A reader of our Dow 130k article has raised an important question about the risks that the stock market faces when confronted with the prospect of rising interest rates. The reader says, in part:

“…they say that interest rates are mean reverting and based on where we are today (historically low) I would think that the betting man would bet that it can only go up from here. If that is the case, I can't see a bull market in the coming years.

“What if the scenario is that we have permanent low inflation (Secular stagnation). Productivity improvements through outsourcing and technology innovation may explain this paradigm shift.”

We don’t have much to go by other than the historical record. In this case, the historical record says the following:

-

Interest rates will go up

-

Inflation is broadly bullish for the stock market

-

the period of “low inflation” is behind us

In this article, we will examine, from a historical perspective, whether this is a new era where all of our claims are false or history will repeat.

Interest Rates Rising

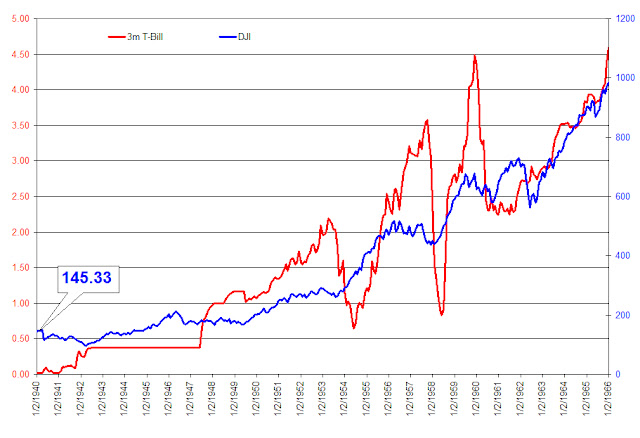

Looking at the discussion of interest rates, we must start from the most basic reference point, a relative stage in the interest rate cycle. When was the last time interest rates began a rising trend from the low? Using the 3-month Treasury, the last time we were at the same launching point was January 1940 when the 3-month Treasury was at 0.01% and the Dow Jones Industrial Average was at 151.43.

From 1940 to 1966, the 3-month Treasury increased from 0.01% to 4.65%, an increase of +46,300%. In the same period of time, The Dow Jones Industrial Average increased from 151.43 to 995.15, an increase of +557.16%. This concern about the stock market rising with interest rates was address in our April 20, 2011 article titled “The Myth of ‘Inflation Proof’ Stocks.”

Additionally, the interest rate sensitive Dow Jones Utility Index increased +724.58% from March 1940 to March 1966. This matter was addressed in our September 4, 2014 article titled “Utility Stocks and Rising Interest Rates.” It is worth re-reading the utility stock article as we present the price and performance of individual utility stocks during the period in question.

The easiest response to this claim is that this time is not like the last time and therefore cannot be relied upon to have the same outcome. This is always the perspective that we take when attempting to consider how any claim works. So, to get a better understanding on the subject, we asked ourselves, “Is this time different and is there evidence to support idea?” First we refer to the better minds on the topic from decades past to see what they think about inflation, interest rates, and the stock market.

Inflation is Still Bullish

According to Edson Gould:

“Inflation is broadly bullish for the stock market (Edson Gould Reports. Findings & Forecasts. The Last 100 points. October 1972. page 15. [Dow was at 953.27 when published, Dow peaked at 1,051.70 on 1/11/1973, 1.57 points short of the “last 100 points”].).”

Is there any way to confirm this claim by Edson Gould? One way to confirm this claim is reviewing past commentary on the direction of commodity prices. Specifically, we have a quote by Charles H. Dow, co-founder of the Wall Street Journal, who makes a direct comparison between the stock market and commodities. Dow said the following:

“For the past 25 years the commodity market and the stock market have moved almost exactly together. The index number representing many commodities rose from 88 in 1878 to 120 in 1881. It dropped back to 90 in 1885, rose to 95 in 1891, dropped back to 73 in 1896, and recovered to 90 in 1900. Furthermore, index numbers kept in Europe and applied to quite different commodities had almost exactly the same movement in the same time. It is not necessary to say to anyone familiar with the course of the stock market that this has been exactly the course of stocks in the same period (Dow, Charles. Review and Outlook. Wall Street Journal.February 21, 1901.).”

Is is possible that a guy who observed stocks and commodities in 1901 could be right about the correlation between both markets? The +3.15% underperformance in the S&P500 and the –0.23% gain in the Bloomberg Commodity Index from 2000 to 2017 should be all the evidence needed to clarify the thought. After all, Dow was living in an era entirely separate from both the 1940-1966 period and today. Dow has no dog in this fight and therefore ensures a balanced view on the general claim.

Dow’s claim about the correlation between stock markets and commodity markets are as good today as they were in 1901, IN SPITE of the technological divide simply because all advancement in society is relative. This explains why Edson Gould suggested that:

"It is vital that the investor have as a foundation a philosophy of investment that will be truly fundamental to his operations, that will not have to be modified with every superficial change in the political, financial and business situation, that will not have to be changed for inflations, wars, earthquakes or dust storms (Barron's. Bull Market Prospectors Sound Cautionary Note. April 12, 1937. page 11.)."

It is worth reiterating that as an investor, we should not have to adjust our investing to fit “every superficial change” that we perceive. Understanding that commodity prices reflect inflation and the commodity index has gone nowhere in the last 17 years while stocks have generally mirrored this change which is consistent with the secular bear markets of the past sets the stage for a secular bull market and inflation going forward. However, we understand the conflict with the idea of major changes in the market. As pointed out by Gould in November 1979:

"By far, the great majority of investors are today preoccupied with the DJIA's next 50 point [6%] move; a lesser number are predicting a DJIA of 600 or 1000; few expect a DJIA move to below 600 or over 1000.

"it is therefore quite understandable why the "600-to-1000-to-600-etc. syndrome" forms the basis for the current investor expectations.

"While we can understand investors' expectations and what those expectations are based upon, we are also aware that the DJIA often has a tendency to do the unexpected.

"The 'unexpected', as we see it, is an intermediate-term DJIA move over the next several years to the 1200-1400 level [+46.31% to +70.70%], with an eventual move up to the 2,500-3,000 level [+204.82% to +265.79%] by the mid- to late-1980's (Edson Gould Reports. Findings & Forecasts. The Sign of the Bull. November 1979. page 20.)."

Goodbye Low Inflation

All of the above should be clear, say goodbye to low inflation. How do we know? We don’t. However, history has been a decent guide in establishing a foundation that does not require changing our view unnecessarily. In the 1947 book titled Cycles: The Science of Prediction, Edward Dewey and Edwin Dakins present the cycle of wholesale prices from 1790 to the year 2000.

Again, 1947 was when the book was written. Note that it was proposed that there would be a peak in or around 1979 and a trough in or around 2006. What are the odds that we would see the exact scenario play out, in general, as anticipated?

There have definitely been major changes to the direction of markets along with innovations which have AND will likely accelerated or decelerated the actual cycle. However, on the whole, where we are is a pretty good approximation of where two guys called it way back in 1947.

Conclusion

We are not averse to the prospect that all of the scenarios present above do not come to fruition. However, there is too much that is not being considered when talking about the future based on the past. The prevailing view is that inflation and rising interest rates kill market advances. Additionally, there is the view that deflation accelerates stock market increases. This view is accurate only in so much as WHEN these situations occur, now is not the time. The scenario that we see, in the long term (16-22 years), is in our Dow 130k article.