One of the biggest challenges to buying and holding a stock for the long term is the wait through thick and thin for the expectations of a particular stock to materialize. In a process of elimination, the New Low Observer team has narrowed down the steps to determining quality stocks by relegating it to those that have increased their dividend every year for at least 10 years in a row. Furthermore, we only seek out those high quality dividend paying stocks, as well as Nasdaq 100 index constituents, when the companies are within 20% of the 1-year low. Having these requirements allows us to select quality companies at (potentially) ideal times to invest.

However, once we have decided on the company that we're interested in investing and we've committed money to, we are still at the whims of "Mr. Market." Although it might seem surprising to some, we are incredibly risk averse and always try to avoid losses whenever we can. We are so risk averse that we have a general rule that if the investment in a particular stock exceeds the gains of the market over the last 100, 50, 25, or 10 years on an annual basis (after expenses) then we tend to sell that stock to seek alternative investment opportunities. If nothing else, we secure the exceptional gains and bide our time until the next "undervalued" opportunity arrives.While the buy-and-hold crowd cries foul at the thought that we're speculating rather than investing when buying and selling high quality stocks at arguably undervalued prices, we have noticed a pattern that keeps emerging from our strategy that sets apart our approach from merely speculating. One of the best recent examples of the value in our investment philosophy is the case of Meridian Biosciences (VIVO).

On March 17, 2010, as the Dow Industrials and Dow Transportation Average were confirming the Dow Theory trend to the upside, Meridian Biosciences (VIVO) was dropping like a rock on news that the future earnings would have to be

revised lower. In one fell swoop, Meridian Biosciences (VIVO) erased 9 months of hard earned gains in the stock price. I say 9 months because after our recommendation to sell VIVO, the stock increased in value an additional 27% in 3 months at the peak in September 2009.

At the time of our sell recommendation, Meridian Biosciences had risen 11.75% from our Research Recommendation on March 26, 2009. We were content in our gains and smug at being so smart at selling while the going was good. However, we watched, in almost horror, as the stock continued to climb higher going from our sell point of $20.35 all the way up to $26. We began to wonder if selling a company that we were convinced was of the highest quality was the best choice. After all, Meridian Biosciences (VIVO) is one of the only Dividend Achievers to match the gains of Google (GOOG) on a percentage basis from the date of Google's (GOOG) IPO to the peak in late 2007/early 2008.

With a tinge of regret we moved on hoping that our next investment would make up for our blunder of selling VIVO at such a cheap price. In the nine months since our

sell recommendation of Meridian Biosciences (VIVO) we've made eight Investment Observations that were followed by Sell Recommendations. Below are the stocks we mentioned and the percentage gains that were secured since our sell recommendation of VIVO on June 12, 2009:

- Cardinal Health (CAH) +23%

- Abbott Labs (ABT) +16.80%

- SuperValu (SVU) +11.87%

- Nor'wst Nat (NWN) +10.53%

- AquaAmer. (WTR) +10%

- Cephalon (CEPH) +13.41%

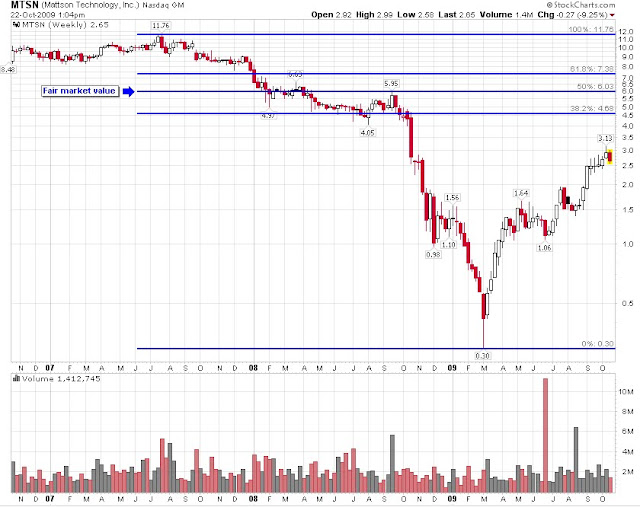

- Mattson (MTSN) +24%

- Monsanto (MON) +22%

With the reduction of earnings estimates and the subsequent collapse of Meridian Biosciences (VIVO), the stock has fallen below the level of the original sell recommendation that was given on June 12, 2009. In addition, we've highlighted eight companies that have provided double digit returns in a complete buy and sell cycle all within a nine month period. The chart below illustrates the recommendation dates in green and the sell dates in red with the post-collapse price in yellow.

Today the New Low Observer team breathes a sigh of relief, not in the lose that has afflicted current Meridian Biosciences shareholders but based on the fact that we stayed the course with our investment philosophy which provided gains that, to this point, have gone beyond our expectations by actually limiting how much we are willing to accept on the upside.The lesson that should be learned about Meridian Biosciences is that although the price is nearly the same as a year ago doesn't mean that there was no movement or activity. In fact, the stock went up as much as 44% in 5 months. This is the hard lesson that most buy-and-hold investors should have learned about where the major indexes have gone over the last 10 years. Within all the drama that occured since 2000, many opportunies presented themselves but may have never been realized if holding for the long-term was the only investment strategy. For most investors, the real challenge becomes whether or not to sell a stock after exceptional gains.

Our Current Take on Meridian Biosciences

In our sell recommendation of Meridian Biosciences at the $20.35 level, we said that VIVO would easily go to the $23.33. Since the peak in the price at $26.20 in September 2009 and the recent decline to $19.60, Dow Theory indicates that for this stock, the upside move should take the price at least to the $23 level before going back to the old high of $26.20 or back down to the $19 range. Our expectation that a reaction of 11% to 13% upside move would not be unusual.For those who are interested in justifications of Meridian Biosciences (VIVO) as an investment candidate (since the negative news is already out), there are several compelling factors to watch for.

First and foremost is the recent confirmation of the bullish move of the stock market according to Dow’s Theory. This gives the investor that chance to make mistakes without paying a hefty price. More specific to Meridian Biosciences (VIVO) is the fact that the company is selling 16% below the 8-year average price-to-earnings ratio according to Morningstar.com. VIVO is also selling 3% below the average price-to-cash flow ratio over the last 10 years. Bolstering the case for VIVO is the fact that the company carries little or no debt. We will be watching Meridian Biosciences (VIVO) closely for any indication that the stock will decline from the current level. Our hope, as it always is, is to buy the stock at a much lower price and take reasonable gains in the shortest period of time possible. It is our hope that others can see the value of our approach of taking gains that exceed the historical average annual return and seeking alternative investment opportunities whether it is in cash or another quality stock that is at or near a new low.

- Don't know the historical average annual gains for 100, 50 or 10 years. Go to Moneychimp.com's CAGR of the Stock Market Calculator. Pick just about any time frame and see what you've been missing (even on an inflation adjusted basis).

- Want more info about the strategy mentioned above, then go to our article title "When Timing Meets Opportunity" on SeekingAlpha.com. The article was posted in July of 2009 and has more relevancy than ever before.

- Our article titled "Seeking Fair Profits" outlines Charles H. Dow's philosophy of fair expectations when investing in the stock market. Charles Dow was the co-founder of the Wall Street Journal and the Dow Jones Indexes.

Tell a friend about us. Thank you.