On February 13, 2024, we received a thoughtful response from Hanif Bayat to a comment that we made about the rise in real estate prices in Canada.

This response was preceded by the comment from Hanif Bayat, “Maybe Bank of Canada’s too many rate cuts in 2008, while Canadian home prices didn't crash unlike U.S.”

First and foremost, neither the Bank of Canada or the Federal Reserve of the United States have any say in the direction of interest rates. Rate policy is dictated by the markets. The only issue is how long before the central banks respond to the market rates.

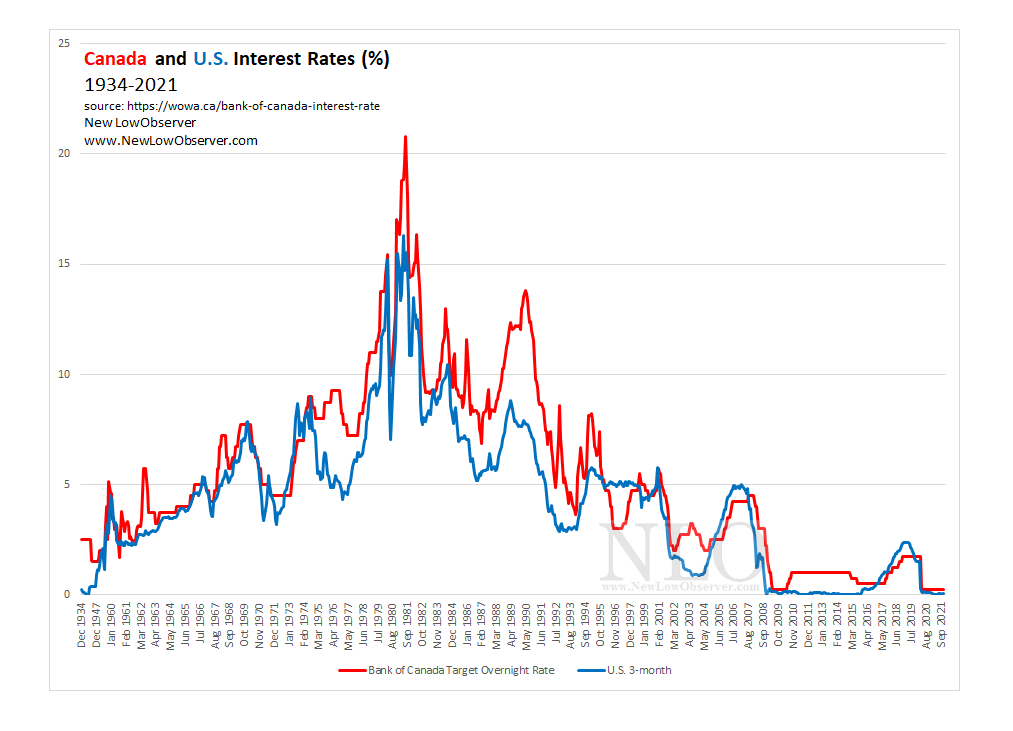

We start with the longest running and continuously reported data series [a must for good analysis] on interest rates found at the Federal Reserve Bank of St. Louis (FRED).

Using the “Monthly, Percent, Not Seasonally Adjusted” (TB3MS) data from January 1934 to January 2024, we can compare that to the “Interest Rates, Discount Rate for United States” (INTDSRUSM193N) data from 1950 to 2021.

The “Interest Rates, Discount Rate for United States” is the actual Federal Reserve response to market rates.

What you’ll notice between to the two data sets from 1950 and after is that the Federal Reserve never led the directions of interest rates from a prior peak or trough.

Pick your period and you’ll see the same outcome. Let’s expand this concept beyond the limited period offered by FRED.

If the 90 year history of the data is consistent with the Federal Reserve Bank following the market then we can expand that to the period from 1915 to 1960 for a reasonable period of overlap to confirm the consistency of the claim [THE CLAIM: neither the Bank of Canada or the Federal Reserve of the United States have any say in the direction of interest rates. Rate policy is dictated by the markets] and the data.

The claim of the Fed holding rates at any level “too long” or “too short” is nullified. This extends to the Bank of Canada. Why?

Autonomy of interest rates is a nuanced topic. However, when we zoom out, we can clearly see that the overall direction of interest rates, on a secular basis, between Canada and the U.S. are joined at the hip. This confirms the words of Charles H. Dow (co-founder of the Wall Street Journal) in October 1, 1901:

For this reason, when we see that the Canadian rate environment following the same secular trend as the U.S., then we don’t have to worry about whether or not Canada has any control over their rates. For this reason, the Bank of Canada didn’t hold down rates artificially or too long.

Let’s solidify the idea that central banks have zero say over the secular trend in interest rates. Why? Because we haphazardly referred to the idea earlier but did not nail down the concept.

In the 1947 book titled “Cycles: The Science of Prediction”, Edward Dewey and Edwin Dakin present the idea that there would be a peak in inflation and interest rates in 1979. This assessment is based on the cyclical pattern of rates from 1790 to 1947. In addition to the idea of a peak in 1979 that would be followed by a decline, Dewey had a low set at 2006. Years of work with cycles has taught us that there will be slippage that pushes out any expected peak or trough.

Most important to understand about Dewey’s work ( founder, Foundation for the Study of Cycles) is that it was premised on the data from 1790 and earlier. For the Wholesale Prices from 1790 to 2000 above, the period in red indicates before the modern central bank.

Let’s reinforce the idea that central banks have little impact on the direction of interest rates. The chart below was generously provided by @WinfieldSmart on Twitter from October 12, 2020. Our update to the chart was to simply indicate the period before the Federal Reserve in red.

As can be plainly seen, the direction of interest rates, on average, has been on a vigorous declining trend for the period in question. That interest rates would possibly go to zero and stay there for an extended period of time should not surprise anyone.

Some have proposed that central bank policy is moving the needle for interest rates in the short term and therefore, they do have an impact on interest rates. More specifically, this claim is often associated with the concept of Quantitative Easing (QE) as a remedy for the housing crisis (GFC). Let’s put that idea to rest with the following review of the data.

The concept of modern Quantitative Easing (QE) is thanks to the work of the Bank of Japan. The perceived manipulation of markets with the uses of QE surely must have been the reason that interest rates were held down for so long, right?

In a piece by Henry McMillan and Jerome Baesel from 1988, they projected the direction of interest rates from near double digits rates to negative rates by 2008 to 2022. Remember, this was before the implementation of QE in Japan and the U.S.

Nothing that central banks have done is out of line for what could have been expected from 1988 or 1310. This brings us to the topic of home prices in Canada. That will be our follow-up article in the commentary with Hanif Bayat.

See also: