As strange as it might seem, the following companies (excel format) traded down or up in after-hours trading in the exact dollar amount that they traded up or down during the regular hours of trading. This is exactly what I mentioned took place August 29, 2008.

These aren't small cap companies that we're talking about. These are large companies with reasonable amounts of market volume during the regular hours. How is it that all the activity of the masses can be so easily off-set by marginal volume after hours to go back from whence they came? Since the article on the same topic was posted last year, it was posited that maybe traders were balancing their books and therefore it really wasn't all that significant after all. Others said that because all of these sources get their data from the same place it really didn't matter how many sources I procured.

First, the balancing of market maker books needs to take place during market hours unless there is a crash in the market and the volume cannot be handle in the normal fashion. Second, after hour balancing of the books in this fashion should be considered market manipulation to the ordinary citizens who bought or sold their stock during the regular trading hours. Third, I chose to confirm the data from as many sources as possible to verify that it is accurate.

At best this should be considered manipulation and at worst it should be considered stealing, especially since the records of these after-hour transactions are lost in the normal course of market trading. When everybody wakes up tomorrow there will be no record of what happened during after hours trading.

After hours trading needs to be stopped or the records of these transactions should be widely available to the public in a fashion that can be tracked over time. Touc.

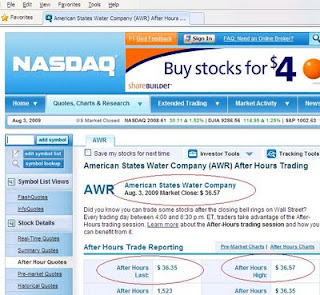

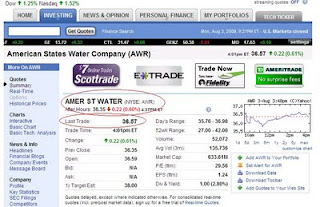

- AMER ST WATER AWR

- Autodesk, Inc. ADSK

- BancFirst Corporation BANF

- BRADY CP CL A BRC

- BRIGGS STRATTON DC BGG

- C.H. Robinson Worldwide, Inc. CHRW

- CIMAREX ENERGY CO XEC

- Cintas Corporation CTAS

- CITIGROUP INC C

- COMMUNITY BK SYS INC CBU

- EMERSON ELEC CO EMR

- Expeditors International of Was EXPD

- FIRST COMMONWLTH FIN FCF

- Fulton Financial Corporation FULT

- Harleysville Group Inc. HGIC

- HARSCO CP HSC

- HEINZ H J CO HNZ

- HILL-ROM HOLDINGS IN HRC

- IBERIABANK Corporation IBKC

- ILL TOOL WORKS INC ITW

- INTEGRYS ENERGY GRP TEG

- MERCK CO INC MRK

- Meridian Bioscience Inc. VIVO

- MINE SAFETY APPL MSA

- MYERS INDS INC MYE

- Otter Tail Corporation OTTR

- OWENS AND MINOR INC OMI

- PENTAIR INC PNR

- PITNEY BOWES INC PBI

- QUESTAR CP STR

- S J W CP SJW

- S&T Bancorp, Inc. STBA

- Sigma-Aldrich Corporation SIAL

- SMITH A O CORP AOS

- STEPAN CO. SCL

- SUPERIOR IND INTL SUP

- TAUBMAN CENTERS INC TCO

- TELEFLEX INC TFX

- TENNANT CO TNC

- TOTAL SYSTEM SVC INC TSS

- Universal Forest Products, Inc. UFPI

- Urban Outfitters, Inc. URBN

- Vertex Pharmaceuticals Incorpor VRTX

- Warner Chilcott Limited WCRX

Sample Data Sources:

Please revisit Dividend Inc. for editing and revisions to this post.

This blog is being featured on www.condron.us, I hope you find this useful.

One response to “Another Market Anomaly”