Today's action was a close one for the market. The Transport index, at one point, broke below the previous high from late August. The Industrial Index is still well above the previous high so nothing to worry about there. If the Transports were to closed below the previous high, we would have the first part of the non-confirmation move under the Dow Theory.

Note: If you are not familiar with the Dow Theory, please read a free description from Dow Theory Letter or StockCharts, but I recommend reading Richard Russell's Letter.

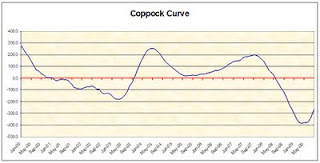

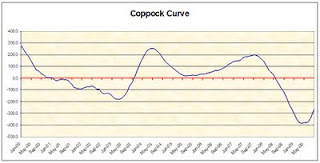

Coppock Curve

At the end of September, the Coppock Curve or Index remained bullish. People who understand the Coppock Curve may wonder why I still keep track of the curve since the buy signal was given to us in May. My answer is that I don't want to this to be a false buying signal such as the one in 2001. The curve rose by 53.8 points, the highest since the buy signal was triggered.

Summary

We are cautiously bullish on the market. We are looking to purchase Northwest Natural Gas (

NWN) and

Cardinal Health (

CAH). This will depend on what the overall market does when we start October.

Art