The great real estate analyst Roy Wenzlick may have called the bottom in real estate again...for the 10th time in a row for the last 78 years. Although he passed away in 1989, Roy Wenzlick gave significant credibility to the idea that real estate has an 18.3 year cycle. Wenzlick compiled data on real estate in St. Louis as well as the rest of the nation from 1932 until 1973 in his publication The Real Estate Analyst.In the diagram below, you will see Wenzlick's 18.3 year cycle displayed from 1795 until 1973.

It is important to note that if you add 18 years to 1973 you get the year 1991 as the next period for a low in the real estate market. Coincidentally, to some, 1991 was the last time we had a bottom in the real estate market. If you add another 18 years to 1991 then you get 2009. My tendency has been to include the years 2008 and 2010 just to play it safe.

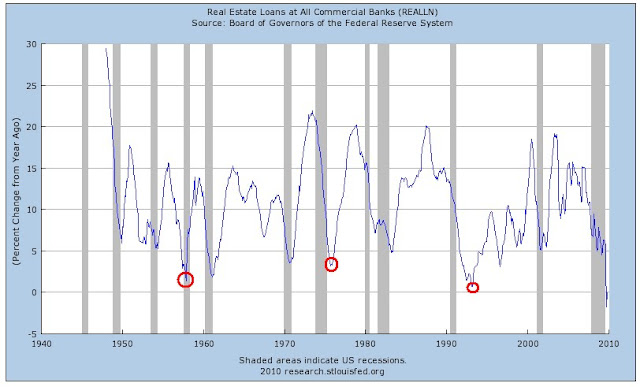

As a way to cross reference our perspective that the bottom is coming, I have included the Federal Reserve's data on real estate loans with the percentage change from the previous year. Although real estate loans by banks is a slightly lagging indicator it has tracked the performance of the real estate market in sync with the Wenzlick model.

If we haven't hit bottom yet it means that within the year 2010 we will have to go below the previous low prices of 2009. Such an occurrence would be a complete disaster for the financial markets. I am hopeful that the real estate market doesn't further devolve. However, the concern does rest in the back of my mind.

If we haven't hit bottom yet it means that within the year 2010 we will have to go below the previous low prices of 2009. Such an occurrence would be a complete disaster for the financial markets. I am hopeful that the real estate market doesn't further devolve. However, the concern does rest in the back of my mind.Barring any further crisis in real estate, I'm willing to go out on a limb and say that on the whole, as opposed to specific geographic regions, based on credible sources like Wenzlick, the bottom in real estate may be in.

Resources: