Mattson Technology (

MTSN) is a supplier of equipment to Semiconductor producers (i.e. Intel). Some of their

competitors are Applied Materials (

AMAT), Lam Research (

LRCX), and Novellus (

NVLS). These are 2 billion dollar plus companies versus a 130 million dollar company. Market cap doesn't tell me anything about valuation of the company, so I would ignore that figure for now.

Macro View

When the economy recovers, people feel better and they go out and buy a computer from suppliers like Dell or HP. These computer suppliers then have to ramp up their production and order more computer chips from Intel or Samsung. A demand surge triggered Intel to boost production by expanding their production capacity by purchasing more tools from the likes of Applied Materials or Mattson. This is what generally happens when the economy recovery takes place.

Market Exposure

In 2008, 19% of MTSN revenue came from Canon and 10% came from Samsung (from

2008 Annual Report). Because 90% of MTSN's revenue comes from overseas, this company is truly international company. The largest market they served is memory, which is estimated to be around 70% of their revenue. As you may guessed from going to Fry's or Best Buy, USB memory sticks sell for next to nothing. It's appropriate that this market has seen a fair share of margin contraction (lower profit). This may be the reason why the share price of Mattson and its competitors who are exposed to memory got cut in half.

Valuation

Mattson is currently trading around the $2.50 to $3.00 range. They hold $1.56 cash per share and $2.24 book value. As a result, you have a tech company with NO DEBT, trading at roughly 1.2x book value. That fits Benjamin Graham's

formula. Tangible book value (this exclude IP value) is at $3.16 at the end of 2008. Because the company has negative earnings and no dividends, we can only assess valuation based on book value. Using

Morningstar valuation tool, you see that over the prior of 10 years, the average trough book value is 1.2.

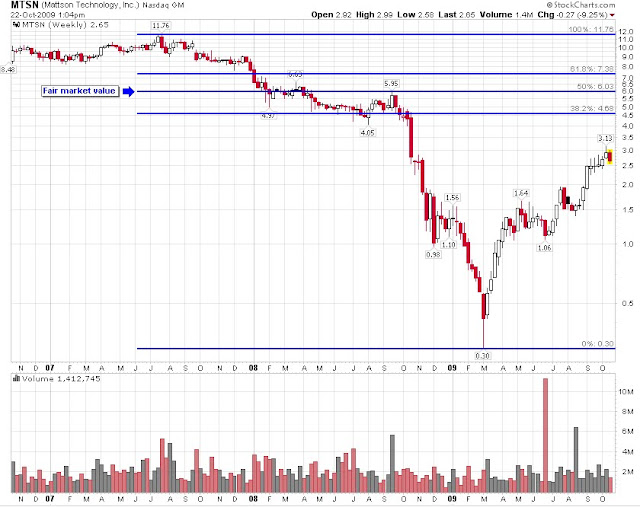

Some of the things I am concern about are negative earnings for this year and the next, possible burn in cash flow, and market liquidity issues. The company traded as high as $11.76 in 2007 then dropped to $0.30 in 2008. Assuming that you bought at the low and sold at $2.50, you would have gained 700%+ on your money. Such extreme low valuation will not likely return because the credit market have recovered somewhat.

So how do I come up with a fair market value for Mattson? Simple calculation based on Dow Theory suggest a fair market price of $6.03. The calculation is simple, take the peak price of $11.76, plus the absolute low of $0.30, then divide it by 2. That's the fair market value based on the Dow Theory interpretation. The chart below shows a graphical representation of from the peak to the most recent trough.

What You Need to Buy?

If you plan on buying MTSN as a speculation, here are things you need.

- Strong and Healthy Heart for the up and down market. Don't be surprised if the price falls to $1.50 range.

- Money you can "throw away". This is a speculation at best, so make sure you can lose it and still be ok.

- Time. This company will need time to work through the current economic environment. It is safest to assume that the price will not revert to $6 simply because I wrote about it. The market will decide that.

Once again, this observation is on the deep end of the speculation pool. I've selected a stock that I believe has a lot more room on the upside but downside should be apparent based on the $0.30 low. Please do your homework and manage this speculation wisely.

Art

Disclosure: None

Follow-up Article: