Carbo Ceramics (CRR) was one of the companies that appeared at the top of our dividend watch list for many weeks beginning in February 2012. The watch list served as a beginning point for our research and we took a position in August (found here) at $65.02 (green arrow on chart below). Within three months, we saw shares of CRR rally to $74, a +13.8% gain. As such, we ‘hedged’ our position by selling the principal (found here) and let the profit run (red arrow on chart below).

Recent activity in Carbo Ceramics price suggests that, on a technical basis, the decline is over. Though a rally to its intraday peak of $180 is not expected, we believed there is a good opportunity for those interested in a short to medium-term speculative position in the stock.

In our view, the biggest bull case, on a technical basis, is that the 50-day moving average has crossed above the 150-day moving average creating what some call a "golden cross." We rely on the 150-day versus the more popular 200-day moving average for the fact that it is the road less traveled and provides an indication ahead of the crowd.

Currently, shares of Carbo Ceramics are trading just above the 50-day moving average, making this an ideal short-term transaction. For those who wish to trade this generally significant technical pattern, we’d consider selling if shares close below the 150-day moving average or if the stock gains +10% or more.

From a fundamental standpoint, Carbo Ceramics (CRR) provides long-term holders of the stock with the following attributes:

-

According to Value Line Investment Survey, the fair value for CRR is 14 times 2012 cash flow of $6.50, or a stock price of $91, a gain of +14% above the current price of $79.64. As an alternative, if the estimates by Value Line are correct, the 2013 fair value figure is $100.10, a potential gain of +25.69%.

-

Value Line indicates that Carbo Ceramics has increased the dividend for 12 consecutive years in a row.

-

Carbo Ceramics book value has had an annualized growth rate of +14.73%.

-

Carbo Ceramics has no debt

What Is the Downside Risk If I Want to Hold CRR for the Long-Term?

Dow Theory has the following downside targets for Carbo Ceramics:

-

$61.34

-

$44.39

-

$27.43

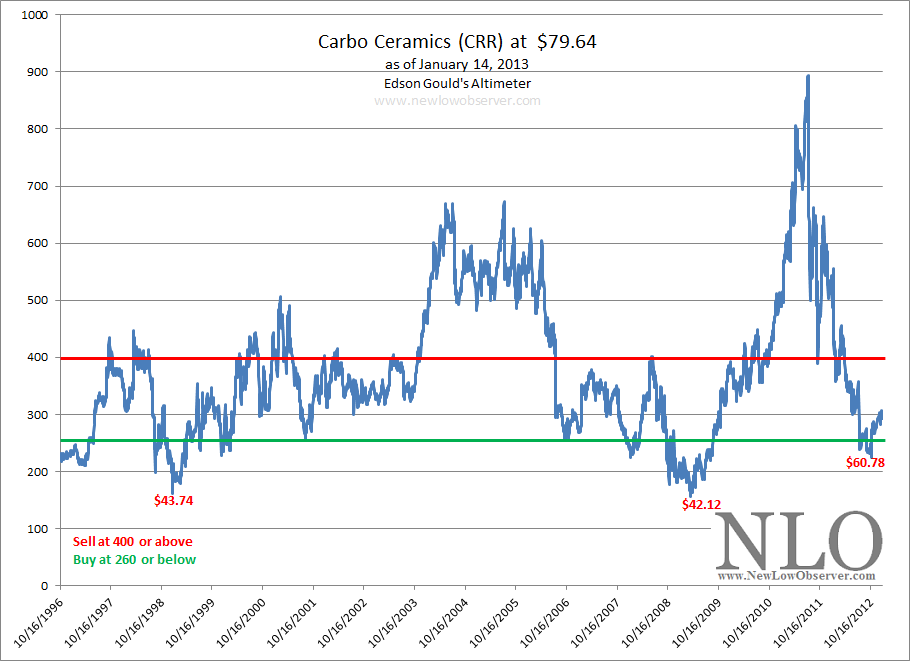

Based on the work of Edson Gould, Carbo Ceramics has the following Altimeter:

Carbo Ceramics would have to fall to $70.20 in order to be considered a buy using the Altimeter above. However, as has been the case in the past, seldom does the Altimeter decline to the buy level and then immediately reverse to the upside. therefore we’d expect a push below the $70.20 level for good measure.

Edson Gould’s Speed Resistance Lines have $65 as the downside support level.

The most conservative of the three downside targets mentioned above is the Dow Theory level of $61. This seems be the most appropriate level to consider a first, or second, purchase if the desire is to hold Carbo Ceramics for the long-term.