In a September 20, 2010 article titled “Dow Theorist Believes Buy Signal is Imminent” on MarketWatch.com, there are views from three different well known Dow Theorists with different conclusions from each one of them. This is an instance where the author, Mark Hulbert, should at least know something about the topic on which he writes. Instead, the author clouds the picture on Dow Theory, which few people really understand or write about. Since Mark Hulbert rates the performance of stock market newsletter, he should probably stick to the performance numbers rather than muddy the interpretation on Dow Theory by writers who aren’t following the clearly defined rules of the theory.

Now it is the job of the New Low Observer team to clean up the confusion created by Mr. Mark Hulbert, on the inaccuracies of the Dow Theorists.

First, in all instances, none of the theorists mentioned (Russell, Schannep, Moroney) could possibly be interpreting Dow Theory accurately if they are somehow about to generate a “buy” signal. This would mean that prior to a buy signal there would have been a sell signal indicated. According to our work on Dow Theory, which is well documented and freely available (check here), there hasn’t been a single sell signal since the July 24, 2009 bull market indication which was selected by the New Low Observer team as the initiation date of our website. This is further evidenced by the simple fact that the Industrials and Transports have continued to climb higher since March 2009 to the present.

Not to be outdone is the great Dow Theorist Richard Russell. Mr. Russell is referred to in the article as a “traditionalist” when it comes to Dow Theory. Mr. Russell says that he cannot “…say that even a short term buy signal has been generated. That’s because the Dow Transports as of mid-day trading in New York remain about 1% below their early August high (which came in at 4,516.35).” To his credit, Mr. Russell sticks with the use of the Dow Transportation Average for an indication of a Dow Theory “buy” signal.

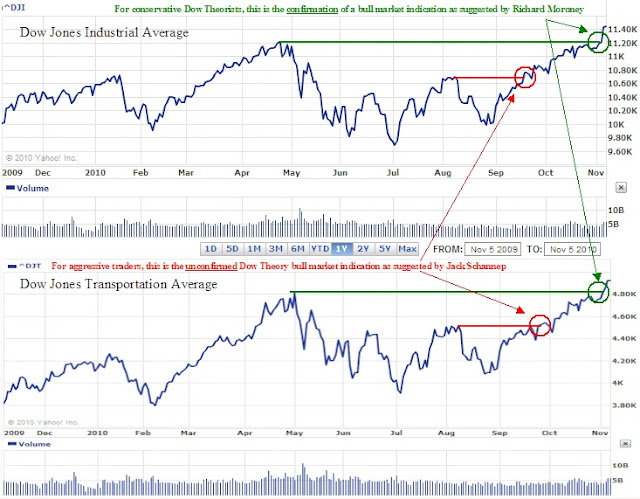

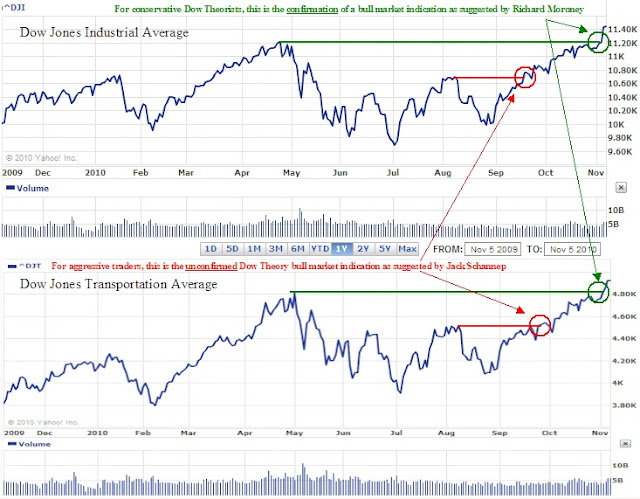

Unfortunately, on the very first day that the Transports exceeded the 4,516.35 level on September 28, 2010, Russell never gave any indication that a short-term buy was at hand. The very next day, still no indication of a short-term buy indication. September 30th, still no indication of a “short-term” buy signal. As the Transportation Average continued to climb to the current level of 4,923.40, Mr. Russell has made no reference to Dow Theory based on the numbers or the technicals. Instead, Mr. Russell has talked about the major premise behind Dow Theory is values. While this is true, some consideration of current market action is what Dow Theory is all about. The pattern created by the “short-term” buy signal is exactly the same one that Russell used when he called the market bottom in January of 1975. We’re not certain why he doesn’t recognize this pattern today.

Next, as a Dow Theorist of sorts (we’re not really sure), Mr. Schannep has several issues that require addressing. Among our concerns, Mr. Schannep never needed to replace the Dow Jones Transportation Average for the S&P 500 Index in order to get a Dow Theory signal. We understand the goal of Mr. Schannep in this strategy, reduce the period of time to garner a signal so that more upside is obtain. If, in fact, the goal of Mr. Schannep was to get an earlier signal by using the S&P 500, then he probably got it by three days at best.

It is important to note that if Mr. Schannep was applying anything like Dow’s theory, then he would have to wait for the last of the two indicators to confirm a signal. This means that although the S&P 500 signal came almost two weeks ahead of the Transportation index, the Industrials’ confirmation came within three days of the Transports’ confirmation. The chart below demonstrates how Mr. Schannep could have utilized the Transportation index and gotten the same signal in the same period of time.

The matter of timing the signal is a concern that plagues every Dow Theorist. However, resorting to the tactics of Mr. Schannep only undermines the point of Dow Theory as outlined by Robert Rhea in his book The Dow Theory. Instead of changing Dow’s theory into our own, in order to generate earlier signals, we have decided to use Dow’s Theory as an asset allocation tool instead. More funds in stocks that are undervalued during bull market indications and fewer funds in stocks that are undervalued during bear market indications. This way, we’re not beholden to issues of late signals requiring modifications of Dow’s theory.

The article suggested that on September 20, 2010 a buy signal was about to be registered according Jack Schennep’s website. Mr. Schannep manages to mix the usage of the Dow Industrials, Dow Transports and the S&P 500 index to garner a “Dow Theory” buy or sell signal. It appears that, according to Mr. Schannep, if you cannot get clarity from the standard indicators, the Dow Industrials and Dow Transports, then you replace any one of the two indexes with the S&P 500 index. Mr. Schannep indicates that this approach is a more modern strategy for determining Dow Theory buy and sell indications. We don’t like Mr. Schannep’s modification to the Dow Theory but if it works profitably for his subscribers then more power to him. However, it should be said that Mr. Schannep isn’t practicing Dow Theory.

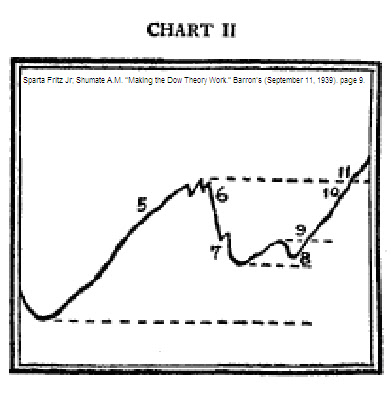

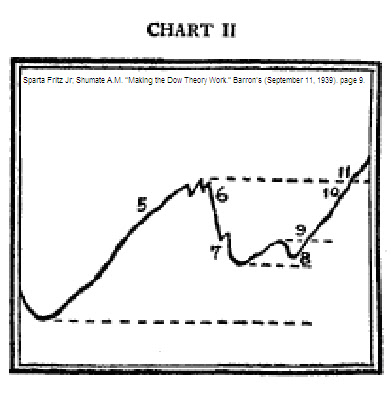

Another problem we have with Mr. Schannep is that he advocates buying at a point just short of a full confirmation. A reasonable market technician would agree that if there is only 4.73% before a clear indication is given (new high), why try to capture so little with the prospect that the market could reverse direction? Instead, wait for the clear signal and decide how much you want invested in the next move. This idea is driven home in the following chart and excerpt from a 1939 series of articles in Barron’s that later became the book “Making the Dow Theory Work” by Sparta Fritz Jr. and A.M. Shumate.

“Point 9 represents the upward penetration of the minor high, with encouragement from the volume of trading. The averages are still at levels to suggest buying.

“All rules of sound practice would forbid buying at point 10. Possible losses, figured against recent lows, are unattractively large. At the same time, a bullish forecast still lacks the authority which the averages could give by bettering the old highs. If the speculator has missed the good chances that have been left behind, surely he out not buy here. It will be far wiser to wait and pay a little more, when and if the averages jump the hurdle of their former highs.

“Aside from other considerations that enter into forecasting, the market position at point 10 actually suggests to the speculator a tactical sell-out of some of his stock. Suppose it turned out that the bull market was over. Important savings could be made by sales here. The speculator can step aside, and re-enter the market at a slight concession, if the highs are bettered.

“The bull market is demonstrated to be still in progress at point 11. Stocks can be bought here, but it cannot be considered a first-class risk. It is simply the last reasonable buying level as the primary trend moves on. Stocks bought here will sometimes show a loss on the next reaction.”

Basically, Mr. Schannep recommends buying the market at the equivalent of point 10 when he could have more certainty in the call at point 11. In our view, this isn’t a responsible approach to calling the market, let alone a mangled version of Dow Theory.

The MarketWatch.com article makes reference to Richard Moroney of the Dow Theory Forecasts newsletter. Mark Hulbert says that Mr. Moroney has an interpretation of Dow Theory that is “different than that of both Schannep and Russell, the two Dow averages must surpass their mid April highs to trigger a buy signal. Those levels, which remain some way off, are 11,205.03 for the Industrials and 4,806.01 for the Transports.” Based on his commentary, Mr. Moroney is the only one who is actually practicing Dow Theory. The numbers that Mr. Moroney indicated as being required for a Dow Theory buy signal were exactly the same numbers that the New Low Observer team was looking for as a continuation of the bull market.

Unfortunately, there is a distinction between a “buy” signal and continuation of the trend. As mentioned before, a buy indication means that a sell had to be given previously. A continuation of the trend indicates that a prior signal is being confirmed and nothing has changed. This nuance is very importance since anyone who considers buying at this point should understand that “…it cannot be considered a first-class risk…” as described by Fritz and Shumate.

The handling of such a topic as Dow Theory should not be left to chance when the material on the topic is so accessible. Unfortunately, Mark Hulbert isn’t aware of the discrepancies mentioned above. Such a lack of knowledge on Mr. Hulbert’s part only feeds the misunderstanding about Dow’s Theory. This is reflected in the comment section that follows the article where readers justifiably deride the theory and it’s practitioners.

Note:

Any and all bull market indications are within the context of a secular bear market. The secular bear market is deem over when the Dow Industrials and Dow Transports exceed the previous highs set in 2007. Therefore, the current market is considered to be a "bear market rally" or a cyclical bull market.

2 responses to “A Lesson in Dow Theory”