Below are the books that we’ve read cover-to-cover from January 2022 to December 2022. Don’t forget to check out our 2021, 2020, 2018, 2017, 2016 and the Dow Theory Letters book lists.

| Title | Author | |

| Revolution That Wasn't, The | by | Spencer Jakab |

| Panic! | by | Michael Lewis |

| Warren Buffett's Ground Rules | by | Jeremy C. Miller |

| Great Quake, The | by | Henry Fountain |

| Pacific | by | Simon Winchester |

| How to Tell a Story | by | Aristotle |

| African Founders | by | David Hackett Fischer |

| How the Hippies Saved Physics | by | David Kaiser |

| Music Is History | by | Questlove |

| Coal | by | Barbara Freese |

| Titans of History | by | Simon Sebag Montefiore |

| A Brief History of Motion | by | Tom Standage |

| Ascent of Money, The | by | Niall Ferguson |

| Mark Inside, The | by | Amy Reading |

| Plagues Upon the Earth | by | Kyle Harper |

| Mutiny on the Rising Sun | by | Jared Ross Hardesty |

| A Brief History of Korea | by | Michael J. Seth |

| Money | by | Jacob Goldstein |

| Story Paradox, The | by | Jonathan Gottschall |

| Boom and Bust | by | William Quinn |

| Players Ball, The | by | David Kushner |

| Unseen Body, The | by | Jonathan Reisman |

| Things are Never So Bad That They Can't Get Worse | by | William Neuman |

| Body, The | by | Bill Bryson |

| Icepick Surgeon, The | by | Sam Kean |

| Why You Like The Science & Culture of Musical Taste | by | Nolan Gasser |

| Reason for the Darkness of the Night: Edgar Allan Poe and the Forging of American Science, The | by | John Tresch |

| A (Very) Short History of Life on Earth | by | Henry Gee |

| In the Shadow of Liberty | by | Kenneth C. Davis |

| Prisoners of Geography | by | Tim Marshall |

| Joy of Sweat, The | by | Sarah Everts |

| Forgetting: The Benefits of Not Remembering | by | Scott A. Small |

| Spinning Magnet, The | by | Alanna Mitchell |

| Midnight in Chernobyl | by | Adam Higginbothham |

| Science of James Smithson, The | by | Steven Turner |

| Knowledge Machine, The | by | Michael Strevens |

| Breathe | by | James Nestor |

| Lithium | by | Walter A. Brown |

| Genetics in the Madhouse | by | Theodore M. Porter |

| An Elegant Defense | by | Matt Richtel |

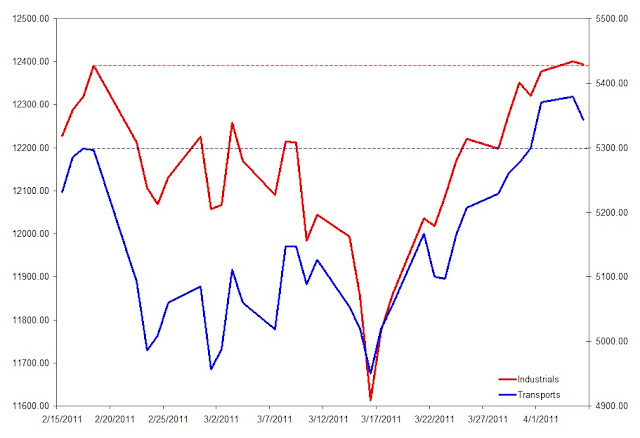

Currently, we're faced with the double top indicated as D1 and D2. From what I can tell, if the decline from D2 goes any further below the August 17th low then we may retrace up to 75% of the gains from C2 to D1. This assessment is based on the prior correction of A2 to C1 from the rise of B2 to A2. On the way down to C2 there are smaller support levels however their significance is not as pronounced as the percentage change from A2 to C1. We should assume the worst case scenario and expect that the Transports will go to 3239.36. Falling to points C1 and B1 would be the next order of operation.

Currently, we're faced with the double top indicated as D1 and D2. From what I can tell, if the decline from D2 goes any further below the August 17th low then we may retrace up to 75% of the gains from C2 to D1. This assessment is based on the prior correction of A2 to C1 from the rise of B2 to A2. On the way down to C2 there are smaller support levels however their significance is not as pronounced as the percentage change from A2 to C1. We should assume the worst case scenario and expect that the Transports will go to 3239.36. Falling to points C1 and B1 would be the next order of operation.