How long does a Dow Theory Primary Bull Market last?

Recently, some followers of Dow Theory had suggested that a new primary bull market began on June 4, 2012. Those same Dow Theorists are now put in the awkward position of changing that primary bull market call to a primary bear market indication as recently as November 11th or 16th of this year.

However, when doing the math, those Dow Theorists who claimed that a primary bull market began on June 4, 2012 have very little to show for it, especially when, by their own account, a primary bear market was signaled on November 11th or 16th. To demonstrate how inaccurate that analysis was, since June 4th, the Dow Industrials has increased +4.02% while the Dow Transports increased +0.90%. Even in the period from June 4th until the respective peaks, the gains were marginal with the Dow Jones Transportation Average gaining +8.31% by June 19th without being able to exceed the 2011 peak. At the same time, the Dow Jones Industrial Average gained +12.47% by October 5th without being able to exceed the 2007 peak. The inability to exceed prior all-time highs is uncharacteristic of what one should expect of any market move deemed a “primary bull market.”

In all of the history of the Dow Industrials and Dow Transportation Averages, primary bull market moves have never lasted for only 5 months. The following examples from renown Dow Theorists suggest that any indication that a primary bull market began in June 2012 and ended in November 2012 was done so in error.

When William Peter Hamilton wrote on the topic of the primary bull market movements in his book Stock Market Barometer, he said the following:

“The average duration of six major bull swings is twenty-five months…(page 44).”

According the Robert Rhea’s book The Dow Theory:

“…a primary bull market is a broad upward movement, interrupted by secondary reactions, and averaging longer than two years (page 44).”

From E. George Schaefer’s book How I Helped 10,000 Investors to Profit in Stocks comes this conclusion:

“…in primary bull markets the duration of a typical primary up-trend might last from four to eleven years…(page 42)”

It is more likely that a primary bear market can last as little as 5 months due to panics and crashes. However, in order for Dow Theory to be worth its weight, a primary bull market should see an investor through an extended period of time (at minimum 12 to 18 months and usually 2 years or more) and not a period of less than 6 months.

Dow Theory: The Backdrop

On August 2, 2011, Dow Theory provided us with the first primary bear market signal since the primary bull market indication of July 23, 2009. This bear market indication came with a very interesting backdrop that is worth reviewing. On the very same day as our bear market indication (Aug. 2, 2011), the Senate passed the bill allowing for the extension of the debt ceiling (found here). The Senate vote came one day after the House of Representatives approved legislation to raise the debt ceiling to $14.3 trillion (found here).

The discussion and debate prior to the actual passage of the bill, allowing for the debt ceiling increase, suggested that the country would suffer irreparable damage if Congress didn’t come up with a solution. Once the bill was passed, Congressional members were as giddy as can be. There was a lot of back slapping and praise because both sides of the aisle could finally agree on something.

Suffice to say, only three days (Aug. 5, 2011) after the “bipartisan” agreement to raise the debt ceiling, Standard & Poor's lowered the credit rating of the United States indicating that “…the downgrade reflects our view that the effectiveness, stability, and predictability of American policymaking and political institutions have weakened at a time of ongoing fiscal and economic challenges to a degree more than we envisioned…” (PDF found here).

We wince when politics has to enter our discussion of the markets since we know that there are no winners when it comes to such a debate. However, we have reminded readers of the backdrop at the time of the Dow Theory bear market indication to suggest that we may actually be sitting on another “buy the rumor and sell the news” scenario when the resolution of the “fiscal cliff” arrives. From the May 3, 2011 to August 1, 2011, the Dow Jones Industrial Average declined –5.27% and from August 1, 2011 to August 10, 2011, the Dow Jones Industrial Average declined –11.64%. It appears the stock market anticipated that the debt ceiling would be increased and that ultimately it would be to no avail, resulting in the downgrade from S&P.

Already, the Dow Jones Industrial Average has declined –7.5% from the October 5, 2012 high. Are we slated for a similar reaction to the ultimate “resolution” of the “fiscal cliff” that currently overhangs the U.S.? It is interesting to note that the increase of the debt ceiling and the “resolution” of the “fiscal cliff” will have a negative effect on the U.S. despite the two political parties’ shameless self-promotion for acting in a bi-partisan manner to come to a “resolution.” If the S&P downgrade of the U.S. came 3 days after the agreement to raise the debt ceiling and a stock market plunge of –11% in seven trading days later, what can we expect when the “fiscal cliff” passes?

Also, keep in mind that with the announcement of QE3 on September 13, 2012, the stock market has declined as much as -7.02%. All prior announcements of quantitative easing by the U.S. and European Union were not accompanied with almost immediate declines in the stock market. It appears that the quick fixes are having less of the desired short-term impact since it is clear that the long-term effects of such strategies are harmful and possibly irreversible. Our article on the diminished impact of QE3 can be found here.

We can’t be sure if the past provides any lessons, however, the solution to the “fiscal cliff” may lead to an outcome that is far worse than anticipated. While everyone in Congress was suggesting that there were going to be dire consequences to not raising the debt ceiling there were few that anticipated that the S&P would downgrade the debt anyway. Likewise, providing a solution to the “fiscal cliff” cannot hid the fact that the U.S. is a house that is not in order. Resolving issues like the debt ceiling with increasing the debt “limit” or the “fiscal cliff” with less cutting and more spending than initially planned, with politicians whose goal is to posture until the 11th hour, suggests that S&P’s downgrade of the U.S. debt will be looked upon in retrospect as an understatement.

Dow Theory: Bear Market Confirmation Due

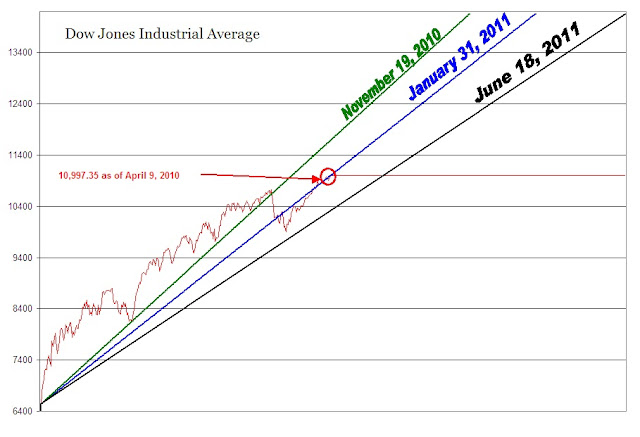

Starting with the movement of the Dow Industrials and Transports, we can seen that the primary bear market began on August 2, 2011. Since that time, the bear market rally (from the August 8, 2011 or October 3, 2011 low) has been very rewarding to anyone who followed our August 9, 2011 (found here) indication that a temporary bottom had been reached.

Now that there has been a substantive decline in the Industrial Average below the April 30, 2012 peak we can see that any decline below the June 4, 2012 low is the level to watch for. Again, Dow Theory indicates that for any signal to have merit, both the Industrials and Transports must simultaneously rise above prior peaks or decline below prior troughs. In order for us to get a bear market confirmation, we’d need the Industrials to decline below 12,101.46 and the Transports to fall below 4,847.73 on a closing basis.

So far, the Industrials are +4.02% above the June 4th low while the Transports are +0.90% above the mid-year level. If either of the indexes fail to fall below the June 4th level we have to put our bear market thesis on hold.

Dow Industrial Upside Targets

The decline that the Dow Jones Industrial Average has experienced isn’t out of the ordinary. However, it is our responsibility to review the prospects of an upside target based on Dow Theory. Taking the most recent intra-day low of 12,471.50 and projecting to the most recent intra-day high of 13,661.90 provides us with the following upside targets:

Each move up to the 13,066.69 level carries the risk that at any point the market can easily descend below the 12,471.50. However, exceeding 13,066.69 and especially the points above the 13,265.10 connotes the prospect that the Dow Industrials can achieve 13,661.90.