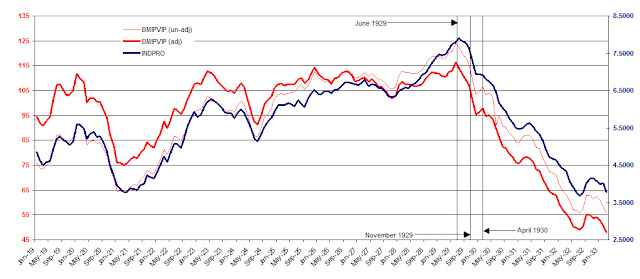

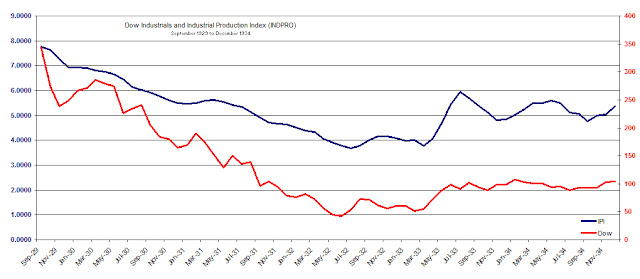

Nothing could be more instructive than the review of the price of gold, gold stocks and Swiss francs during what was perceived to be a gold bull market. Few gold bugs will acknowledge the amazing decline in the price of gold from early 1975 to the low of 1976. The decline was nearly 50% of the peak price and lasted nearly two full years. Likewise, the Barron’s Gold Average lost nearly 66% from the high achieved in 1974 to the low near mid-1976. The Swiss franc, on the other hand, remained in the a narrow trading range or moved higher.

Russell was correct to question “…what the hell makes the Swiss franc better than gold?” Although Russell never mentions it, by pointing out the “uncharacteristic” rise of the Swiss franc at the time, we gathered that the activity of the Swiss franc implies that it is an indicator for the longer-term price of gold. Because we’ve pointed out in many previous articles the fact that gold isn’t always the safe haven that it is fabled to be, when the next big decline in the price of gold occurs we will be watching closely the action of the Swiss franc for any indications of investment opportunities in gold stocks. We have constructed what we believe to be a reliable indicator for the best time to buy gold stocks that are constituents of the Philadelphia Gold and Silver Stocks Index. The action of the Swiss franc will act as a confirming indicator when the index is near a new low.

More Russell Reviews: