Dow Theory is as much about values as it is about squiggly lines on a chart. Charles H. Dow, co-founder and former editor of the Wall Street Journal, often expressed the idea of values in many different ways. However, there is one passage from his editorials in the Wall Street Journal that we feel is critical to the general idea of what Dow meant whenever he talked on the subject of values. On July 20, 1901, Dow said the following:

“The best way of reading the market is to read from the standpoint of values. The market is not like a balloon plunging hither and thither in the wind. As a whole, it represents a serious, well-considered effort on the part of farsighted and well-informed men to adjust prices to such values as exist or which are expected to exist in the not too remote future. The thought with great operators is not whether a price can be advanced, but whether the value of property which they propose to buy will lead investors and speculators six months hence to take stock at figures from ten to twenty points above present prices.

"In reading the market, therefore, the main point is to discover what a stock can be expected to be worth three months hence and then to see whether manipulators or investors are advancing the price of that stock toward those figures. It is often possible to read movements in the market very clearly in this way. To know values is to comprehend the meaning of movements in the market."

Source: Hamilton, William Peter. Stock Market Barometer. Page 38.

Dow Theorists like Richard Russell often quote the last sentence of the above excerpt, “…to know values is to comprehend the meaning…,” without giving the proper context of what is meant. The progression of thought that precedes the last sentence is critical to understanding why knowing values and their relationship to price is so important. Let’s deconstruct the ideas laid out before us.

First, Charles Dow tells us that the stock prices of today are adjusted for what is expected in the future. The distinction between great operators [Buffett, Einhorn, Paulson, Berkowitz etc.] and average traders/investors is the ability to know values enough to project at least six (6) months down the road that, even at higher prices, the investing public will still be willing to buy more of the stock in question.

Next, these great operators are supposed to be willing to accept half the gains that they expect for 6 months and in half the time. At which point, the great operators move on to other undervalued opportunities. Dow believed that not only should the great operators be able to predict the direction of the price of an undervalued asset, they must also accept less than the full amount possible despite their confidence and accuracy of prior investments using the same approach. This idea is based on a concept called “

seeking fair profits,” which we mention in every sell recommendation that is posted on our site.

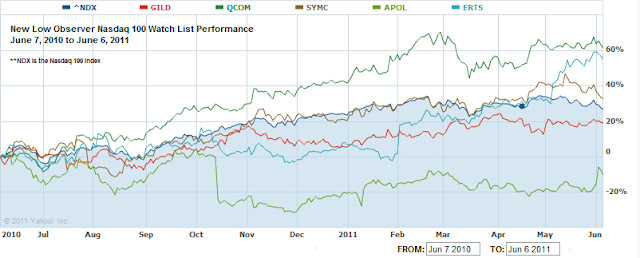

We readily admit that we don’t know all there is about fundamental analysis which is critical to the understanding of values. However, the creation of this site is specifically for the purpose of pointing you in the right direction. It is not accidental that we’ve selected the two lists, dividend increasing and Nasdaq 100 stocks, for your consideration. What we understand and hope to convey is that specific stocks at or near a new low are the benchmark for testing any and all forms of fundamental analysis, in the pursuit of determining values, with reduced probability of exceptional loss.

As an example, we found a stock recommendation made by Richard Moroney of the

Dow Theory Forecasts (

DTF) newsletter. On

June 24, 2011,

DTF recommended that investors consider all of the redeeming attributes of Dish Networks (DISH).

DTF had the following to say about (DISH):

“Like its service, DISH’s also shares seem attractively valued. At 10 times trailing earnings, the stock trades at a 33% discount to its five-year average and 47% below the average cable or satellite stock.

"Should DISH meet the 2011 consensus profit estimate of $3.16 per share and its P/E simply holds steady, the shares stand to gain 30% by early next year. DISH also boasts widening profit margins, and steady sales growth.”

Additional commentary about the pros and cons of DISH are provided with closing remarks indicating that the stock “…is a Long-Term Buy.”

However, the recommendation of (DISH) at the current price of $28.39 is very much in contradiction to what Charles Dow viewed as an attribute of a “great” operator in the market. Evidence of this is demonstrated in the chart below.

Notice that when DISH appeared on our Nasdaq 100 Watch (

September 18th &

December 12th), the stock rose $5 in the first six months. After rising $5, DISH rose an additional $7 and settled at the current price of $28.39 or $10 above the price when it first appeared on our watch list. An observer of the chart should take note of the fact that even though February 2010 was lower than the Sept and Dec 2010 prices, the 1-year period prior to February 2010 had price points that were much lower. Therefore, DISH did not fall within 10%-20% of the 1-year low at that time.

The recommendation of (DISH) by DTF, at the current price, seems a bit of a stretch and makes us wonder if such a recommendation can withstand a cursory market reaction, let alone a full-on bear market (a -30% decline or more.) This also makes us question the thought process of DTF when basic principles of momentum investing (buying high, hoping that the long-term is favorable) are applied under the name of a newsletter presumably based on concepts of Charles H. Dow.

We believe that adherence to Charles Dow’s explanation of values is a key contributing factor for why we have constructed our watch lists for you. We are confident that, although not experts in values, you could apply any fundamental methodology you like and feel fairly comfortable about the investment decisions that you’ve made (especially if you’re willing to wait for the long-term to arrive.)

The lack of attention paid to the price as it relates to values, in the case of the recommendation of DISH, may cost an investor a decline of 30% before a material gain is achieved unless the company is bought by a larger institution.

Please consider donating to the New Low Observer. Thank you.