Below are the Nasdaq 100 companies that are within 10% of their respective 52-week lows. Stocks that appear on our watch lists are not recommendations to buy. Instead, they are the starting point for doing your research and determining the best company to buy. Ideally, a stock that is purchased from this list is done after a considerable decline in the price and rigorous due diligence.

| symbol | Name | Price | P/E | EPS | Yield | P/B | % from Low |

| SYMC | Symantec Corporation | 14.57 | 9.28 | 1.57 | - | 2.06 | 2.17% |

| DELL | Dell Inc. | 12.12 | 6.92 | 1.75 | - | 2.28 | 2.71% |

| CHRW | CH Robinson Worldwide Inc. | 57.92 | 21.6 | 2.68 | 2.3 | 7.51 | 3.65% |

| EA | Electronic Arts Inc. | 13.47 | 58.57 | 0.23 | - | 1.75 | 4.74% |

| INFY | Infosys Ltd. | 43.62 | 14.54 | 3 | 1.3 | 3.81 | 5.36% |

| NVDA | NVIDIA Corporation | 12.12 | 14.8 | 0.82 | - | 1.72 | 5.67% |

| GMCR | Green Mountain Coffee Roasters | 23.13 | 11.11 | 2.08 | - | 1.76 | 6.25% |

| EXPD | Expeditors Int'l of WA | 39.36 | 22.75 | 1.73 | 1.4 | 3.95 | 6.49% |

| CTRP | Ctrip.com Int'l | 18.66 | 17.86 | 1.04 | 0 | 2.38 | 6.63% |

| SPLS | Staples, Inc. | 12.86 | 9.23 | 1.39 | 3.4 | 1.24 | 7.71% |

| LRCX | Lam Research | 37.62 | 16.65 | 2.26 | - | 1.72 | 8.07% |

| NFLX | Netflix, Inc. | 65.64 | 22.22 | 2.95 | - | 5.41 | 8.14% |

| WYNN | Wynn Resorts Ltd. | 104.21 | 22.1 | 4.72 | 1.9 | 46.53 | 8.76% |

| NTAP | NetApp, Inc. | 30.33 | 19.2 | 1.58 | - | 2.65 | 9.14% |

| MCHP | Microchip Technology Inc. | 32.01 | 19.4 | 1.65 | 4.4 | 3.08 | 9.25% |

| VOD | Vodafone Group | 26.58 | 12.6 | 2.11 | 7.5 | 1.1 | 9.34% |

| MRVL | Marvell Technology | 12.28 | 13.15 | 0.93 | 2 | 1.4 | 9.35% |

| ORCL | Oracle Corporation | 27.16 | 14.23 | 1.91 | 0.9 | 3.16 | 9.87% |

| CTSH | Cognizant | 58.85 | 19.81 | 2.97 | - | 4.14 | 9.92% |

Watch List Summary

Of interest on our watch list is NVIDIA (NVDA). According to Yahoo!Finance, “NVIDIA Corporation provides graphics chips for use in smartphones, personal computers (PC), tablets, and professional workstations markets worldwide.” As we’ve described in the past, we have a strong interest in chip sector stocks and believe that the long-term prospects for companies in the chip industry is very appealing.

NVDA first appeared on our watch list on June 12, 2010. At that time, NVDA was trading at $11.61. By February 18, 2011, NVDA was trading as high as $25.68 which was a gain of over +120%. We’re not certain that NVDA’s decline has ended. According to Edson Gould’s Speed Resistance Lines, NVDA has already declined below the conservative downside target of $17.87 based on the February 2011 high. The persistence of the current decline suggests that the stock could decline to the extreme downside target of $8.67. We’re doing everything we can to hold off buying this stock at the current time.

Watch List Performance Review

The following is a performance review of the top five Nasdaq 100 Watch List from June 4, 2010. Keep in mind that this is a 2 year performance review instead of a 1 year review.

|

Symbol

|

Name | 2010 | 2012 | % change |

| GILD | Gilead Sciences, Inc. | $34.71 | 49.21 | 41.77% |

| SYMC | Symantec Corporation | $13.92 | 14.43 | 3.66% |

| ERTS | Electronic Arts Inc. | $15.81 | 13.07 | -17.33% |

| APOL | Apollo Group, Inc. | $51.48 | 32.42 | -37.02% |

| QCOM | QUALCOMM | $35.30 | 55.85 | 58.22% |

| average | 9.86% | |||

| NDX | Nasdaq 100 | 1,832.04 | 2,478.13 | 35.27% |

As can you can see, the list of top five stocks significantly underperformed the Nasdaq 100 (NDX), mainly due to Apple Inc. (AAPL) having an outsized impact on the index. However, underneath the static 2-year performance data is a story to be told, which is the basis of our New Low investment strategy.

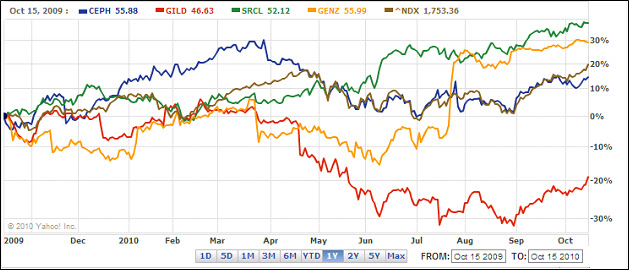

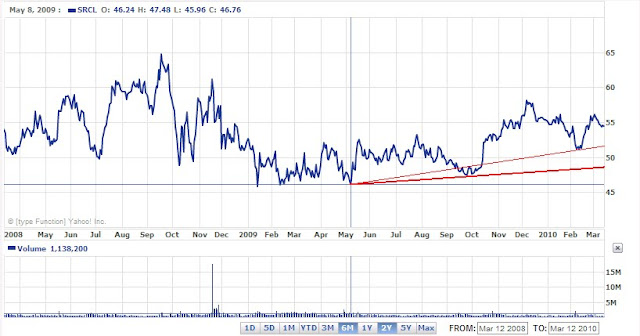

In the chart below, take note of the period around July 2011. At that time, Qualcomm had gains of +60%, Electronic Arts had gains of +55%, Symantec had gains of +42% and Gilead Sciences had gains of +21%. Only Apollo Group had losses to compare against the other stocks.

In the case of Symantec and Electronic Arts, they have come full circle after a 2-year period. This cycle is not unusual for most of the stocks that we track. Even when the stock does not approach the prior low of a watch list, many stocks attain a 52-week low after 2 to 2.5 years (as in the NVDA example above). Be on the lookout for stocks that have similar cycles like EA, SYMC and NVDA since their ability to replicated such moves adds to the prospect that they could pull a repeat performance.