When it comes to the cornering of a stock there are two kinds, those that fail and those that succeed. The essential element that causes the failure is the inability to get the public to "buy in" to the market action. The movement of Freddie Mac (FRE) today appears to be on the side of those who are behind the cornering of the stock.

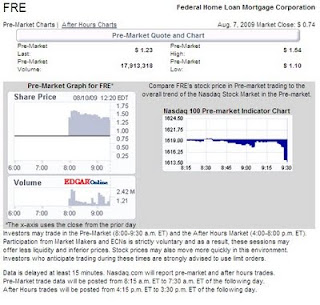

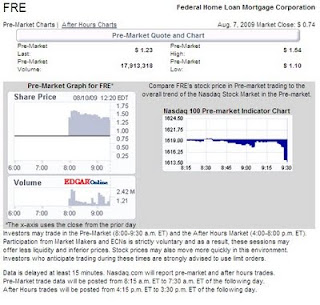

Market activity for Freddie Mac (FRE) was off the charts today, rising $0.49 or 66% in the pre-market session on almost 18 million shares and rising another 37% on 391 million in the regular hours of trading. This equals a combined increase, from Friday's closing price of $0.74, of 128%. (pre-market data below)

Chart Source: Nasdaq.com

There is a distinction between the price movement of FRE and AIG. Although both are moving on syndicates' pre-market prompting, the FRE cornering of the stock may have the ability to succeed at keeping the price high for an extended period of time. Notice in the chart below that the accumulation/distribution of the stock had gone from the extremely negative low of -319 million (red arrow at point A) to a positive figure (green arrow at point A) based on the activity of today's trading.

Chart Source: Schwab.com

Chart Source: Schwab.com

Contrast the movement of FRE's accumulation/distribution with the that of AIG. While both accumulation lines hit their lowest point on July 24th, the day after the

Dow Theory bull market confirmation, AIG has not yet broken above the accumulation line (red circle.) Additionally, as AIG has gone up in price the volume has trended down.

Chart Source: Schwab.com

Chart Source: Schwab.comThe AIG run does not look "sustainable" over the long term unless the accumulation/distribution improves along with a rising price and rising volume. For traders, it is expected that FRE will have a pullback, however there may be legs on this speculation as compared to AIG.

Because we're in a cyclical bull market within an even larger bear market I would consider these stocks as pure speculation regardless of the "potential" upside. Let's see which of the syndicates that are running these stocks up in pre/post market activity comes out the winner. From what I can tell, the FRE gang is miles ahead of the AIG crew in this race. This should be interesting to watch. Touc.

related articles:

Please revisit

Dividend Inc. for editing and revisions to this post.

Chart Source: Schwab.com

Chart Source: Schwab.com Chart Source: Schwab.com

Chart Source: Schwab.com