This from Dow Theory Letters on July 5, 1974.

"What’s happening, what’s gone wrong? The answer: there's a giant squeeze in world liquidity, and it is scaring the devil out of investors, large and small, from one end of the globe to the other. Last week two German banks declared bankruptcy, while it was revealed (WSJ, June 26) that an oil-drilling "tax write-off" situation has turned into what may be the biggest swindle in US history. On June 27 trading in Westinghouse was halted at 12 1/8 (“you can be short if it’s Westinghouse”), and an hour later the President of the company announced that the outfit was solvent (all this while WX broke its 1962 low) (page 1)."

Those two German banks were Bankhaus I.D. Herstatt of Cologne and Bass & Herz Bankhaus. This was a situation where the failure of Herstatt led to the failure of Bass & Herz and a host of other substantial losses.

Chase Manhattan Bank was in possession of $156 million in Herstatt deposits. This meant that U.S. creditors (namely Citibank’s British banking unit of Hill, Samuel & Co.) were seeking claims on these funds even though Chase Manhattan had no authority to recognize the claims.

Seattle First National Bank (SeaFirst) was caught in a bind when they performed a $22.5 million transaction at their Swiss subsidiary and the funds were not transferred to the parent company hours before Herstatt was forced into bankruptcy.

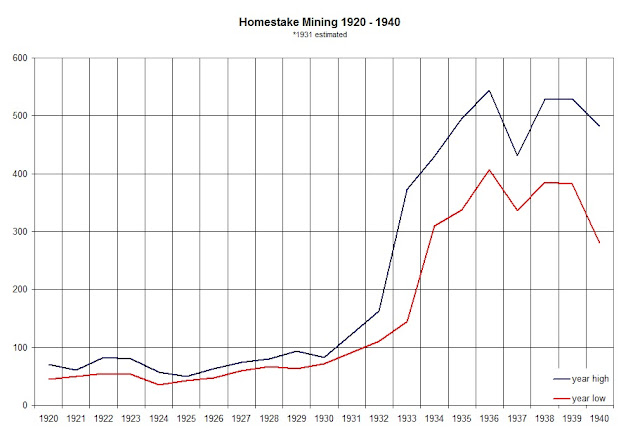

In classic scam fashion, the oil-drilling "tax write-off" scheme was named Home-stake Production Company of Tulsa Oklahoma. Using the name “Homestake” tied the swindler with the success and stability of Homestake Mining while not having achieved anything of note.

What made this swindle exceptional is the fact that people like Liza Minelli, Candice Bergen, and Buddy Hackett (as well as Congressmen) were involved in the money losing fraud. The motivation for getting into these “tax write-off” schemes might have been inspired, at the peak, by articles like the following from Barron’s in March 1974.

“Bank shares at 10% yields mean that investor are scared of the banks (page 2).”

It was not long before this comment was published on banks that banks were on a mad dash to lure investors and analysts. In a Barron’s article titled “Beautiful Balloon?” it was indicated that the 1970 amendment to the Bank Holding Company Act of 1956 led banks “…into related (and some not-so-related) financial areas.”

It was those related financial areas that banks had “…been heavily engaged in financing real estate activities, and, despite the debacle among REITs, thus far have escaped essentially unscathed.” It wasn’t long before those banks almost paid the price for their foray into REITs, until the government intervened. This article from Barron’s should have been titled “Beautiful Bubble” as the collapse was in the early stages at this time and by July 5, 1974, there was more pain until December 1974, to the tune of –27.04% in the Dow Jones Industrial Average.

see also: Homestake Mining: The Exception that Proves the Rule