Members

-

Topics

Archives

-

-

Recent Posts

-

-

-

Investor Education

Market Return After Exceptional Years

Dollar Cost Averaging Tool

Dow Theory: The Formation of a Line

Dividend Capture Strategy Analysis

Golden Cross – How Golden Is It?

Debunked – Death Cross

Work Smart, Not Hard

Charles H. Dow, Father of Value Investing

It's All About the Dividends

Dow Theory: Buying in Scales

How to Avoid Losses

When Dividends are Canceled

Cyclical and Secular Markets

Inflation Proof Myth

What is Fair Value?

Issues with P-E Ratios

Beware of Gold Dividends

Gold Standard Myth

Lagging Gold Stocks?

No Sophisticated Investors

Dollar down, Gold up?

Problems with Market Share

Aim for Annualized Returns

Anatomy of Bear Market Trade

Don’t Use Stop Orders

How to Value Earnings

Low Yields, Big Gains

Set Limits, Gain More

Ex-Dividend Dates -

-

Historical Data

1290-1950: Price Index

1670-2012: Inflation Rate

1790-1947: Wholesale Price Cycle

1795-1973: Real Estate Cycle

1800-1965: U.S. Yields

1834-1928: U.S. Stock Index

1835-2019: Booms and Busts

1846-1895: Gold/Silver Value

1853-2019: Recession/Depression Index

1860-1907: Most Active Stock Average

1870-2033: Real Estate Cycles

1871-2020: Market Dividend Yield

1875-1940: St. Louis Rents

1876-1934: Credit-New Dwellings

1896-1925: Inflation-Stocks

1897-2019: Sentiment Index

1900-1903: Dow Theory

1900-1923: Cigars and Cigarettes

1900-2019: Silver/Dow Ratio

1901-2019: YoY DJIA

1903-1907: Dow Theory

1906-1932: Barron's Averages

1907-1910: Dow Theory

1910-1913: Dow Theory

1910-1936: U.S. Real Estate

1910-2016: Union Pacific Corp.

1914-2012: Fed/GDP Ratio

1919-1934: Barron's Industrial Production

1920-1940: Homestake Mining

1921-1939: US Realty

1922-1930: Discount Rate

1924-2001: Gold/Silver Stocks

1927-1937: Borden Co.

1927-1937: National Dairy Products

1927-1937: Union Carbide

1928-1943: Discount Rate

1929-1937: Monsanto Co.

1937-1969: Intelligent Investor

1939-1965: Utility Stocks v. Interest Rates

1941-1967: Texas Pacific Land

1947-1970: Inventory-Sales Ratio

1948-2019: Profits v. DJIA

1949-1970: Dow 600? SRL

1958-1976: Gold Expert

1963-1977: Farmland Values

1971-2018: Nasdaq v. Gold

1971-1974: REIT Crash

1972-1979: REIT Index Crash

1986-2018: Hang Seng Index Cycles

1986-2019: Crude Oil Cycles

1999-2017: Cell Phone Market Share

2008: Transaction History

2010-2021: Bitcoin Cycles -

Interesting Read

Inside a Moneymaking Machine Like No Other

The Fuzzy, Insane Math That's Creating So Many Billion-Dollar Tech Companies

Berkshire Hathaway Shareholder Letters

Forex Investors May Face $1 Billion Loss as Trade Site Vanishes

Why the oil price is falling

How a $600 Million Hedge Fund Disappeared

Hedge Fund Manager Who Remembers 1998 Rout Says Prepare for Pain

Swiss National Bank Starts Negative

Tice: Crash is Coming...Although

More on Edson Gould (PDF)

Schiller's CAPE ratio is wrong

Double-Digit Inflation in the 1970s (PDF)

401k Crisis

Quick Link Archive

Category Archives: Sell Recommendations

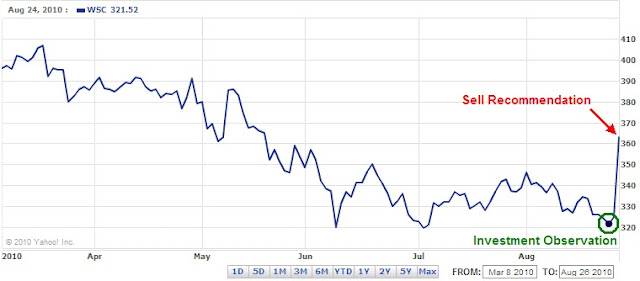

Sell Wesco Financial (WSC) at the Market

Sell Aqua America (WTR) at the Market

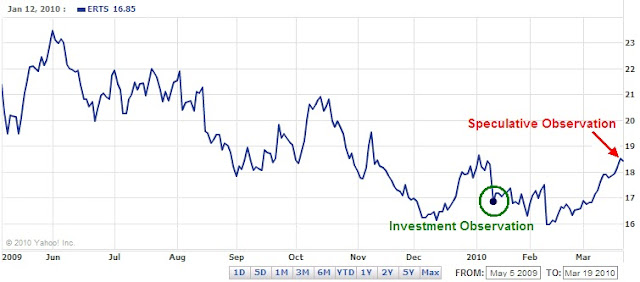

Sell Electronic Arts (ERTS) at the Market

- maximize the annual yield of each trade.

- reduce time between buying and selling of each stock.

- exceed the annual yield of government guaranteed alternatives in each trade.

Sell Cephalon (CEPH) at the Market

-

maximize the annual yield of each trade.

-

reduce time between buying and selling of each stock.

-

exceed the annual yield of government guaranteed alternatives in each trade.

Sell Cardinal Health (CAH) at the Market

Let's review the numbers. The table below shows the previous article's fundamentals compared to today's figures.

| Date | P/B | F P/E | P/CF | Yield |

| 9/29/2009 | 1.11 | 12.00 | 6.00 | 2.60% |

| 2/23/2010 | 2.33 | 13.81 | 8.70 | 2.10% |

Sell recommendations are intended to deal with the short term reality of the market. The tracking of the Sell recommendations are the worst case scenario if you happen to have bought a stock at the time the Investment Observation was made (please avoid making this mistake.) We aim for mediocrity in our returns, therefore we are happy with 9-12% annual gains. However, since codifying this approach to investing in 2005, we have had annual returns of 20% and above every year since.

It is always recommended that when selling a stock, one should not place stop orders, limit orders or orders after hours. This leaves the seller in the position of being vulnerable to the whims of the market makers. Instead, place your sell orders only as a market order during market hours. Some would complain that a market order during market hours might leave some profits on the table. However, we would rather leave some money on the table rather than have it taken away from us by the trades that are placed by institutions and market makers.

Comments Off on Sell Cardinal Health (CAH) at the Market

Posted in CAH, Cardinal Health, Sell Recommendations

Sell Abbott Labs (ABT) at the Market

ABT's stock price has gone nothing but up since the recommendation. However, in the pursuit of "seeking fair profits" the returns that this stock has provided within the last 133 days say that it is necessary to consider alternative opportunities. The key to investment success and a key principle of economics is to seek the best alternatives.

ABT was recommended when it closed at $46.94 on September 24th. As of February 3, 2010, ABT was quoted at $54.60. Based on yesterday's closing price of $54.44, ABT has gained 16.80% (including reinvested dividends.) The annualized return on this position would be close to 46%. Selling this stock now generates a return of 4.94x greater than the amount of the dividend yield if held for a full year. Additionally, the 16.80% gain exceeds the return on a 30-year treasury purchased on September 24, 2009 by 4.01x (if held to maturity.)

As we have indicated in the purposes and function of this site, our goal is to:

- maximize the annual yield of each trade.

- reduce time between buying and selling of each stock.

- exceed the annual yield of government guaranteed alternatives in each trade.

Sell recommendations are intended to deal with the short term reality of the market. The tracking of the Sell recommendations are the worst case scenario if you happen to have bought a stock at the time the Investment Observation was made (please avoid making this mistake.) We aim for mediocrity in our returns, therefore we are happy with 9-12% annual gains. However, since codifying this approach to investing in 2005, we have had annual returns of 20% and above every year since.

It is always recommended that when selling a stock, one should not place stop orders, limit orders or orders after hours. This leaves the seller in the position of being vulnerable to the whims of the market makers. Instead, place your sell orders only as a market order during market hours. Some would complain that a market order during market hours might leave some profits on the table. However, we would rather leave some money on the table rather than have it taken away from us by the trades that are placed by institutions and market makers.

Comments Off on Sell Abbott Labs (ABT) at the Market

Posted in ABT, Sell Recommendations

Sell SuperValu (SVU) at the Market

SVU's stock price has gone nothing but up since the recommendation. However, in the pursuit of "seeking fair profits" the returns that this stock has provided within the last 9 days say that it is necessary to consider alternative opportunities. The key to investment success and a key principle of economics is to seek the best alternatives.

SVU was recommended when it was trading at $12.81. As of January 14, 2010, SVU was quoted at $14.33. In after-hour trading, SVU was up $0.05 to $14.38. Based on the closing price of $14.33, SVU has gained 11.87%. The annualized return on this position would be 481%. Selling this stock now generates a return of 4.75x greater than the amount of the dividend yield if held for a full year. Additionally, the 11.87% gain exceeds the return on a 30-year treasury purchased on January 6, 2010 by 2.53x (if held to maturity.)

As we have indicated in the purposes and function of this site, our goal is to:

- maximize the annual yield of each trade.

- reduce time between buying and selling of each stock.

- exceed the annual yield of government guaranteed alternatives in each trade.

Sell recommendations are intended to deal with the short term reality of the market. The tracking of the Sell recommendations are the worst case scenario if you happen to have bought a stock at the time the Investment Observation was made (please avoid making this mistake.) We aim for mediocrity in our returns, therefore we are happy with 9-12% annual gains. However, since codifying this approach to investing in 2005, we have had annual returns of 20% and above every year since.

It is always recommended that when selling a stock, one should not place stop orders, limit orders or orders after hours. This leaves the seller in the position of being vulnerable to the whims of the market makers. Instead, place your sell orders only as a market order during market hours. Some would complain that a market order during market hours might leave some profits on the table. However, we would rather leave some money on the table rather than have it taken away from us by the trades that are placed by institutions and market makers. -Touc.

Posted in Sell Recommendations, Supervalu Inc, SVU

Sell American National Insurance (ANAT) at the market

Again, ANAT was recommended when it was trading at $105. As of December 21, 2009, ANAT was quoted at $117.51. The total return (including dividends) on ANAT since the recommendation date is 18.27%. On an annualized basis, this equals a total return (including dividends) of 10.59%.

As I have indicated in the purposes and function of this site, the goal is to:

-

maximize the annual yield of each trade.

-

reduce time between buying and selling of each stock.

-

exceed the annual yield of government guaranteed alternatives in each trade.

Research recommendations and investment observations are intended to be a starting point for investigating a quality company at a reasonable price. It is hoped that after doing the background research you can buy the stock at a lower price. Ideally the stock should be held in a tax deferred account and should not consist of less than 20% of your holdings. Personally, I prefer holding only 2-3 stocks at a time.

Sell recommendations are intended to deal with the short term reality of the market. The tracking of the Sell recommendations are the worst case scenario if you happen to have bought a stock at the time the research recommendation was made (please avoid making this mistake.) I aim for mediocrity in my returns, therefore I am happy with 9-12% annual gains. However, since codifying my approach to investing in 2005, I have had annual returns of 20% and above every year since.

It is always recommended that when selling a stock, one should not place stop orders, limit orders or orders after hours. This leaves the seller in the position of being vulnerable to the whims of the market makers. Instead, place your sell orders only as a market order during market hours. Some would complain that a market order during market hours might leave some profits on the table. However, I would rather leave some money on the table rather than have it taken away from me by the trades that are placed by institutions and market makers. -Touc

Sell Northwestern Natural Gas (NWN) at the Market

NWN's stock price has gone nothing but up since the recommendation. However, in the pursuit of "seeking fair profits" the returns that this stock has provided within the last 80 days say that it is necessary to consider alternative opportunities.

NWN was recommended when it was trading at $40.94. As of December 21, 2009, NWN was quoted at $45.25. This equals a return of 10.53%. Selling this stock now generates a return of 2.6x greater than the amount of the dividend yield. Additionally, the 10.53% gain exceeds the return on a 30-year treasury purchased on October 2, 2009 by 2.63x.

As I have indicated in the purposes and function of this site, the goal is to:

-

maximize the annual yield of each trade.

-

reduce time between buying and selling of each stock.

-

exceed the annual yield of government guaranteed alternatives in each trade.

Research recommendations and investment observations are intended to be a starting point for investigating a quality company at a reasonable price. It is hoped that after doing the background research you can buy the stock at a lower price. Ideally the stock should be held in a tax deferred account and should not consist of less than 20% of your holdings. Personally, I prefer holding only 2-3 stocks at a time.

Sell recommendations are intended to deal with the short term reality of the market. The tracking of the Sell recommendations are the worst case scenario if you happen to have bought a stock at the time the research recommendation was made (please avoid making this mistake.) I aim for mediocrity in my returns, therefore I am happy with 9-12% annual gains. However, since codifying my approach to investing in 2005, I have had annual returns of 20% and above every year since.

It is always recommended that when selling a stock, one should not place stop orders, limit orders or orders after hours. This leaves the seller in the position of being vulnerable to the whims of the market makers. Instead, place your sell orders only as a market order during market hours. Some would complain that a market order during market hours might leave some profits on the table. However, I would rather leave some money on the table rather than have it taken away from me by the trades that are placed by institutions and market makers. -Touc

Posted in Northwest Natural Gas, NWN, Sell Recommendations

Sell AquaAmerica (WTR) at the Market

WTR's stock price has gone nothing but up since the recommendation. However, in the pursuit of "seeking fair profits" the returns that this stock has provided within the last 46 days say that it is necessary to consider alternative opportunities.

WTR was recommended when it was trading at $15.64. As of December 15, 2009, WTR was quoted at $17.28. This equals a return of 10%. Selling this stock now generates a return of 2x greater than the amount of the dividend yield. Additionally, the 10% gain exceeds the return on a 30-year treasury purchased on October 30, 2009 by 2.35x (if held to maturity.)

As I have indicated in the purposes and function of this site, the goal is to:

-

maximize the annual yield of each trade.

-

reduce time between buying and selling of each stock.

-

exceed the annual yield of government guaranteed alternatives in each trade.

Research recommendations and investment observations are intended to be a starting point for investigating a quality company at a reasonable price. It is hoped that after doing the background research you can buy the stock at a lower price. Ideally the stock should be held in a tax deferred account and should not consist of less than 20% of your holdings. Personally, I prefer holding only 2-3 stocks at a time.

Sell recommendations are intended to deal with the short term reality of the market. The tracking of the Sell recommendations are the worst case scenario if you happen to have bought a stock at the time the research recommendation was made (please avoid making this mistake.) I aim for mediocrity in my returns, therefore I am happy with 9-12% annual gains. However, since codifying my approach to investing in 2005, I have had annual returns of 20% and above every year since.

It is always recommended that when selling a stock, one should not place stop orders, limit orders or orders after hours. This leaves the seller in the position of being vulnerable to the whims of the market makers. Instead, place your sell orders only as a market order during market hours. Some would complain that a market order during market hours might leave some profits on the table. However, I would rather leave some money on the table rather than have it taken away from me by the trades that are placed by institutions and market makers. Touc.

Posted in Aqua America, Sell Recommendations, touc, WTR

Air Products & Chemicals (APD): Sell at the Market

-

maximize the annual yield of each trade.

-

reduce time between buying and selling of each stock.

-

exceed the annual yield of government guaranteed alternatives in each trade.

Research recommendations are intended to be a starting point for investigating a quality company at a reasonable price. It is hoped that after doing the background research you can buy the stock at a lower price. Ideally the stock should be held in a tax deferred account and should not consist of less than 20% of your holdings. Personally, I prefer holding only 2-3 stocks at a time.

Sell recommendations are intended to deal with the short term reality of the market. The tracking of the Sell recommendations are the worst case scenario if you happen to have bought a stock at the time the research recommendation was made (please avoid making this mistake.) I aim for mediocrity in my returns, therefore I am happy with 9-12% annual gains. However, since codifying my approach to investing in 2005, I have had annual returns of 14% and above every year since.

It is always recommended that when selling a stock, one should not place stop orders, limit orders or orders after hours. This leaves the seller in the position of being vulnerable to the whims of the market makers. Instead, place your sell orders only as a market order during market hours. Some would complain that a market order during market hours might leave some profits on the table. However, I would rather leave some money on the table rather than have it taken away from me by the trades that are placed by institutions and market makers.

Comments Off on Air Products & Chemicals (APD): Sell at the Market

Posted in Air Products, APD, Sell Recommendations

Walgreen Co. (WAG): Sell at the Market

WAG has been on a steady rise since hitting a technical double bottom on March 9th 2009. At the current rate, WAG could easily breach the $39 level in the next few weeks. WAG is up an astounding 59% from the low in March. In the pursuit of "seeking fair profits" the returns that this stock has provided within the last 338 days say that it is necessary to consider alternative opportunities.

As I have indicated in the purposes and function of this site, the goal is to:

-

maximize the annual yield of each trade.

-

reduce time between buying and selling of each stock.

-

exceed the annual yield of government guaranteed alternatives in each trade.

Sell recommendations are intended to deal with the short term reality of the market. The tracking of the Sell recommendations are the worst case scenario if you happen to have bought a stock at the time the research recommendation was made (please avoid making this mistake.) I aim for mediocrity in my returns, therefore I am happy with 9-12% annual gains. However, since codifying my approach to investing in 2005, I have had annual returns of 14% and above every year since.

It is always recommended that when selling a stock, one should not place stop orders, limit orders or orders after hours. This leaves the seller in the position of being vulnerable to the whims of the market makers. Instead, place your sell orders only as a market order during market hours. Some would complain that a market order during market hours might leave some profits on the table. However, I would rather leave some money on the table rather than have it taken away from me by the trades that are placed by institutions and market makers. Touc.

Please revisit Dividend Inc. for editing and revisions to this post.

Comments Off on Walgreen Co. (WAG): Sell at the Market

Posted in Sell Recommendations, WAG, Walgreen

Sell Bard Corp. (BCR) at the Market

BCR has formed a powerful accumulation base which could indicate that the stock is headed much higher. BCR is among many of the medical device manufacturers that are being underpriced due to the debate about healthcare reform. In the pursuit of "seeking fair profits" the returns that this stock has provided within the last 126 days say that it is necessary to consider alternative opportunities.

As I have indicated in the purposes and function of this site, the goal is to:

-

maximize the annual yield of each trade.

-

reduce time between buying and selling of each stock.

-

exceed the annual yield of government guaranteed alternatives in each trade.

Research recommendations are intended to be a starting point for investigating a quality company at a reasonable price. It is hoped that after doing the background research you can buy the stock at a lower price. Ideally the stock should be held in a tax deferred account and should not consist of less than 20% of your holdings. Personally, I prefer holding only 2-3 stocks at a time.

Sell recommendations are intended to deal with the short term reality of the market. The tracking of the Sell recommendations are the worst case scenario if you happen to have bought a stock at the time the research recommendation was made (please avoid making this mistake.) I aim for mediocrity in my returns, therefore I am happy with 9-12% annual gains. However, since codifying my approach to investing in 2005, I have had annual returns of 14% and above every year since.

It is always recommended that when selling a stock, one should not place an order after hours or when the market is closed. This leaves the seller in the position of being vulnerable to the whims of the market makers. Instead, place your sell orders only as a market order during market hours. Some would complain that a market order during market hours might leave some profits on the table. However, I would rather leave some money on the table rather than have it taken away from me by the trades that are placed by institutions and market makers. Touc.

Please revisit Dividend Inc. for editing and revisions to this post.

Comments Off on Sell Bard Corp. (BCR) at the Market

Posted in BCR, Sell Recommendations

Sell Sysco (SYY) at the Market

SYY has formed an upside down head and shoulders pattern which could indicate that the stock is headed much higher. SYY is the ultimate hedge against inflation and it may go as high as my first target price of $27.58. In the pursuit of "seeking fair profits" the returns that this stock has provided within the last 253 days say that it is necessary to consider alternative opportunities.

As I have indicated in the purposes and function of this site, the goal is to:

-

maximize the annual yield of each trade.

-

reduce time between buying and selling of each stock.

-

exceed the annual yield of government guaranteed alternatives in each trade.

Research recommendations are intended to be a starting point for investigating a quality company at a reasonable price. It is hoped that after doing the background research you can buy the stock at a lower price. Ideally the stock should be held in a tax deferred account and should not consist of less than 20% of your holdings. Personally, I prefer holding only 2-3 stocks at a time.

Sell recommendations are intended to deal with the short term reality of the market. The tracking of the Sell recommendations are the worst case scenario if you happen to have bought a stock at the time the research recommendation was made (please avoid making this mistake.) I aim for mediocrity in my returns, therefore I am happy with 9-12% annual gains. However, since codifying my approach to investing in 2005, I have had annual returns of 14% and above every year since.

It is always recommended that when selling a stock, one should not place an order after hours or when the market is closed. This leaves the seller in the position of being vulnerable to the whims of the market makers. Instead, place your sell orders only as a market order during market hours. Some would complain that a market order during market hours might leave some profits on the table. However, I would rather leave some money on the table rather than have it taken away from me by the trades that are placed by institutions and market makers. Touc.

Please revisit Dividend Inc. for editing and revisions to this post.

Comments Off on Sell Sysco (SYY) at the Market

Posted in Sell Recommendations, SYY

Sell Bank of Hawaii (BOH) at the Market

It is always recommended that when selling a stock, one should not place an order after hours or when the market is closed. This leaves the seller in the position of being vulnerable to the whims of the market makers. Instead, place your sell orders only as a market order during market hours. Some would complain that a market order during market hours might leave some profits on the table. However, I would rather leave some money on the table rather than have it taken away from me by the trades that are placed by institutions and market makers. Touc.

Please revisit Dividend Inc. for editing and revisions to this post.

Comments Off on Sell Bank of Hawaii (BOH) at the Market

Posted in Bank of Hawaii, Sell Recommendations