On January 31, 2023, Richard Bernstein penned a piece in the Financial Times titled “End The Fed ‘Put.’” While eloquently written, there are points that require response which, if taken as a whole, negate the title and the claims that follow. Below, our less than eloquent attempt on the subject of the "Fed Put.”

To start, we are always fascinated by how frequently freshly minted opinion pieces become age old truism to those whose faith is only that the view is what they want to hear.

This falling over an opinion piece as fact because it fits the reader’s preloaded faith and bias is the first stumbling block to critical thinking. This creates a feedback loop for which there is little hope of recovery.

Paragraph One & Two

Along the way, however, there is a trail of breadcrumbs which, if followed through to their conclusion, will automatically warn of hyperbole and in some cases deception. In this article, the first paragraph drops the biggest, and most appropriate, crumb of all.

“The Maytag Repairman was a fictional washing machine mechanic who was lonely because no one ever needed to repair a reliable Maytag appliance.”

“For many years, the US Federal Reserve played the role of the Maytag Repairman with respect to inflation.”

The highlighted sentences in the first and second paragraph speak to the idea that the Federal Reserve is a fictional repairman in an economic system that never needs repair. This is the very first breadcrumb which indicates that, whether needed or not, the Fed exists for the purpose of meddling in markets. However, what is fictional is the Fed’s impact on the long term secular trend in inflation.

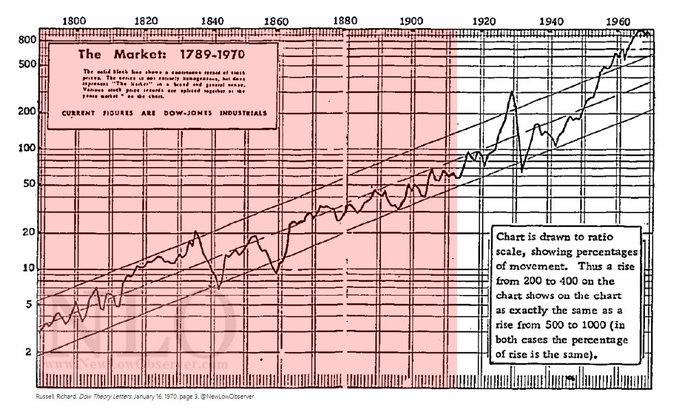

As shown in the work of Edward R. Dewey and Edwin F. Dakin’s 1947 book, Cycles: The Science of Prediction, the secular trend in Wholesale Prices (inflation/rates) from 1790 to 2000 were easily outlined and as highlighted in red, have been consistent in the United States long before the Fed was a twinkle of the eye of J.P. Morgan. Especially worth noting is the fact that in 1947, Dewey and Dakin projected a peak in inflation in 1979 and a trough in 2006.

Paragraph Three & Four

The curious thing about financial populist writing is that it doesn’t rely on checking their own premise. As an example, when we loop back to the opening paragraphs of this opinion piece, there was the claim or suggestion that the Federal Reserve is somehow a fictional character that sits in the background who plays solitaire or does crossword puzzles. Yet, the entirety of the remaining article is about how the Fed is anything but uninvolved in financial markets.

“The repeated efforts to curtail financial market volatility led to the term the Fed ‘put’.”

“…the Fed repeatedly quelled financial market volatility with significantly lower interest rates.”

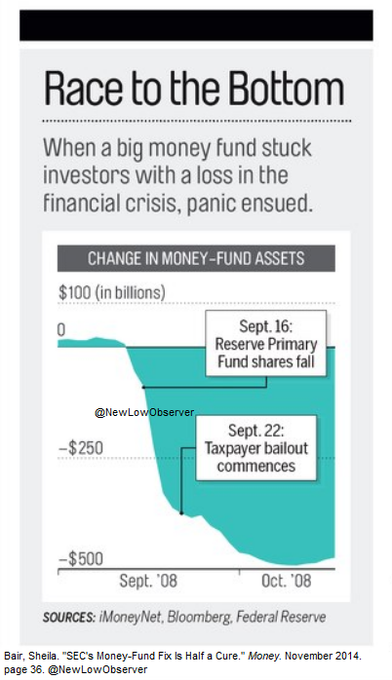

Nicely wrapped in this tripping up of their own metaphor of the Fed being like the Maytag repairman is the modern religion of the Fed. In this case, it is a false faith in the Fed’s activity being the reason that markets work. The claim that the Fed’s role to “curtail financial market volatility” led investors to take “excessive risks” doesn’t address the willingness of investors to take risks whether it is holding cash or putting their money into a money market mutual fund. Although the idea of the two seem “safe” they carry their own risks.

Additionally, the author cites the most egregious failures (low hanging fruit) of risk taking but not the successes. Likewise, this opinion piece doesn’t address the long history of risk takers that arrive when all seemed lost, before the Bank of England or Federal Reserve existed.

Noteworthy in this opinion piece is the crafty, or uninformed, use of “financial bubbles in the past 25 years.” This limits the purview of analysis to only those points which “I’m willing to argue but not those which I haven’t attempted to address, I’m also hoping you have no understanding of history because this really sells.”

The reality of markets suggest that the frequency of bubbles, crashes, panics, and recessions were far more prevalent before the Federal Reserve than afterwards. There, you’ve done it, you’ve gotten us to somehow defend the very institution which we think doesn’t matter. However, worth mentioning is the fact that whatever brand of capitalism the U.S. subscribes to would likely lead to fewer economic calamities over time with or without the Feds existence. Seemingly, even in the worst cases, around the world, the defaults keep coming but at less regular intervals.

Ultimately, this becomes a one-sided coin or a flat earth narrative that appeals to the basic instinct of the masses but is diametrically opposed to reason and the way that financial markets have worked throughout history.

Paragraph Five, Six, & Seven

Again, we can’t help but be reminded that the article starts out with a metaphor that doesn’t stick. Repeatedly the claim is that the Fed is very active in something (climate change, inflation, unemployment etc.) but then not involved like the Maytag repairman.

This section opens with the idea that the Fed has some kind of mandate. The claim is that there is a dual mandate of meddle with unemployment and tinker with inflation. Then there is the complaint that, while having this mandate, the Fed got involved in something it wasn’t supposed to, because it was bored.

First, the Fed has only one mandate, bail out banks when trouble arises. The bailout of banks can take the guise of bailing out utilities to save banks:

Bailing out the Livestock Industry to save banks:

Bailing out the Railroads to save banks:

Of course, there are the direct bailouts of banks. However, there isn’t a dual mandate. There is only one goal, objective, or mandate of the Fed, bail out the banks.

Second, if the Fed is really a Maytag repairman, then how is it supposed that they wandered from their “dual mandate?”

Paragraph Eight & Nine

The opening of paragraph eight continues to go back to the observation of the Fed being a disinterested party and yet somehow needs to “focus” on whatever its mandate, which is, regardless of opinions, to meddle.

This opinion piece draws the conclusion that:

“the growing notion that inflation has peaked and the central bank will soon ‘pivot’ to lower interest rates has fuelled a rally so far during 2023 in the riskiest, most speculative assets”

This ignores the rally that has occurred in the “average” risk assets and the extensive history of markets to rise when rates increase, with and without a central bank:

While cherrypicked data is handy in a pinch it is useful to see how such a spurious claim well in advance of the event can manifest in the reality of markets.

Paragraph Ten & Eleven

As the article concludes, we get to the gristle that the author seems to hold out on for so long. In this case, it is a plea, a plea to, presumably, the author’s own interests and away from the interests of the “greater good” opening of curtailing “ financial market volatility.”

What is the author’s interests? Well, the unsolicited investment advice that is offered requires, presumably, that the Fed maintain a policy of rate increases. This is unfortunate since this is a behavior that we’ve observed in previous cycles and have anticipated in this cyclical move within a secular trend. Our August 2020 claim was that “People would be begging for higher rates soon.”

This is a plea for the Fed, as a mere witness that only responds to market rates since inception, to embark on a path that is in opposition of the market. In instances of central banks taking such a position, the consequences have been unmitigated disasters as noted in the Fed’s policy of shaking out speculators in 1929, Japan’s attempt to curb real estate speculation in 1989 and China’s more recent foray into trying to stop the flight of capital.

Paragraph 12 & 13

The closing paragraphs are almost ironic in that they contradict all the previous claims that were made by the author.

One claim that stands out is:

“Much of the financial sector’s business has been built on generous and cheap money.”

As self serving as this article is, nothing is further from the truth. As noted above, the period from 1896-1906 saw the market boom with rising rates and no central bank.

The closing sentence should be considered galling, in saying:

“allowing inflation to reignite could damage the US economy for a decade or more and, in the current volatile political environment, could even destabilise the governments of the US and other nations.”

As we’ve demonstrated in the opening, a cycle which precedes the existence of the Fed indicates that the central bank doesn’t “allow” inflation.

Closing Thoughts

Can an opinion piece ever cover all sides of an issue to make their point? No. That is the purpose of a populist financial opinion piece, to shows what they want to show while ignoring key facts and truths that confirm a contrary standpoint. This is the acceptable trade off of an opinion piece. However, tripping on your own metaphor while serving up unsolicited investment advice and recommend the Fed embark on a policy that supports your investments should be the very last thing that we as readers should be faced with when deciding whether we need to “End the Fed ‘Put’.”

3 responses to “Deconstructing the “ End the Fed ‘Put’””