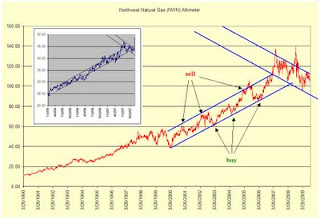

NWN's stock price has gone nothing but up since the recommendation. However, in the pursuit of "seeking fair profits" the returns that this stock has provided within the last 80 days say that it is necessary to consider alternative opportunities.

NWN was recommended when it was trading at $40.94. As of December 21, 2009, NWN was quoted at $45.25. This equals a return of 10.53%. Selling this stock now generates a return of 2.6x greater than the amount of the dividend yield. Additionally, the 10.53% gain exceeds the return on a 30-year treasury purchased on October 2, 2009 by 2.63x.

As I have indicated in the purposes and function of this site, the goal is to:

-

maximize the annual yield of each trade.

-

reduce time between buying and selling of each stock.

-

exceed the annual yield of government guaranteed alternatives in each trade.

Research recommendations and investment observations are intended to be a starting point for investigating a quality company at a reasonable price. It is hoped that after doing the background research you can buy the stock at a lower price. Ideally the stock should be held in a tax deferred account and should not consist of less than 20% of your holdings. Personally, I prefer holding only 2-3 stocks at a time.

Sell recommendations are intended to deal with the short term reality of the market. The tracking of the Sell recommendations are the worst case scenario if you happen to have bought a stock at the time the research recommendation was made (please avoid making this mistake.) I aim for mediocrity in my returns, therefore I am happy with 9-12% annual gains. However, since codifying my approach to investing in 2005, I have had annual returns of 20% and above every year since.

It is always recommended that when selling a stock, one should not place stop orders, limit orders or orders after hours. This leaves the seller in the position of being vulnerable to the whims of the market makers. Instead, place your sell orders only as a market order during market hours. Some would complain that a market order during market hours might leave some profits on the table. However, I would rather leave some money on the table rather than have it taken away from me by the trades that are placed by institutions and market makers. -Touc