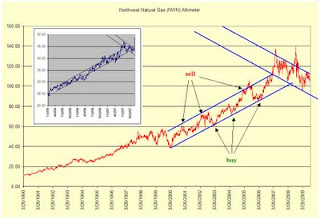

Today's altimeter is on Northwest Natural Gas (NWN) and there is a lot to appreciate when we exam the pattern that has been established so far. NWN has increased its dividend for 53 years in a row. With such a history of dividend increases, I think NWN will do everything it can to avoid cutting or leaving the dividend the same. At the price of $42.29, NWN is within 16% of the 52-week low.

NWN has a challenging altimeter to decipher until you take a closer look. The pattern that has been established since 2000 until the present is an exact replication of the move from the period 1995 to 1997 (shown in the inset.) After the 1995 to 1997 moves we can see that the stock traded in a wide range until the ultimate low in 2000. From the 2000 low the stock traded in a narrow ascending range, offering several clear opportunities to buy and sell the stock.

Although I have taken artistic license on the interpretation of this altimeter, I do believe that the possibility may exist that NWN will not go materially below the March 2009 low. With the recent decline in natural gas prices, NWN offers a reasonable investment opportunity with a long history of dividend increases and a fair payout ratio. NWN is definitely worth investigating at the current levels. Let us hope that the stock price declines while you're doing the research on this company. Touc.

Please revisit

Dividend Inc. for editing and revisions to this post.