Members

-

Topics

Archives

-

-

Recent Posts

-

-

-

Investor Education

Market Return After Exceptional Years

Dollar Cost Averaging Tool

Dow Theory: The Formation of a Line

Dividend Capture Strategy Analysis

Golden Cross – How Golden Is It?

Debunked – Death Cross

Work Smart, Not Hard

Charles H. Dow, Father of Value Investing

It's All About the Dividends

Dow Theory: Buying in Scales

How to Avoid Losses

When Dividends are Canceled

Cyclical and Secular Markets

Inflation Proof Myth

What is Fair Value?

Issues with P-E Ratios

Beware of Gold Dividends

Gold Standard Myth

Lagging Gold Stocks?

No Sophisticated Investors

Dollar down, Gold up?

Problems with Market Share

Aim for Annualized Returns

Anatomy of Bear Market Trade

Don’t Use Stop Orders

How to Value Earnings

Low Yields, Big Gains

Set Limits, Gain More

Ex-Dividend Dates -

-

Historical Data

1290-1950: Price Index

1670-2012: Inflation Rate

1790-1947: Wholesale Price Cycle

1795-1973: Real Estate Cycle

1800-1965: U.S. Yields

1834-1928: U.S. Stock Index

1835-2019: Booms and Busts

1846-1895: Gold/Silver Value

1853-2019: Recession/Depression Index

1860-1907: Most Active Stock Average

1870-2033: Real Estate Cycles

1871-2020: Market Dividend Yield

1875-1940: St. Louis Rents

1876-1934: Credit-New Dwellings

1896-1925: Inflation-Stocks

1897-2019: Sentiment Index

1900-1903: Dow Theory

1900-1923: Cigars and Cigarettes

1900-2019: Silver/Dow Ratio

1901-2019: YoY DJIA

1903-1907: Dow Theory

1906-1932: Barron's Averages

1907-1910: Dow Theory

1910-1913: Dow Theory

1910-1936: U.S. Real Estate

1910-2016: Union Pacific Corp.

1914-2012: Fed/GDP Ratio

1919-1934: Barron's Industrial Production

1920-1940: Homestake Mining

1921-1939: US Realty

1922-1930: Discount Rate

1924-2001: Gold/Silver Stocks

1927-1937: Borden Co.

1927-1937: National Dairy Products

1927-1937: Union Carbide

1928-1943: Discount Rate

1929-1937: Monsanto Co.

1937-1969: Intelligent Investor

1939-1965: Utility Stocks v. Interest Rates

1941-1967: Texas Pacific Land

1947-1970: Inventory-Sales Ratio

1948-2019: Profits v. DJIA

1949-1970: Dow 600? SRL

1958-1976: Gold Expert

1963-1977: Farmland Values

1971-2018: Nasdaq v. Gold

1971-1974: REIT Crash

1972-1979: REIT Index Crash

1986-2018: Hang Seng Index Cycles

1986-2019: Crude Oil Cycles

1999-2017: Cell Phone Market Share

2008: Transaction History

2010-2021: Bitcoin Cycles -

Interesting Read

Inside a Moneymaking Machine Like No Other

The Fuzzy, Insane Math That's Creating So Many Billion-Dollar Tech Companies

Berkshire Hathaway Shareholder Letters

Forex Investors May Face $1 Billion Loss as Trade Site Vanishes

Why the oil price is falling

How a $600 Million Hedge Fund Disappeared

Hedge Fund Manager Who Remembers 1998 Rout Says Prepare for Pain

Swiss National Bank Starts Negative

Tice: Crash is Coming...Although

More on Edson Gould (PDF)

Schiller's CAPE ratio is wrong

Double-Digit Inflation in the 1970s (PDF)

401k Crisis

Quick Link Archive

Category Archives: NFLX

Apple (AAPL) and Speed Resistance Lines

As describedin our article on speed resistance lines (SRL) dated September 22, 2011 (found here), Netflix (NFLX) fell below our projecteddownside target of $99.58. Although we thought that the stock would be worthconsidering below such a level, we had to concede that, “...the difficulty may be that thesentiment that pushed the stock price to $298.73 would likely be just theopposite to push the price down.” Assuming the purchase of thestock at $99.58, an investor would have gained 21.10% based on the currentprice of $120.59.

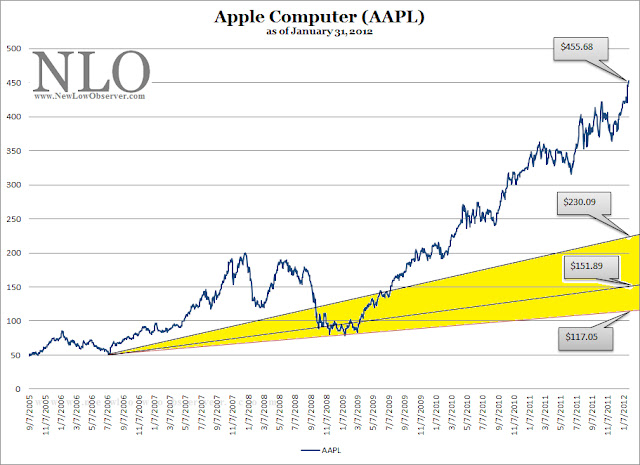

Naturally, wewondered what Edson Gould’s speed resistance lines would say about AppleComputer (AAPL). The very first thing that we look for, to determine speedresistance lines, is the most recent peak in the price. Because AAPL is continually making new highs,we only need to use the latest price of $455.68 as our starting point.

Based onGould’s work, Apple (AAPL) has a conservative downside target of $230.09 and theextreme downside target is $151.89. Whenwe ran the same calculations on Netflix (NFLX) in September 2011, we made aseemingly innocuous error. We overlookedthe fact that NFLX had a lower support line (red line) at the price level of $85. In this case, we have denoted AAPL’s supportline (also in red line), at $117.05, as a potential downside target for thestock.

As the priceof Apple increases, so too does the SRL lines based on the work ofEdson Gould. The rampant enthusiasm for AAPLsuggests that the stock isn’t likely to decline to the indicated levels anytime soon. However, when and if you seeAAPL start to make a swan dive, the levels indicated are reasonable downside targets.

Posted in AAPL, Edson Gould, NFLX, speed resistance line, William X. Scheinman

Tagged members

Edson Gould’s Speed Resistance Lines: Chipotle & Green Mountain

As described in our article on speed resistance lines dated September 22, 2011 (found here), Netflix (NFLX) has fallen below the level of $99.58 in a quick crash. At the time that we first ran the speed resistance lines on NFLX on December 3, 2010 we calculated a conservative range of $117 and an extreme range of $66.

Although we thought that the stock would be worth considering below the indicated levels, at the time, we had to concede that, “the difficulty may be that the sentiment that pushed the stock price to $298.73 would likely be just the opposite to push the price down.” Therefore, we’re not buyers of NFLX at these levels. However, we wondered what Edson Gould’s speed resistance lines would say about two other stocks that have had tremendous increases recently.

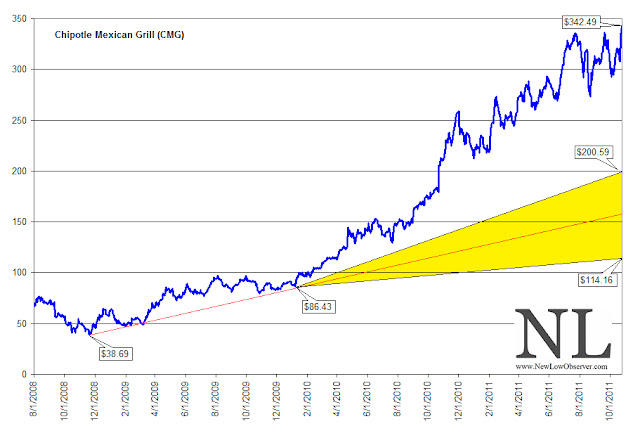

The first stock is Chipotle Mexican Grill (CMG) which has had a tremendous run-up in the last several years. In the chart below we can seen that Chipotle has recently peak around the $342.49 level. Based on Gould’s work, the near term conservative downside target is $200.59 while the extreme downside target is $114.16. If the stock price increases above $342.49 then so too will the downside targets.

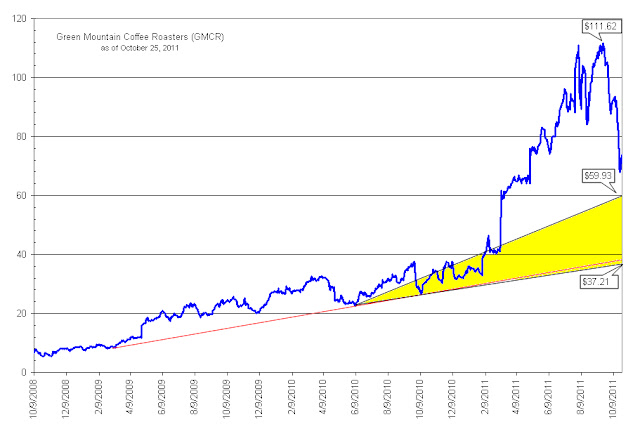

The next company that we’re interested in seeing the outcome on is Green Mountain Coffee Roasters (GMCR). It is challenging to believe that Green Mountain Coffee Roasters is going to increase above the prior peak in the near term. However, there appears to be a tremendous amount of downside risk for this company despite the decline that has already taken place. The conservative downside target is $59.93 while the extreme downside target is $37.21. Green Mountain Coffee Roasters (GMCR) appears to have the worst technicals since a move below the $37.21 price could bring the stock down to the old support level of $3.

We believe that it is worth examining whether or not these targets are accomplished. Chipotle Mexican Grill (CMG) actually appears to have some upside momentum in it still. However, we believe that the downside targets are reasonable estimates of where the stocks could go before initiating new research on whether these companies have viable business models.

Disclaimer: This piece is a continuation of the examination of Edson Gould's speed resistance line as explained in prior articles. This is not an endorsement to sell short at the current levels nor buy these stocks once falling below the extreme downside targets since the stocks have been randomly selected, at best.

Those who understand interest earn it, those who don't pay it.