While champagne glasses are being raised to celebrate the nearly 62% increase in the Dow Jones Industrial Average over the bottom that was reached on March 9, 2009 we’d like to outline some of our worst performing research recommendations as part of our former website at Dividend Inc. We’re not surprised at the markets rise as outlined in our article on SeekingAlpha.com titled “

The Importance of Market Perspective” issued in February 2009. Our only concern now is how much further the market could go before a mild decline of 30% or so.

As you may know, even in the worst environment for investing in stocks (during 2008) we still made recommendations for investors to look out for as new investment opportunities. Of the 15 companies that we recommended in 2008, only five under-performed. However, anyone who actually put money in these five stocks might have lost a large portion of their assets if they didn’t sell early enough.

First on the list is

Mine Safety Appliance (MSA) which fell 61.93% from the Research Recommendation date to the lowest point on March 9, 2009. Almost as soon as we made the recommendation the stock fell to $35 a share from $41.61. The stock moderated for a couple of months until it finally collapsed in early October. (MSA) discontinued its policy of increasing the dividend every year which is a warning sign for the future outlook on earnings. Adjusted for dividend payments, (MSA) is in the lose column to the tune of –32.19%.

Next on our list is

Masco Corp. (MAS). (MAS) also took an incredible dip right after the recommendation. Falling from $19.43 all the way down to $14.00. After a rise all the way back to the recommendation level of around $19, (MAS) made the amazing march down 81.27% to the March 9, 2009 low. Because (MAS) is in the home improvement and building industry it stands to reason that the stock would fall as much as it did. Not surprisingly, (MAS) cut their dividend which for the New Low Observer teams means sell the stock and watch what develops from the sideline. Adjusted for dividend payments, (MAS) is in the lose column to the tune of –15.41% since the initial recommendation.

The next stock is

Illinois Tool Works (ITW) which was a stock that was handled in the most irresponsible manner on our part. After recommending the stock on April 2, 2008 at $50.34, we were able to watch the stock exceed a gain of 9% in less than 2 months but didn’t put in a sell recommendation. Given what we knew about the market conditions at the time, we should have been more vigilant about the movement of this stock. Subsequent to our recommendation of ITW the company’s stock fell by as much as 49.15% at its worst and has discontinued it’s record of dividend increases. Adjusted for dividend payments since the recommendation date, ITW is in the lose column by –2.14%.

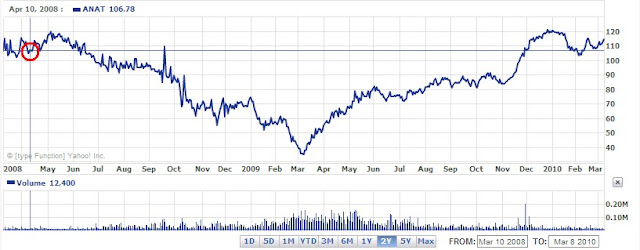

American National Insurance (ANAT), one of my favorite insurance companies has had an astounding run since our recommendation. ANAT initially rose 15% after our recommendation which was great. However, we didn’t adhere to our rule of taking exceptional gains in a short period of time. The price to pay for this error was to watch ANAT fall a gut wrenching 67.87% to the low of March 9, 2009. Even more astounding is the rise from the bottom however, we cannot take any credit for the rise that has taken place since. ANAT has discontinued its record of increasing the dividend every year. One claim that can be made is that since our recommendation date, ANAT has risen by 14.97% when adjusted for dividend payments.

Finally, our recommendation of

Nucor (NUE) fell by 47.75% at the lowest point on November 20, 2008. NUE later cut the dividend and has an adjusted lose of –2.97% since or initial recommendation.

It should be pointed out that our policy is to make Investment Observations at a time when we think a stock should be investigated as a potential investment opportunity. Our hope is that after the recommendation/observation the stock price will be lower than when we first pointed out the stock. If you review our

2008 Transaction Overview, you will see that we did carry a few of these stocks in our portfolio with varying results. Despite the fact that these companies cut or did not increase their dividend we will continue to follow these stocks as former Dividend Achievers.

-Touc

A reader asks:

“Is there some common trait among these 5 that, if known, could be used as a red flag or indicator not to repeat a future sub-optimal purchase?”

Touc’s reply is here.