Members

-

Topics

Archives

-

-

Recent Posts

-

-

-

Investor Education

Market Return After Exceptional Years

Dollar Cost Averaging Tool

Dow Theory: The Formation of a Line

Dividend Capture Strategy Analysis

Golden Cross – How Golden Is It?

Debunked – Death Cross

Work Smart, Not Hard

Charles H. Dow, Father of Value Investing

It's All About the Dividends

Dow Theory: Buying in Scales

How to Avoid Losses

When Dividends are Canceled

Cyclical and Secular Markets

Inflation Proof Myth

What is Fair Value?

Issues with P-E Ratios

Beware of Gold Dividends

Gold Standard Myth

Lagging Gold Stocks?

No Sophisticated Investors

Dollar down, Gold up?

Problems with Market Share

Aim for Annualized Returns

Anatomy of Bear Market Trade

Don’t Use Stop Orders

How to Value Earnings

Low Yields, Big Gains

Set Limits, Gain More

Ex-Dividend Dates -

-

Historical Data

1290-1950: Price Index

1670-2012: Inflation Rate

1790-1947: Wholesale Price Cycle

1795-1973: Real Estate Cycle

1800-1965: U.S. Yields

1834-1928: U.S. Stock Index

1835-2019: Booms and Busts

1846-1895: Gold/Silver Value

1853-2019: Recession/Depression Index

1860-1907: Most Active Stock Average

1870-2033: Real Estate Cycles

1871-2020: Market Dividend Yield

1875-1940: St. Louis Rents

1876-1934: Credit-New Dwellings

1896-1925: Inflation-Stocks

1897-2019: Sentiment Index

1900-1903: Dow Theory

1900-1923: Cigars and Cigarettes

1900-2019: Silver/Dow Ratio

1901-2019: YoY DJIA

1903-1907: Dow Theory

1906-1932: Barron's Averages

1907-1910: Dow Theory

1910-1913: Dow Theory

1910-1936: U.S. Real Estate

1910-2016: Union Pacific Corp.

1914-2012: Fed/GDP Ratio

1919-1934: Barron's Industrial Production

1920-1940: Homestake Mining

1921-1939: US Realty

1922-1930: Discount Rate

1924-2001: Gold/Silver Stocks

1927-1937: Borden Co.

1927-1937: National Dairy Products

1927-1937: Union Carbide

1928-1943: Discount Rate

1929-1937: Monsanto Co.

1937-1969: Intelligent Investor

1939-1965: Utility Stocks v. Interest Rates

1941-1967: Texas Pacific Land

1947-1970: Inventory-Sales Ratio

1948-2019: Profits v. DJIA

1949-1970: Dow 600? SRL

1958-1976: Gold Expert

1963-1977: Farmland Values

1971-2018: Nasdaq v. Gold

1971-1974: REIT Crash

1972-1979: REIT Index Crash

1986-2018: Hang Seng Index Cycles

1986-2019: Crude Oil Cycles

1999-2017: Cell Phone Market Share

2008: Transaction History

2010-2021: Bitcoin Cycles -

Interesting Read

Inside a Moneymaking Machine Like No Other

The Fuzzy, Insane Math That's Creating So Many Billion-Dollar Tech Companies

Berkshire Hathaway Shareholder Letters

Forex Investors May Face $1 Billion Loss as Trade Site Vanishes

Why the oil price is falling

How a $600 Million Hedge Fund Disappeared

Hedge Fund Manager Who Remembers 1998 Rout Says Prepare for Pain

Swiss National Bank Starts Negative

Tice: Crash is Coming...Although

More on Edson Gould (PDF)

Schiller's CAPE ratio is wrong

Double-Digit Inflation in the 1970s (PDF)

401k Crisis

Quick Link Archive

Monthly Archives: January 2012

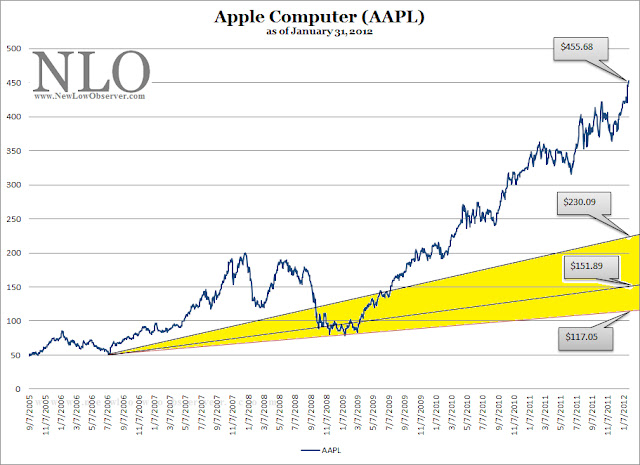

Apple (AAPL) and Speed Resistance Lines

Posted in AAPL, Edson Gould, NFLX, speed resistance line, William X. Scheinman

Tagged members

Insurance Watch List: January 27, 2012

NamePriceP/EEPSYieldP/Bpayout ratio% from Low

Alleghany Corp.288.0518.0715.9400.880.00%3.98%

National Western Life Insurance143.27.2819.660.30%0.41.83%10.15%

American National Insurance72.6411.296.444.20%0.5347.83%10.55%

Tower Group, Inc.21.9110.82.033.40%0.8536.95%10.77%

HCC Insurance Holdings, Inc.27.9411.562.422.20%0.9325.62%13.30%

Loews Corp.37.6312.253.070.70%0.798.14%14.38%

XL Group plc20.328.190.722.20%0.6761.11%14.75%

Kansas City Life Insurance32.3613.62.383.30%0.5145.38%15.53%

Sun Life Financial20.1413.631.486.90%0.8293.24%15.75%

Everest Re Group85.1525.563.332.30%0.7657.66%16.09%

Unum Group22.928.012.861.80%0.7114.69%16.23%

Endurance Specialty Holdings37.0870.760.523.20%0.58230.77%17.08%

Willis Group Holdings38.7324.421.592.70%2.5165.41%17.22%

Hanover Insurance Group36.6935.871.023.30%0.67117.65%18.35%

| Symbol | |||||||||||||

| Y | NWLI | ANAT | TWGP | HCC | L | XL | KCLI | SLF | RE | UNM | ENH | WSH | THG |

In the News: January 28, 2012

High-TechEmployee AntiTrust Litigation (PDF) at Lieff, Cabraser, Heimann & Bernstein,LLP

Apple,Google Must Face Antitrust Lawsuit Over Tech Employee-Poaching Ban atBloomberg

FormerGroupon sales reps countersue over tactics at Reuters

WhatMakes FPA Crescent Tick? at Morningstar

Olympuspanel clears accounting firms of blame in scandal at Reuters

TheFannie and Freddie Chronicles, Cont. at Barron’s

PaulsonDigs Deep Hole, Needs Big Returns To Recoup Losses at Barron’s

Digitalmusic sales top physical sales at CNNMoney

Milkfutures: Better than gold at CNNMoney

FHAsays: It's ok to flip that house at CNNMoney

Yourcell phone is out of your control at CNNMoney

Gold,Silver Move Towards 3-4% Weekly Gains; Time To Sell Miners? at Barron’s

GoldETF almost a sell at MarketWatch

What'sbehind Netflix's 22% spike? at CNNMoney

Is the ETFbubble about to burst? At CNNMoney

GoldIs The Hottest Currency In The World at Forbes

BePrepared To Sell Your Soul If You Use Google at Forbes

MerrillLynch Hit With $1 Million Fine For Employee Note Collections at Forbes

The Big401(k) Match Mistake at Forbes

ThePitfalls Of Variable Annuities at Forbes

FacingSEC Charges, Ex-Fannie Chief Daniel Mudd Resigns At Fortress at Forbes

Whathappens when you walk away from your home? at Reuters

Questioningthe Volcker Rule at The Atlantic

Posted in In the news

Thoughts on Gold

We’re opting for the view that goldexperiences good times and bad rather than the view that our nation is comingto an end. After all, the redemption ofour gold, as with all forms of insurance, is not something that we look forwardto.

Posted in Dow Theory Letters, gold, Richard Russell, Silver, Simmons First National

Tagged members

|

Nasdaq 100 Watch List

| Symbol | Name | Price | P/E | EPS | Yield | P/B | % from Yr Low |

| BMC | BMC Software, Inc. | 34.01 | 13.93 | 2.44 | N/A | 3.74 | 7.56% |

| DTV | DIRECTV | 43.03 | 13.41 | 3.21 | N/A | N/A | 8.06% |

| CHRW | C.H. Robinson Worldwide, Inc. | 67.66 | 26.33 | 2.57 | 2.00% | 8.92 | 8.60% |

| NTAP | NetApp, Inc. | 36.85 | 22.46 | 1.64 | N/A | 3.54 | 11.67% |

| SYMC | Symantec Corporation | 16.79 | 19.1 | 0.88 | N/A | 2.69 | 12.38% |

| INFY | Infosys Limited | 52.29 | 18.09 | 2.89 | 1.10% | 5.03 | 13.38% |

| EXPE | Expedia, Inc. | 31.04 | 9.21 | 3.37 | 3.60% | 1.59 | 13.78% |

| VOD | Vodafone Group Plc | 27.76 | 13.16 | 2.11 | 3.60% | 1.07 | 14.19% |

| WYNN | Wynn Resorts, Limited | 115.47 | 26.95 | 4.28 | 1.80% | 5.66 | 14.30% |

| Symbol | Name | 2011 | 2012 | % change |

| CEPH | Cephalon, Inc. | 59.64 | 81.5 | 36.65% |

| CSCO | Cisco Systems, Inc. | 20.73 | 19.92 | -3.91% |

| QGEN | Qiagen N.V. | 18.56 | 15.42 | -16.92% |

| TEVA | Teva Pharmaceutical | 52.86 | 45.83 | -13.30% |

| ATVI | Activision Blizzard, Inc | 11.25 | 12.22 | 8.62% |

| average | 2.23% | |||

| Nasdaq 100 | 2268.32 | 2437.02 | 7.44% |

The Time Has Come For California Water Services (CWT)

CaliforniaWater Services Group (CWT) has finally arrived at the point that we’veanticipated for the last 2 years. OnJanuary 3, 2010, we submitted an investment observation that CWT would continueto trade in an established 6-year range that had been identified for at least4 other periods. Just as a debrief, inthe 2010 piece (found here), we said the following periods traded in 6-year ranges afterbreaking out of the previous range:

- 1976to 1982

- 1985to 1993

- 1993to 1997

- 1997to 2004

- 2005to 2011

-

$17.28

-

$13.70

-

$10.52

Posted in California Water Service, CWT, Dividend Achievers, dividends, water utilities

Tagged members

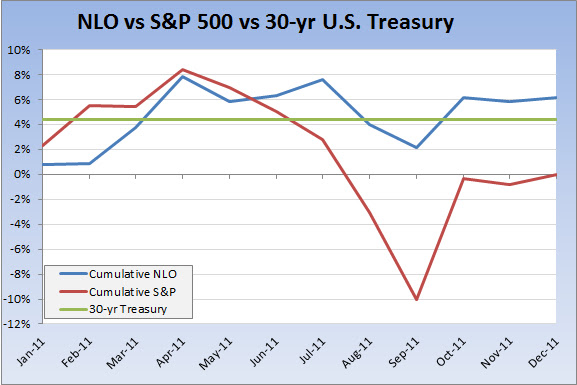

2011 Performance Review

| Year | Dow | S&P 500 | Nasdaq | NLO Portfolio |

| 2006 | 16.29% | 15.74% | 9.52% | 18.30% |

| 2007 | 6.43% | 5.46% | 9.81% | 19.80% |

| 2008 | -33.84% | -37.22% | -40.54% | 14.35% |

| 2009 | 18.82% | 27.11% | 43.89% | 36.65% |

| 2010 | 11.02% | 14.32% | 16.91% | 7.14% |

| 2011 | 5.53% | 0.00% | -1.80% | 6.20% |

NLO Dividend Watch List: January 13, 2012

January 13, 2012

| Symbol | Name | Price | % Yr Low | P/E | EPS (ttm) | Dividend | Yield | Payout Ratio |

| TR | Tootsie Roll Industries Inc | 23.63 | 3.55% | 32.82 | 0.72 | 0.32 | 1.35% | 44% |

| BCR | CR Bard, Inc. | 85.45 | 5.75% | 21.97 | 3.89 | 0.76 | 0.89% | 20% |

| JW-A | John Wiley & Sons Inc. | 44.59 | 6.45% | 15.65 | 2.85 | 0.80 | 1.79% | 28% |

| CHRW | C.H. Robinson Worldwide | 66.73 | 7.11% | 25.96 | 2.57 | 1.32 | 1.98% | 51% |

| WAG | Walgreen Co. | 32.63 | 7.55% | 11.02 | 2.96 | 0.90 | 2.76% | 30% |

| BDX | Becton, Dickinson and Co. | 74.91 | 7.64% | 13.33 | 5.62 | 1.80 | 2.40% | 32% |

| CWT | California Water Service | 17.94 | 7.75% | 18.31 | 0.98 | 0.62 | 3.46% | 63% |

| WST | West Pharmaceutical | 38.29 | 7.86% | 21.15 | 1.81 | 0.72 | 1.88% | 40% |

| OMI | Owens & Minor, Inc. | 27.96 | 8.08% | 15.71 | 1.78 | 0.80 | 2.86% | 45% |

| ANAT | American National Insurance | 71.06 | 8.14% | 11.03 | 6.44 | 3.08 | 4.33% | 48% |

| CLX | Clorox Co. | 68.03 | 8.38% | 19.61 | 3.47 | 2.40 | 3.53% | 69% |

| AVP | Avon Products, Inc. | 17.52 | 8.89% | 10.31 | 1.70 | 0.92 | 5.25% | 54% |

| MATW | Matthews International Corp. | 31.19 | 9.17% | 12.68 | 2.46 | 0.36 | 1.15% | 15% |

| KO | Coca-Cola Co | 66.99 | 9.30% | 12.31 | 5.44 | 1.88 | 2.81% | 35% |

| AROW | Arrow Financial Corp. | 23.58 | 9.67% | 12.75 | 1.85 | 1.00 | 4.24% | 54% |

| BMO | Bank of Montreal | 56.92 | 9.82% | 11.07 | 5.14 | 2.73 | 4.80% | 53% |

| BMS | Bemis Co Inc | 29.89 | 9.85% | 15.02 | 1.99 | 0.96 | 3.21% | 48% |

| CAH | Cardinal Health, Inc. | 41.25 | 9.91% | 16.11 | 2.56 | 0.86 | 2.08% | 34% |

| TGT | Target Corp. | 49.82 | 10.03% | 11.59 | 4.30 | 1.20 | 2.41% | 28% |

| PEP | PepsiCo Inc. | 64.4 | 10.09% | 16.14 | 3.99 | 2.06 | 3.20% | 52% |

| WTR | Aqua America Inc | 21.26 | 10.27% | 21.47 | 0.99 | 0.66 | 3.10% | 67% |

| T | AT&T Inc | 30.07 | 10.55% | 15.26 | 1.97 | 1.76 | 5.85% | 89% |

| SJW | SJW Corp. | 23.11 | 10.73% | 19.42 | 1.19 | 0.69 | 2.99% | 58% |

| NFG | National Fuel Gas Co. | 49.35 | 10.87% | 15.97 | 3.09 | 1.42 | 2.88% | 46% |

| CATO | Cato Corp. | 23.98 | 10.97% | 10.90 | 2.20 | 0.92 | 3.84% | 42% |

| 25 Companies | ||||||||

Not much movement has occurred since our last watch list on December 23, 2011.

Top Five Performance Review

In our ongoing review of the NLO Dividend Watch List, we have taken the top five stocks on our list from January 14, 2011 and have check their performance one year later. The top five companies on that list can be seen in the table below.

| Symbol | Name | 2010 Price | 2011 Price | % change |

| ABT | Abbott Laboratories | 46.89 | 55.43 | 18.21% |

| CL | Colgate-Palmolive Co. | 78.31 | 88.52 | 13.04% |

| CLX | Clorox Co. | 63.98 | 68.03 | 6.33% |

| LLY | Eli Lilly & Co. | 34.91 | 39.94 | 14.41% |

| KMB | Kimberly-Clark Corp. | 63.64 | 72.7 | 14.24% |

| Average | 13.25% | |||

| DJI | Dow Jones Industrial | 11,787.38 | 12,422.06 | 5.38% |

| SPX | S&P 500 | 1,293.24 | 1,289.09 | -0.32% |

Disclaimer

4-Year Cycle Update

|

Symbol

|

Name

|

Price

|

P/E

|

EPS

|

% Yield

|

Price/Book

|

% from Low

|

|

Tootsie Roll

|

23.77

|

32.82

|

0.72

|

1.40

|

2.03

|

4.12%

|

|

|

C.R. Bard, Inc.

|

85.81

|

22.05

|

3.89

|

0.90

|

3.96

|

6.14%

|

|

|

Becton, Dickinson

|

74.24

|

13.22

|

5.62

|

2.50

|

3.26

|

6.70%

|

|

|

John Wiley & Sons

|

44.77

|

15.7

|

2.85

|

1.80

|

2.66

|

6.88%

|

|

|

California Water Service

|

17.83

|

18.29

|

0.98

|

3.40

|

1.64

|

7.09%

|

|

|

Owens & Minor

|

27.8

|

15.61

|

1.78

|

2.90

|

1.93

|

7.46%

|

|

|

Clorox Company

|

67.76

|

19.54

|

3.47

|

3.60

|

-116.98

|

8.64%

|

|

|

West Pharmaceutical

|

38.55

|

21.28

|

1.81

|

1.90

|

1.85

|

8.73%

|

|

|

Frisch's Restaurants

|

20.27

|

22.93

|

0.88

|

3.30

|

0.8

|

9.92%

|

Posted in 4 1/2 year, 4 year, Charles H. Dow, Dow Theory Letters, Richard Russell

Tagged members

Crime and Punishment

Posted in AADB, Arthur Andersen, Deloitte and Touche, Enron, MF Global, PCAOB, PwC

Tagged members

NLO Dividend Watch List: December 30, 2011

December 30, 2011

| Symbol | Name | Price | % Yr Low | P/E | EPS (ttm) | Dividend | Yield | Payout Ratio |

| TR | Tootsie Roll Industries Inc | 23.67 | 3.72% | 32.88 | 0.72 | 0.32 | 1.35% | 44% |

| FRS | Frisch's Restaurants, Inc | 19.4 | 5.21% | 22.05 | 0.88 | 0.64 | 3.30% | 73% |

| BMO | Bank of Montreal | 54.81 | 5.75% | 10.66 | 5.14 | 2.74 | 5.00% | 53% |

| BCR | CR Bard, Inc. | 85.5 | 5.82% | 21.98 | 3.89 | 0.76 | 0.89% | 20% |

| JW-A | John Wiley & Sons Inc. | 44.4 | 5.99% | 15.58 | 2.85 | 0.80 | 1.80% | 28% |

| LM | Legg Mason, Inc. | 24.05 | 6.37% | 14.66 | 1.64 | 0.32 | 1.33% | 20% |

| SCHW | Charles Schwab Corp. | 11.26 | 6.63% | 16.81 | 0.67 | 0.24 | 2.13% | 36% |

| WST | West Pharmaceutical | 37.95 | 6.90% | 20.97 | 1.81 | 0.72 | 1.90% | 40% |

| EXPD | Expeditors Intl of Washington | 40.96 | 7.08% | 22.63 | 1.81 | 0.50 | 1.22% | 28% |

| GS | Goldman Sachs Group, Inc. | 90.43 | 7.31% | 13.76 | 6.57 | 1.40 | 1.55% | 21% |

| BDX | Becton, Dickinson and Co. | 74.72 | 7.37% | 13.30 | 5.62 | 1.80 | 2.41% | 32% |

| OMI | Owens & Minor, Inc. | 27.79 | 7.42% | 15.61 | 1.78 | 0.80 | 2.88% | 45% |

| CAH | Cardinal Health, Inc. | 40.61 | 8.21% | 15.86 | 2.56 | 0.86 | 2.12% | 34% |

| AVP | Avon Products, Inc. | 17.47 | 8.58% | 10.28 | 1.70 | 0.92 | 5.27% | 54% |

| WAG | Walgreen Co. | 33.06 | 8.97% | 11.17 | 2.96 | 0.90 | 2.72% | 30% |

| AROW | Arrow Financial Corp. | 23.44 | 9.02% | 12.67 | 1.85 | 1.00 | 4.27% | 54% |

| UTX | United Technologies Corp. | 73.09 | 9.30% | 13.71 | 5.33 | 1.92 | 2.63% | 36% |

| BMI | Badger Meter, Inc. | 29.43 | 9.57% | 18.28 | 1.61 | 0.64 | 2.17% | 40% |

| CWT | California Water Service | 18.26 | 9.67% | 18.63 | 0.98 | 0.62 | 3.40% | 63% |

| CLX | Clorox Co. | 66.56 | 9.91% | 19.18 | 3.47 | 2.40 | 3.61% | 69% |

| MATW | Matthews International Corp. | 31.43 | 10.01% | 12.78 | 2.46 | 0.36 | 1.15% | 15% |

| BMS | Bemis Co Inc | 30.08 | 10.55% | 15.12 | 1.99 | 0.96 | 3.19% | 48% |

Last Year Review

Disclaimer

Nasdaq 100 Watch List: December 30, 2011 (revised)

Below are the Nasdaq 100 companies that are within 10% of their respective 52-week lows. Stocks that appear on our watch lists are not recommendations to buy. Instead, they are the starting point for doing your research and determining the best company to buy. Ideally, a stock that is purchased from this list is done after a considerable decline in the price and rigorous due diligence.

| Symbol | Name | Price | P/E | EPS | Yield | P/B | % from low |

| BMC | BMC Software, Inc. | 32.78 | 13.43 | 2.44 | N/A | 3.65 | 1.83% |

| ORCL | Oracle Corp. | 25.65 | 14.11 | 1.82 | 0.90% | 3.1 | 3.76% |

| VMED | Virgin Media Inc. | 21.38 | 68.53 | 0.31 | 0.70% | 4.99 | 4.19% |

| SYMC | Symantec Corp. | 15.65 | 17.8 | 0.88 | N/A | 2.54 | 4.75% |

| CTRP | Ctrip.com | 23.4 | 19.93 | 1.17 | N/A | 3.09 | 4.79% |

| LRCX | Lam Research | 37.02 | 7.67 | 4.82 | N/A | 1.89 | 6.35% |

| EXPE | Expedia, Inc. | 29.02 | 8.61 | 3.37 | 3.90% | 1.49 | 6.38% |

| BRCM | Broadcom Corp | 29.36 | 17.68 | 1.66 | 1.20% | 2.57 | 6.42% |

| SRCL | Stericycle, Inc. | 77.92 | 30.92 | 2.52 | N/A | 5.66 | 6.67% |

| EXPD | Expeditors Int'l of Was | 40.96 | 22.63 | 1.81 | 1.20% | 4.46 | 7.08% |

| DTV | DIRECTV | 42.76 | 13.33 | 3.21 | N/A | N/A | 7.38% |

| AMZN | Amazon.com | 173.1 | 91.25 | 1.9 | N/A | 10.19 | 7.79% |

| CA | CA Inc. | 20.22 | 11.86 | 1.7 | 1.00% | 1.74 | 8.62% |

| AVGO | Avago Tech. | 28.86 | 13.18 | 2.19 | 1.60% | 3.57 | 9.24% |

| WYNN | Wynn Resorts | 110.49 | 25.79 | 4.28 | 1.80% | 5.32 | 9.37% |

| MSFT | Microsoft Corp. | 25.96 | 9.44 | 2.75 | 3.10% | 3.68 | 9.77% |

| NTAP | NetApp, Inc. | 36.27 | 22.1 | 1.64 | N/A | 3.42 | 9.91% |

Watch List Summary

The Punchline: Broadcom is a strong company in a strong industry that is experiencing consolidation, thereby reducing the number of competitors. Consider buying BRCM in two stages, once at the current price and again at any price below $25.17.

Watch List Performance Review

In our ongoing review of the Nasdaq 100 Watch List, we have taken the stocks from our list of January 7, 2011 (found here) and have checked their performance one year later. The companies on that list are provided below with the closing prices from January 7, 2011 to December 30, 2011.

| Symbol | Name | Jan-11 | Dec-11 | % change | |||

| ISRG | Intuitive Surgical | 267.4 | 463.01 | 73.15% | |||

| CEPH | Cephalon | 60.32 | 81.49 | 35.10% | |||

| CSCO | Cisco Systems | 20.97 | 18.08 | -13.78% | |||

| APOL | Apollo Group | 37.98 | 53.87 | 41.84% | |||

| AMGN | Amgen | 56.98 | 64.21 | 12.69% | |||

| Average | 29.80% | ||||||

| ^NDX | Nasdaq 100 | 2276.7 | 2277.83 | 0.05% |

Even with the underperformance from Cisco (CSCO), our watch list from the beginning of last year exceeded the Nasdaq 100 Index by a wide margin.

Disclaimer:

On our current list, we excluded companies that have no earnings. Stocks that appear on our watch lists are not recommendations to buy. Instead, they are the starting point for doing your research and determining the best company to buy. Ideally, a stock that is purchased from this list is done after a considerable decline in the price and extensive due diligence. We suggest that readers use the March 2009 low (or the companies' most distressed level in the last 2 years) as the downside projection for investing. Our view is to embrace the worse case scenario prior to investing. A minimum of 50% decline or the November 2008 to March 2009 low, whichever is lower, would fit that description. It is important to place these companies on your own watch list so that when the opportunity arises, you can purchase them with a greater margin of safety. It is our expectation that, at the most, only 1/3 of the companies that are part of our list will outperform the market over a one-year period.