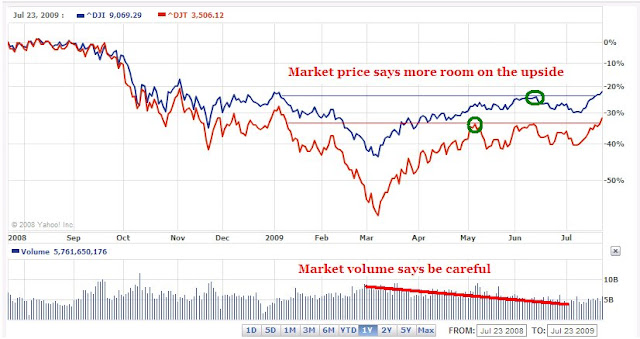

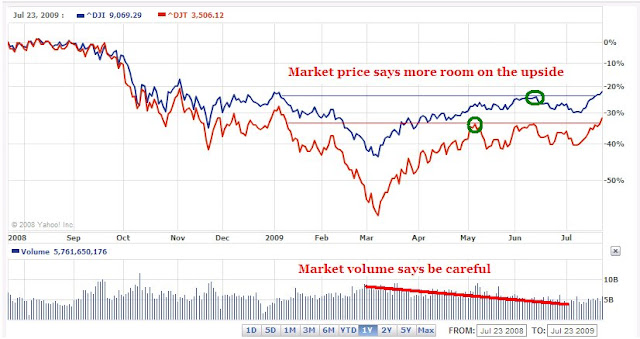

The Dow Jones Industrials and the Dow Jones Transports both broke above previous highs on July 23rd. As shown below, the previous highs that were exceeded were the June 12th high of 8799.25 for the Industrials (blue line) and the May 6th high of 3404.11 for the Transports (red line.)  Based on the fact that both indexes went to new highs on the same day would normally mean that we are in a new bull market. However, because Dow Theory considers trading volume as well as price, the fact that trading volume has been declining throughout the most recent price rise means that there isn't broad participation by either institutional or retail investors. Therefore, I would label this a cyclical bull market which can change direction to the downside without warning.

Based on the fact that both indexes went to new highs on the same day would normally mean that we are in a new bull market. However, because Dow Theory considers trading volume as well as price, the fact that trading volume has been declining throughout the most recent price rise means that there isn't broad participation by either institutional or retail investors. Therefore, I would label this a cyclical bull market which can change direction to the downside without warning.

The following are the upside and downside targets for the Dow Industrials:

Upside:

-

9,626

-

10,302 (fair value)

-

11,588

Downside:

-

8192.89

-

7754.68 (fair value)

-

7316.49

At this point it becomes challenging to suggest buying any stocks that have already run up in price since the March 9th low. Direct exposure to the Dow Industrials or Transports might be the best way to take advantage of further moves upwards. I prefer the individual stocks with the largest weighting in the respective indexes. However, most investors probably would feel more comfortable with the exchange traded funds (ETF) DIA or IYT. ETFs aren't my cup of tea but they are alternatives to picking individual stocks.

If you've followed my blog for any amount of time then you'd know that I'm all for selling stocks that are relatively high (up from the March 9th low) and researching Dividend Achievers that are at or near a new lows. Right now there are only three Dividend Achievers within 10% of their 1 year low. The companies are Wal Mart (WMT), Bard Corp. (BCR), and Abbott Labs (ABT). I'm not comfortable with Wal Mart as explained in my June 18th posting. Additionally, I don't expect to be investing more than 50% of my portfolio during this period unless a company gets extremely underpriced. Good luck with your investing. Touc.

Please revisit Dividend Inc. for editing and revisions to this post.

Based on the fact that both indexes went to new highs on the same day would normally mean that we are in a new bull market. However, because Dow Theory considers trading volume as well as price, the fact that trading volume has been declining throughout the most recent price rise means that there isn't broad participation by either institutional or retail investors. Therefore, I would label this a cyclical bull market which can change direction to the downside without warning.

Based on the fact that both indexes went to new highs on the same day would normally mean that we are in a new bull market. However, because Dow Theory considers trading volume as well as price, the fact that trading volume has been declining throughout the most recent price rise means that there isn't broad participation by either institutional or retail investors. Therefore, I would label this a cyclical bull market which can change direction to the downside without warning.