Watch List Summary

At the end of the week for October 15, 2010, the top performing stocks from our Nasdaq 100 list for

September 17, 2010 are Seagate (STX) with a gain of 38.98%, Logitech (LOGI) with a gain of 25.15% and Google (GOOG) with a gain of 22.71%. Gains of 10% or more in a month may require mental trailing stops or selling in our estimation. The trajectory of the top performing stocks in this category cannot continue at the same rate for too long; expect reversion to the mean.

The worst performing stock from our September 15th watch list are Urban Outfitters (URBN) down –9.12%, FLIR Systems (FLIR) down –5.32% and Steel Dynamics (STLD) down –4.40%. The average gain for the Watch List was 6.67%. In the 1-month period from September 17th to October 15th, 86% of the stocks were up while 14% of the stocks were down.

The average gain for stocks that were up was 8.45% while the average loss for stocks that fell was –3.76%. Among the top ten performing stocks the average gain was 17.94%.

From prior observations, FLIR Systems (FLIR) and Adobe Systems (ADBE) should be examined carefully as potential investment opportunities. It is our expectation that Apollo Group will be among the companies that will be rotated out of the Nasdaq 100 index in the coming new year.

Nasdaq 100 Watch List

Below are the Nasdaq 100 companies that are within 11% of their respective 52-week lows. Stocks that appear on our watch lists are not recommendations to buy. Instead, they are the starting point for doing your research and determining the best company to buy. Ideally, a stock that is purchased from this list is done after a considerable decline in the price and rigorous due diligence.

| Symbol |

Name |

Trade |

P/E |

EPS |

Yield |

P/B |

% from Low |

| APOL |

Apollo Group, Inc. |

36.58 |

9.37 |

3.9 |

0 |

4.05 |

2.29% |

| URBN |

Urban Outfitters, Inc. |

31 |

20.17 |

1.54 |

0 |

3.83 |

3.06% |

| FLIR |

FLIR Systems, Inc. |

25.79 |

17.53 |

1.47 |

0 |

3.05 |

7.46% |

| INTC |

Intel Corporation |

19.32 |

11.56 |

1.67 |

3.30% |

2.35 |

9.77% |

| ADBE |

Adobe Systems |

28.08 |

31.34 |

0.9 |

0 |

2.77 |

10.33% |

Watch List Performance Review

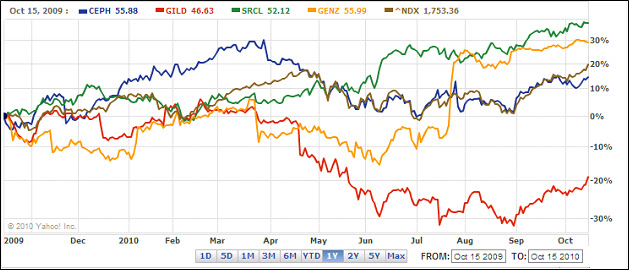

The following is a total return (appreciation plus dividends) performance review of our Nasdaq 100 Watch List from October 15, 2009:

-

Stericycle (SRCL) up 37.95%

-

Genzyme (GENZ) up 28.93%

-

Cephalon (CEPH) up 14.33%

-

Gilead (GILD) down -19.09%

As a group, the average gain for the stocks mentioned was 15.53%. This is contrasted by the Nasdaq 100 gain of 19.64% in the same period of time. It is our expectation that only 1/3 of the companies that are part of our list will outperform the market over a one year period. However, when the market of 5,000 investment opportunities is winnowed down to what we believe are the best 50, we think that selecting one out of four companies become so much easier.

The companies that are within 10% of the low offer a great opportunity to do research and consider buying.

The companies that are within 10% of the low offer a great opportunity to do research and consider buying.