In a series of articles examining Edson Gould’s Speed Resistance Lines (SRL), we put some big name stocks to the test. The test was to see if Gould’s SRL had any reasonable predictive ability to determine the downside targets for the stocks in question. The results have been astounding and are well worth your careful consideration.

First, we will review the SRLs for Netflix (NFLX) and Green Mountain Coffee Roasters (GMCR) and the outcome of the analysis related to Gould’s indicator. Next, we will review the updated Chipotle Mexican Grill (CMG) downside target.

The first stock that we applied the SRLs to was Netflix (NFLX) on December 3, 2010. At that time, NFLX was trading at $205.90. When the stock rose to the eventual peak of $298.73, we thought that maybe the SRL was a waste of effort.

However, almost one year to the day after we ran the SRL on Netflix, the stock had broke through our conservative downside target of $117.76. Even more amazing, NFLX later declined below the extreme downside target that we set at $68.63. Today Netflix trades at $66.56. Because we’re not short-sellers, we did not take any position on the decline of the stock. However, we were able to buy the stock at $62 and sell the stock at $100 in the subsequent rebound from the initial low.

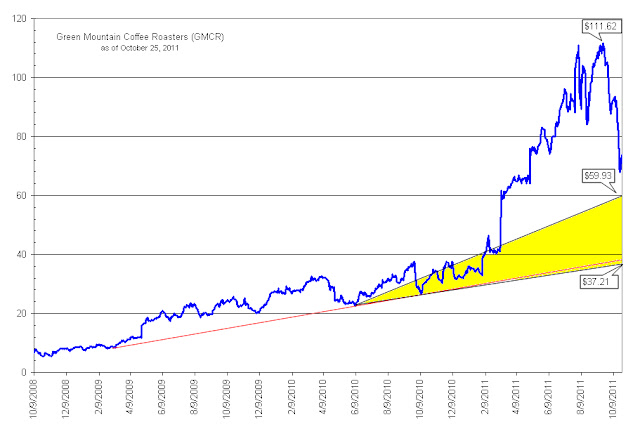

The next stock that we applied the SRL to was Green Mountain Coffee Roasters (GMCR) in our October 25, 2011 review of Edson Gould’s formula. At the time, GMCR was trading at $64.75 after declining –42% from the peak in the stock price on September 19, 2011. There were some who said that the stock was a bargain and should be bought. However, Gould’s SRL indicated that at minimum, GMCR was to decline to $59.93 and possibly decline to the $37.21 level.

In a May 2, 2012 revision of Gould’s SRL for Green Mountain Coffee Roasters (GMCR), when the stock was trading at $28.50, we suggested that the stock could trade down to $22.53 with and additional downside target of $8.30. Today GMCR trades at $22.13 (see chart above).

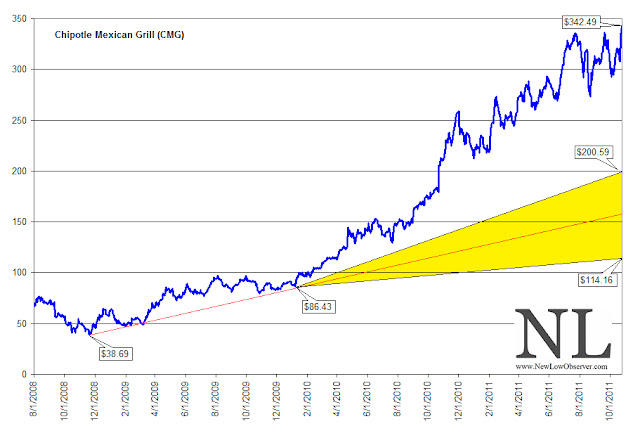

In the same October 25, 2011 review of Green Mountain Coffee Roasters, we covered Chipotle Mexican Grill (CMG). At that time, Gould’s indicator suggested that CMG had a conservative downside target of $200.59 and an extreme downside target of $114.16. As we’ve indicated in the past, SRLs are based based on the highest price the stock attains. In this case, CMG rose as much as +45.70% since our October 25, 2011 article. Below is the revised SRL for CMG.

Based on the high of $440.40, Chipotle Mexican Grill has a conservative downside target of $233.23 and an extreme downside target of $146.80. We’re cautious about anyone who suggests that CMG is a “good buy” or “undervalued” at the current price. Already, we’re within striking distance of the $233.23 conservative downside target as CMG trades at $280.93 after hedge fund manager David Einhorn recently recommended selling the stock short (article found here). If past use of SRL is any indication, when CMG declines below the upward trending conservative downside line, you can be assured that the stock will hit $233.

Again, our purpose of using SRLs to determine the downside risk of a stock that we’d like to buy but don’t want to chase. We’re willing to wait for the eventual decline or admit that we missed the boat on a great investment opportunity. Again, we don’t sell stocks short because we’re interested in acquiring great companies at the best price possible.

Disclaimer: This piece is a continuation of the examination of Edson Gould's speed resistance line as explained in prior articles. This is not an endorsement to sell short at the current levels nor buy these stocks once falling below the extreme downside targets since the stocks have been randomly selected, at best.