Today, AIG traded up a whopping 20.46% on volume of 101,064,355 shares. On the surface of it this seems like a resounding vote of confidence for a company that is 80% owned by U.S. taxpayers. However, beneath the surface lies a murky story waiting to be told.

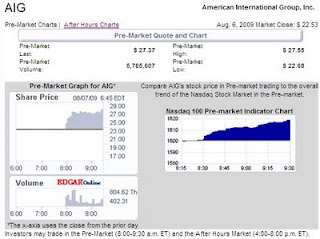

The story waiting to come out is that on Thurday August 6, 2009, AIG had a closing price of $22.53. During "Pre-market" trading Friday August 7th, AIG went from $22.53 to $27.37, a gain of 21.48%. The volume of shares traded during the "Pre-market" was 5,785,607 (after hour thumbnail.)

Once the regular hours of trading began on Friday August 7, 2009 the price of AIG actually fell from the $27.37 pre-market level to finally close at $27.14. Again, the regular hours of trading volume was 101,064,355.

What does all this mean? Over 5 million shares moved the price from $22.53 to $27.37. Once the regular market opened the public battled it out to come to the conclusion that the $27.37 wasn't the right price. Over 100 million only impacted the price by $0.23 lower than what 5 million was able to do by increasing the price over 20%.

My conclusion is that the public has less confidence in the future prospects for this company, and possibly the stock market, than the pre-market participants would have us believe. I also noticed that in after-hours trading the price rose an additional $0.08 on volume of 244,363 shares. Ain't it funny, 244,363 shares can raise the stock $0.08 while 100 million results in a loss of $0.23. The pre-market and after-market traders are gaming the system.

It appears that if you want to be a "trader" then you need to be entering and exiting the market before or after regular market hours. Otherwise, I would be cautious about dealing in this stock and any other stocks that are so easily managed based on so few participants. Conversely, if you're a "long term" investor then be ready to sell on a moments notice using market orders only. If you use a

stop order to sell at the price of $27 then it is likely that you

could get stopped out at $24 instead of $26.99 or thereabout if the stock trades down in the pre-market on Monday (wouldn't be surprised if this happens.) Touc.

Source:

Related Articles:

Please revisit Dividend Inc. for editing and revisions to this post.

This blog is being featured on www.condron.us, I hope you find this useful