Wall Street seems to be rewarding Apple Computer (

AAPL) for its increased earning by giving the stock price a boost of 15% in the last 10 days. Yesterday it was announced that Apple beat mean consensus earning estimates by 15%.

I have followed Apple for many years and I can't seem to understand why investors continue to allow themselves to be taken again and again without pause. Apple is replete with examples of how the company has managed to game the system. I will point out the glaring examples that can be proven and hope that others will allow for the facts to stand juxtapose to the exciting stories that have been created to fan the destructive flame of an adoring public. Below are my top five reasons why I can't trust the way Apple operates as a company.

Problem 1: Option Repricing

Since its IPO, Apple Computer had been the innovator of “serial option repricing.” This method allowed Apple to continually reprice the stock options as the shares of Apple stock fell. This is unique since most companies would reprice their options only one time after the price fell below the exercise price. In the case of Apple, the options would be continually repriced as the stock went on a downward decline. This is critical since Apple has used options as the primary means of compensation in the executive suite as well as for frontline employees.

It is worth noting that Steve Jobs garners an annual salary of $1. It’s not because Steve Jobs is Mr. Benevolent , instead he is compensated through the value of the options that are issued to him. If the stock price starts to decline then Jobs would be out the value he could have received if he exercised the options at a higher price. This creates the perverse incentive to adjust the strike price of the options lower if the stock goes down.

While the debate of the use of stock options as a form of compensation has died down it should be noted that as early as 1998 the critics of such instruments were vociferous about the risks associated with them. Warren Buffett’s business partner Charlie Munger said that, “stock options resemble ‘a chain letter.’” According to Dennis Beresford, former chairman of the Financial Accounting Standards Board (FASB), options are similar to a “Ponzi scheme.” And like Bernard Madoff’s scheme, the game really starts to fall apart when a sustained decline ensures.

Source: Welles, Edward O. "Motherhood, apple pie & stock options. " Inc. Magazine. Feb 1998.

Problem 2: Management Compensation

During the days of when Gil Amelio was CEO, the board at Apple granted tremendous leeway in how it chose to compensate the CEO. At the time, Apple was expected to lose money for many quarters. How did the board at Apple circumvent this problem to give Amelio the most compensation? The board allowed the company to pursue a strategy of projecting larger losses in the future than was realist and then beating the lose projections. From this standpoint, the board would reset the compensation markers for when the CEO would be able to receive their bonus based on quarterly performance on top of their ordinary pay. This meant that regardless of the number of quarters that had passed without profitability, the CEO was going to receive a bonus no matter what happened. This strategy is similar to what happened to Fannie Mae when the company was forced to restate their earnings and fire CEO Franklin Raines.

Source: Crystal, Graef. "One bad Apple doesn't spoil a whole bunch of stock options. " San Francisco Business Times. Jan 31, 1997.

Problem 3: CEO Bailing

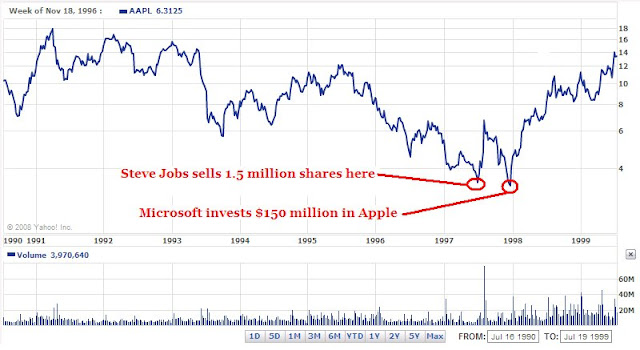

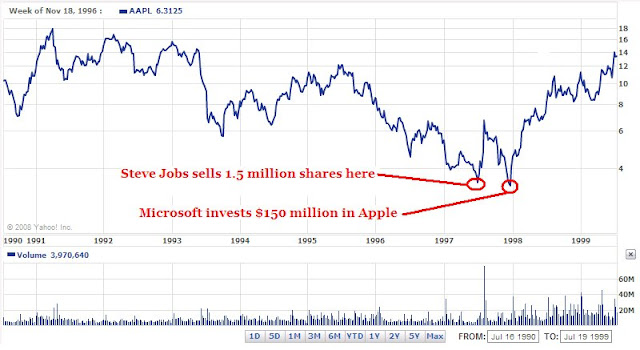

In the chart below you'll see that on June 26, 1997, when Apple was in the throes of a death spiral in the stock price, Steve Jobs decided to sell 1.5 million shares of Apple stock.  This would seem to be the time when the CEO should be trying to “inspire” confidence in the company stock. Instead, Jobs chose to sell his shares just after selling his NeXT Software to Apple for $6.50 a share earlier in the same year. Not long afterwards Microsoft (MSFT) inject a large amount of money into Apple. At that point, Apple shares started to rise tremendously.

This would seem to be the time when the CEO should be trying to “inspire” confidence in the company stock. Instead, Jobs chose to sell his shares just after selling his NeXT Software to Apple for $6.50 a share earlier in the same year. Not long afterwards Microsoft (MSFT) inject a large amount of money into Apple. At that point, Apple shares started to rise tremendously.

Source: Mardesich, Jodi, and Chris Schmitt. "Jobs admits selling shares. " San Jose Mercury News. August 12, 1997.

Problem 4: Slight of Hand

Another problem is that Apple always gives conservative guidance on their projections and always seems to beat expectations by a wider than expected margin. This was a strategy that was employed by General Electric (GE) until it could not sustain the lie of earnings management due to the collapse of GE Capital. GE was able to convince the public that all was well with the way they operates. Even convincing management junkies that Jack Welch’s Six Sigma was the reason for the company’s success. Instead, it was the practice of managing expectations and a little accounting mumbo-jumbo that kept things moving.

Did you notice that the analysts who cover Apple stock continually get the numbers wrong. When I compared the analysts estimates tracking Ebay, Cisco, Google, Adobe and Apple I found that Apple was always off target by a wide margin. In the data below, the last five years analysts estimating the annual earnings were below the target numbers as follows:

- Google (GOOG): 2.85%

- Ebay (EBAY): 1.35%

- Cisco (CSCO): 1.52%

- Adobe (ADBE): 0.006%

- Apple (AAPL): 5.56%

In the last five quarters, analysts were off of the target numbers as follows:

- Google (GOOG): 3.33%

- Ebay (EBAY): 8.25%

- Cisco (CSCO): 7.98%

- Adobe (ADBE): 4.50%

- Apple (AAPL): 15.88%

The relatively huge disparity between analyst estimates for Apple and other “high flyer” tech companies is cause for alarm. How is that Apple projections are off by nearly 100% as compared to other tech companies that are subjected to the same economic downturn in the economy? Either the analysts aren't getting it right or Apple is managing the situation. From the prior track record of Apple, I suspect that the earnings are being managed to the Nth degree.

Note: The preceding annual and quarterly numbers are derived from ThompsonReuters as of July 15, 2009.

Problem 5: Backdating Options

In 2001, Apple was called to task for the issuance of, among other things, a 7.5 million options grant to Steve Jobs. The problem with this is that the issuance, made by Chief Counsel Nancy Heinen, was dated two months prior to the date actually created. Heinen was later fired from Apple and fined for her role in the illegal activity but it didn't seem that Steve Jobs had any problem with the action until the SEC started doing an inquiry into the unusual backdating of the options. Strangely, the Apple board, "exonerated Jobs---in part because Jobs 'did not appreciate the accounting implication' of backdating."

It seems strange that Heinen would benefit Mr. Jobs and later get thrown under the bus. It is interesting to note that the Apple board said that Steve Jobs didn't know the implications of such actions even though the board "admitted to frequent backdating." If Apple had as a practice the backdating and repricing of options since its IPO, then Steve Jobs should have known as the CEO, the implications, from an accounting and legal basis, the actions being taken.

Again, like every good scheme, the act of backdating options didn't come up as an issue until the blowup of the tech sector. Had the Nasdaq stocks continued to move higher I don't think any of the SEC actions would have been taken on the matter of backdating or repricing of options.

Source: Burrows, Peter. Parting Shots at Apple's Jobs; Former CFO Fred Anderson reached a settlement with the SEC over options backdating--but says the CEO deserves part of the blame. Business Week Online. April 26, 2007.

While the products that Apple create are great for the gee-whiz hipster crowd of the new millennium the actions of the board of directors and executive suite has been questionable at best. As far as I can tell, Apple hasn't cleared the air about the way they have managed the company in the past to justify buying or holding the stock right now. Touc.

Please revisit Dividend Inc. for editing and revisions to this post.

This would seem to be the time when the CEO should be trying to “inspire” confidence in the company stock. Instead, Jobs chose to sell his shares just after selling his NeXT Software to Apple for $6.50 a share earlier in the same year. Not long afterwards Microsoft (

This would seem to be the time when the CEO should be trying to “inspire” confidence in the company stock. Instead, Jobs chose to sell his shares just after selling his NeXT Software to Apple for $6.50 a share earlier in the same year. Not long afterwards Microsoft (