There is one issue that we believe undermines the fabric and credibility of the stock market and it will darken everyone's door some day. That issue is the murkiness of pre & after-hour trading and their impact on risk control tools like stop loss orders. Currently, these extra hours of trading do not trigger stop-loss orders. As a result, this creates an uneven playing field for those with the access and those without the access to pre/post market trading. The impact of an uneven playing field in after-hours will ultimately be the undoing of the market in general.

However, before going into specific details, it needs to be said that standing stop-loss orders are very simple. An investor wishing to avoid significant loss can instruct their broker to automatically place a market order to sell their stock when the stock falls to a specified price (the opposite applies to short sellers). As the stock hits the indicated level on the way down (on the way up for short sellers), the stock automatically becomes a market order and is sold at the best available price. Normally, this procedure is done automatically once the shareholder provides these instructions to their broker.

While the process seems pretty simple, any investor who thinks that having stop-loss orders is a rational way to limit losses (or protect profits) are paying through the nose for the most recent lesson from Mr. Market.

The latest lesson is with Verifone Systems (PAY). After the market closed on February 20, 2013, Verifone announced that it would miss Q1 and Q2 targets (found here). At the close of trading on February 20, 2013, PAY was at $31.89. Unfortunately, in after-hours trading, PAY declined -32.55% on trading volume of 4,783,086 shares.

Then, in pre-market trading volume of 2,263,950 shares, PAY fell an additional -5% to the opening price of $19.97, a total decline of -37.28% from the close of market on February 20th to the open on February 21st.

A total of 7,047,036 shares were traded in the combined post/pre-market trading resulting in the decline of PAY to the tune of –37.28%. During the regular hours of trading, the total volume of shares traded was 50,411,282 as the stock closed the day at $18.24.

What needs to be understood is that roughly 12% of the shares traded caused PAY to decline –37% while 88% of the shares traded caused PAY to decline only –8%. This is the equivalent of an 11-story building weighing more than the 102-story Empire State Building.

According to the NYSE Euronext website (found here):

“NYSE and NYSE Amex are the only equities markets that offer a rich combination of cutting edge, ultrafast technology with the volatility buffer of human judgment and accountability to create orderly opens and closes, lower volatility, deeper liquidity and improved prices.”

These are bold claims for NYSE Euronext to make when 12% of trades are allowed to increase volatility, decrease liquidity and destroy prices. It is probable that NYSE Euronext will say that it doesn’t happen enough to warrant any changes. However, investors will discount the after-hours by piling their trades into this narrow window between conventional hours of trading. This is setting the markets up for the opposite of what the NYSE Euronext and other exchange operators claim to provide market participants.

Questions That Need Answers

-

Is it necessary to have the minority of traders affect the majority of the movement in the stock price while stop loss orders aren’t allowed?

-

If an investor has a sitting stop-loss order at a "reasonable" level, like $30 or lower, does it make sense that their shares automatically sell at the February 21st opening price of $19.97?

-

Can the investor be given the option, when the stock falls more than -10% in pre/post trading, as to whether they wish to commit to their initial order during “regular” hours?

-

Should we get rid of pre/post trading hours?

-

Is the current system adequate?

We believe that market regulators need to answer these questions before the situation really, really gets out of control. For now it only affects individual holders of the wrong stocks at the wrong time, which seems to be a little too frequently, of late. At some point, there will be a mass of pre/post market participants that will cause a stampede for the narrowest exits on a much broader scale that will put into the question whether what remains of the current system actually works.

Until the time comes when the above questions are answered and changes are implemented, the next stock market crash will be born in the pre/after-hour markets with flash crash characteristics if this issue isn’t addressed. We recommend that investors avoid using stop-loss orders as a means of protection against downside risk or seriously consider making use of pre/after-hour market trading platforms.

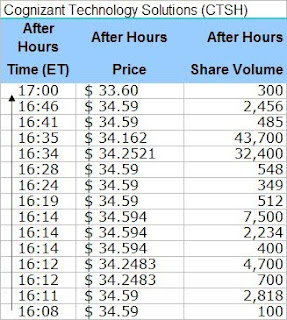

However, during after-hour session we can see that CTSH trades back down by $0.99. It only took 99,202 shares to get the price exactly back to where it started earlier in the day.

However, during after-hour session we can see that CTSH trades back down by $0.99. It only took 99,202 shares to get the price exactly back to where it started earlier in the day.  Again, notice that someone with 43,700 shares worth $1,468,966 decided that after-hours was the best time to unload the shares. Not to be outdone, someone else with 32,400 shares valued at $1,109,768 feels like getting rid of their shares.

Again, notice that someone with 43,700 shares worth $1,468,966 decided that after-hours was the best time to unload the shares. Not to be outdone, someone else with 32,400 shares valued at $1,109,768 feels like getting rid of their shares.